Stocks Hit Records as Inflation Holds and Dollar Weakens

Strong corporate earnings and steady economic data drove U.S. stocks to record highs last week, despite the dollar hitting a three-year low amid Fed leadership uncertainty and expected inflation data.

U.S. Airstrikes, Fed Actions, and Economic Trends in Focus

Stock futures fall after the U.S. launched airstrikes on Iranian nuclear sites, entering the war against Iran and raising fears of a wider Middle East turmoil. The conflict pushed oil prices up 3.8% to nearly $77 a barrel.

Labor Market Softens, Inflation Cools, and Global Tensions Weigh on Markets

Rising jobless claims, cooling inflation, and escalating Middle East tensions created mixed signals, as investors considered a softening labor market, possible Fed rate cuts, and renewed geopolitical risks.

Job Market Cools, Growth Stocks Surge, and U.S.-China Talks Resume

Job growth slowed in May, with private payrolls missing expectations, but strong job openings suggest labor demand remains healthy.

S&P 500 Regains Momentum as Tech Stocks Surge

After a volatile spring, May brought a market rebound driven by tech strength, solid earnings, and cooling inflation — reminding investors that staying the course can pay off.

Uncertainty Persists Amid New Inflation Data, Court Ruling on Tariffs

Markets are assessing mixed economic signals – including lower-than-anticipated inflation, a surprise ruling on tariffs, and a slightly improved GDP revision – as speculation builds around the Federal Reserve’s next move.

529 Plans Explained: A Smarter Way to Save

Saving for school? This guide for 529 plans outlines what they are and how they can benefit you and your family.

Growth Returns, But Inflation and Policy Risks Weigh on Markets

U.S. business activity is picking up and bond yields are rising, but inflation concerns and a divisive tax bill are keeping markets on edge.

Growth Slows, Inflation Eases and Trade Dynamics Continue to Shift

Trade tensions ease as the U.S. and China cut tariffs, while April data shows slowing growth, manageable inflation, and a widening gap between sentiment and actual economic activity.

How to Protect Your Finances Against Scams

As AI strengthens, the answer to "What is a scam?" becomes increasingly blurry. Here are some tips to protect yourself.

Market Recovers Amid Trade Optimism While Fed Remains Patient

Investor confidence improved following initial trade agreements and steady interest rate policy, signaling cautious optimism in the economic outlook.

After a Wild Ride, U.S. Stocks Rally

In this month's commentary, CIO Matthew Rubin discusses how April tested investors' resolve, yet a cautious optimism springs.

Does Stress Create Strength?

Domestic equities struggle. Public policy uncertainty looms. Here are the challenges and opportunities shaping market performance.

Asset Management Viewpoints: European Resurgence

As international markets surge in 2025, discovering underlying factors and implications for investors becomes essential in navigating the shifting landscape.

Breaking Barriers: Empowering Women to Invest with Confidence

At Cary Street Partners, we recognize the importance of investing as a woman. In this post, we'll show you how to get started.

It’s Raining Uncertainty

As clouds of ambiguity gather over the markets, the forecast for equities hinges on the unpredictable winds of public policy and earnings growth.

Asset Management Viewpoints: Tariffs: Risk or Nonevent?

When it comes to potential tariff policies, it's important to understand their complexities and implications for earnings in the coming years.

Roth 401k vs. Roth IRA

Discover what distinguishes the Roth option as an IRA account versus a 401k contribution.

The Magnificent Seven + 493 = A Healthier Market

Following a rough December, stocks got off to a good start in 2025 as the gap between the Mag 7 and the S&P 493 is still expected to narrow. See what this could mean.

Repeal of WEP and GPO Provides Major Relief for Public Sector Workers

Big changes are on the horizon for public sector retirees! We explore benefit updates and legislation repeals from the new Social Security Fairness Act.

Eligibility For 401(K) Enhanced Catch-Up

The Secure Act 2.0 Legislation approved an Enhanced catch-up starting in 2025 for those participants ages 60-63. We clear up confusion regarding eligibility.

How To Invest Your Year-End Bonus

Learn how to spend your year-end bonus with Cary Street Partners, whether by investing it, contributing to your 401k, or creating your estate planning documents.

Asset Management Viewpoints: Private Versus Public Performance

A deeper understanding of recent performance trends and future outlooks reveals intriguing implications for equity strategies.

2025 Market Outlook

Explore the trends and forecasts shaping the market landscape and gain valuable insights with our market outlook for 2025.

Street SMARTS: December Commentary 2024

November saw equities surge, but with bullish sentiment nearing extremes and potential market shifts on the horizon, a strategic approach to investment could be key.

The Estate Settlement Process: Navigating Legal & Emotional Challenges

Recently lose a loved one? Learn about the estate settlement process and what steps to take with our guide on how to settle an estate.

Making Sense of Required Minimum Distributions

This guide clarifies recent changes to RMD regulations, how distributions are calculated, the penalties for non-compliance, tax considerations, and how to withdraw RMDs.

Maximizing Your Social Security Benefits

Introducing a comprehensive guide to Social Security with ways to optimize your benefits and ensure your financial well-being.

Retirement Secure Act 2.0 Major Changes 2025

Although the Secure Act 2.0 was passed nearly two years ago, several provisions will become effective in 2025 that may affect those aged 60-63 and LTPT employees.

Asset Management Viewpoints: Beyond the Ballot: Voting Day Reverberations

What implications does the November 5 US elections have on yields, mortgage rates and the overall market?

Street SMARTS: November Commentary 2024

An update on the recent rise in yields and the fears driving it. Is this a return of the "bond vigilantes?"

Asset Management Viewpoints: Risk is Always With Us

Election implications? Middle East tensions? War in Ukraine? Striking port workers? Hurricanes? Or is it something else? What are the biggest market risks?

Street SMARTS: Q3 Commentary 2024

Chief Market Strategist Tom Herrick offers a detailed analysis of third-quarter market results and the implications of the Federal Reserve's rate cuts on inflation, employment, and the housing market.

Asset Management Viewpoints: Volatility Spike, Part 2

Find out the latest about the sudden spike in equity volatility from Chief Market Strategist Tom Herrick. New data is included in this "Part 2" of our original "Volatility Spike" report.

Maximizing Your Impact With Charitable Giving Strategies

Cary Street Partners Financial Advisors guide you through several strategies that can help you achieve your philanthropic goals in a tax-efficient manner.

Asset Management Viewpoints: Facts Over Fear: Decoding the Stock Market’s Election Year Behavior

Chief Market Strategist Tom Herrick evaluates historical data to answer the question: “How will the stock market be impacted by the upcoming 2024 presidential election?”

Financial Literacy Quiz: Assessing Your Financial Knowledge

To gauge your financial knowledge, CSP has prepared a short quiz comprising five questions. How much do you know about finances?

Asset Management Viewpoints: Volatility Spike

Chief Market Strategist Tom Herrick deconstructs the latest volatility spike, identifying the culprits, outlook and positioning recommendations.

Street SMARTS: August Commentary 2024

Chief Market Strategist Tom Herrick analyzes the recent market trends and potential impacts of upcoming rate cuts on different sectors and market caps.

Street SMARTS: Q2 Commentary 2024

An analysis of the second quarter market performance highlights the concentrated gains in equities, emphasizing the importance of broader participation for sustained growth.

Street SMARTS: June Commentary 2024

Discover the latest insights into the May market rebound, the impact of strong earnings on risk assets, and the trends in bond market volatility in this comprehensive analysis from Chief Market Strategist Tom Herrick.

What to Do When Traditional Diversification Falls Short

Stocks and bonds have long been the go-to portfolio combination in investing, but the pair also has a repeated history of falling short of investor expectations. Learn more about their relationship and our hedged-equity strategies.

Street SMARTS: May Commentary 2024

Among equity pullbacks and yield pressure, what is the group to watch? Find out in Tom Herrick's May Commentary of Street SMARTS.

Asset Management Viewpoints: Another Chance to Bite into Bonds

What opportunities exist in the current bond market? Chief Market Strategist Tom Herrick explains what the recent back-up in yields means for investors in this Asset Management Viewpoints article.

Cryptocurrency and 401k’s

Is cryptocurrency a fruitful investment option for your 401k? Discover what the retirement services professionals at Cary Street Partners recommend.

The Importance of Family Financial Planning

Unlock a secure future through effective family financial planning. Take action now to safeguard your loved ones and build a stable financial foundation.

Street SMARTS: Q1 Commentary 2024

In Chief Market Strategist Tom Herrick's new Street SMARTS series, he goes in depth about market observations and trends, offering valuable insight on the first quarter of 2024.

Estate Planning Checklist: A Step-by-Step Guide

Navigate the complexities of estate planning with our comprehensive checklist to ensure a smooth transfer of assets and peace of mind for your loved ones. Start planning today!

March Monthly Update

Markets were generally favorable over the course of February. The S&P 500 Index has advanced 5.34% since the end of January.

February Monthly Update

Markets unsurprisingly consolidated over the course of the last month. Unsurprisingly is the operative phrase given the strong nine week run that risk assets experienced through the end of December.

Private Student Loans: Finding the Best Private Student Loans

What are factors to consider when choosing a private student loan? What are the pros and cons? In this article, you'll learn more about private student loans and uncover our advice for students considering them.

Asset Management Viewpoints: The Right Vintage of Private Credit

Private credit funds and breaking down the components of a direct lending yield are discussed in Chief Market Strategist Tom Herrick's Asset Management Viewpoints.

Asset Management Viewpoints: Breadth Breakout

Cary Street Partners Chief Market Strategist Tom Herrick sees hints of breadth expansion in 2024's equity performance.

Loan vs Gift: Making the Distribution Decision

At some point, you will probably give or loan a family member some money, so it is important to know the difference and impact of the two choices.

2024 Market Outlook

Explore the trends and forecasts shaping the market landscape and gain valuable insights with our market outlook for 2024.

November Monthly Update

The November Monthly Update takes a close look at 10-year yields and explains how "the beatings will continue until morale improves."

Financial Independence for Women

Financial independence is a goal that every individual, regardless of gender, aspires to achieve. However, women often face unique challenges when it comes to their finances. Originally featured on MoneyGeek, CSP Advisor Christina E. Todd, CDFA®, CFP® shares insight.

Asset Management Viewpoints: Mortgages—Home to Opportunities

Agency mortgage-backed securities, also known as Agency MBS, offer a good entry point to fixed-income investors. Cary Street Partners Chief Investment Officer Tom Herrick expounds how the current opportunity is two-fold.

Interviewing Financial Advisors: What Questions Should You Ask?

Finding the right financial advisor for you is important. Check out these six questions to find the perfect fit.

3rd Quarter 2023 Commentary

Risk assets do not do well when yields move higher. The third quarter was a case in point. Regardless of our viewpoint that yields have overshot, the price is the price, and there is no denying the impediment that yields present to stocks and bonds.

Asset Management Viewpoints: Time for Small Caps

Cary Street Partners Chief Investment Officer Tom Herrick talks cap comparisons and explains why it's time for small caps.

Retirement Savings Tax Credit

Did you know that you can get a match on your 401(k) contributions when you file your taxes, if you qualify? It’s called the Retirement Saver’s tax credit.

Artificial Intelligence: The Fourth Industrial Revolution?

Artificial intelligence — is it being over-hyped? Or could it really have profound economic and societal implications?

August Monthly Update

Epic dis-inflation. That is the short answer regarding what has been driving markets since last October.

Retirement Secure Act 2.0 Part 2: Timeline

Building off our earlier Retirement Secure Act 2.0 article, Cary Street Partners' retirement team introduces a timeline to highlight some key provisions of the new legislation.

Why You Need an Emergency Financial Folder (In Addition to a Will)

What if something were to happen to you? Do loved ones know where to find your important estate planning and financial documents? Is it all in one place or scattered everywhere? What about passwords for digital files?

RetirePath Virginia Highlights

The CSP Retirement Services Team compiles essential highlights of the mandatory state-facilitated retirement plan, RetirePath Virginia.

2nd Quarter 2023 Commentary

As we approach the halfway point in 2023, investors will find global equity and bond markets considerably improved from January 1st, although still well below peaks reached in 2021...

June Monthly Update

An underappreciated characteristic of Nobel prize-winning monetary economist Milton Freidman was that he could turn a phrase. In fact, he wrote a well-read column in Newsweek for years. Freidman is said to have likened central bankers to fools in the shower...

Importance of 529 College Savings Plans

Saving for your child's education is prudent, and 529 college savings plans can help you prepare for your child's higher education to guarantee a better future.

May Monthly Update

Domestic equities largely consolidated and continued to trade within a relatively tight range throughout the month of April. Using the S&P 500 Index as context, the current equity trading range is...

Clarification for Inherited IRA Distributions

The IRS recently clarified some of the language addressing how/when distributions should be taken from an inherited IRA. Here's what you need to know.

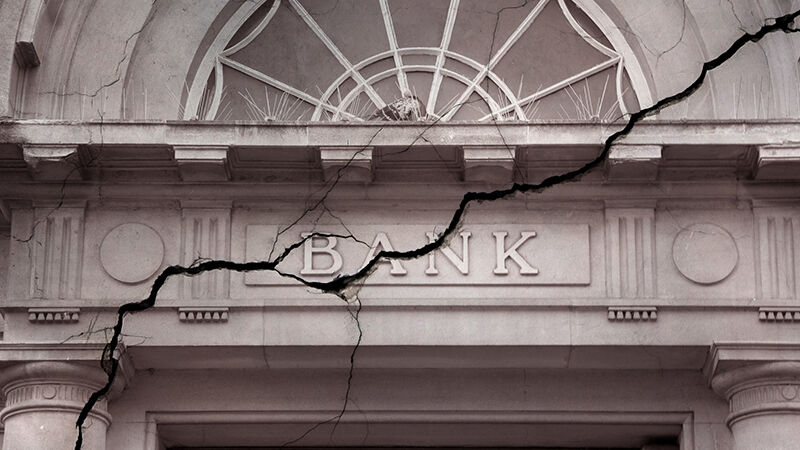

The Fed is Starting to Break Banks

There is an expression on Wall Street that the “Fed raises rates until something breaks.” Well, something broke in March: Silicon Valley Bank and Signature Bank failed, and a host of regional banks came under stress...

Retirement Secure Act 2.0 Major Changes

How have contributions changed? What are the new required minimum distributions? Here are some highlights of the biggest changes affecting 401k plans from the Retirement Secure Act 2.0 legislation.

March Monthly Update

Last month we highlighted the strong relationship between calmer yields and better risk returns. That dynamic held in place from late October until approximately three weeks ago. Since that point, markets have been rattled...

How to Prepare Financially for a Divorce

Going through a divorce can be stressful. Going through a divorce with the right financial information can help alleviate some of that stress.

February Monthly Update

Stocks and bonds have begun 2023 on a high note. As we discussed at length in our 2023 Market Outlook, these two asset classes are much more highly correlated in a higher inflation dynamic, something we have not seen for decades.

2023 Market Outlook

2022 resulted in one of the more difficult investment environments in recent decades. One in which both stocks and bonds suffered significant losses...

November Monthly Update

In previous commentaries, we have focused on the number one tactical driver of markets, liquidity. Commonly, this is summarized in the number one rule for market guidance— “Don’t fight the Fed”. The bear market continues to hold...

3rd Quarter 2022 Commentary

Don’t fight the Fed. If there was one market mantra to live by, 2022 has reminded us that “Don’t fight the Fed” is it. As of this writing, the market continued to pull back from the mid-summer bear market rally that culminated on August 18th.

September Monthly Update

From their mid-June low through the 18th of August, equities picked up short-term momentum and advanced about 16% using the S&P 500 as a proxy, a classic bear market rally.

August Monthly Update

Equity markets spent the last six weeks rallying from deeply oversold conditions reached in mid-June.

2nd Quarter 2022 Commentary

As we begin the second half of 2022, investors likely feel a lot like a football or basketball team hanging on by their fingernails just trying to get to the locker room for a halftime regroup.

What Happens To Your 401(k) When You Quit?

When leaving your job one of the most frequent questions employees have is: “What should I do with my 401(k) balance?”

What To Do In A Bear Market

May has been miserable. As equity markets broke downside support, the market tipped briefly into bear market territory.

May Monthly Update

With a nod to Yogi Berra; “it’s déjà vu all over again.” Throughout 2022, the stock market has repeatedly visited a low found around 4200.

1st Quarter 2022 Commentary

Equities and bonds both experienced a great deal of volatility since our last Update, February 24th.

What Does the Invasion of Ukraine Mean for Investors?

Equity markets sold off in the last two weeks, triggered by fear of Russian aggression in Europe followed by an actual invasion of Ukraine...

February Monthly Update

Markets began 2022 by moving decisively lower, with both stocks and bonds enduring continuous selling pressure throughout January.

2022 Market Outlook

To begin, let us recap our 2021 Outlook against the year’s results. At this time last year, we held three primary viewpoints going forward...

The Value of a Retirement Plan Advisor

Managing a retirement plan for a company is not a small task. The expertise of a knowledgeable plan Advisor can have important benefits.

December Monthly Update

Black Friday, credit stress, inflation and the new COVID variant, omicron, all affect the market this month.

Advice for Those Nearing Retirement

For those nearing retirement, it is natural to worry. The secret? A good financial plan.

November Monthly Update

Equities posted sizable gains during the month of October as negative, COVID-surge-induced, sentiment swung from an overly risk-off condition to risk-on by month end.

The Value of a Good Recordkeeper

Recordkeepers can be the backbone of a retirement plan. Here's what to keep in mind when selecting a retirement plan platform.

Why is Estate Planning Important?

There can be great peace of mind in knowing that your financial affairs are in order, and your final wishes will be fulfilled as you’d like.

Revenue Sharing: Isn’t Sharing a Good Thing?

A recent survey from Callan shows the percentage of plans using revenue sharing declining. Find out what this means and how Cary Street Partners can help you.

Weekly Update – August 30, 2021

Equities moved higher yet again last week — following a very brief and shallow decline the prior week.

2nd Quarter 2021 Commentary

Equity markets moved higher in the second quarter with the S&P 500 Index picking up 8.55%.

Is Inflation Ahead?

Find out what's in the financial market forecast and what it means for portfolio positioning.

A Higher Standard

Hear a leadership message from Cary Street Partners Board Chairman, Douglas G. Stewart, and CEO, Joseph R. Schmuckler.

1st Quarter 2021 Commentary

Equity market performance for the first quarter of 2021 was best characterized as churning higher amid a huge rotation from technology issues toward cyclicals.

2021 Market Outlook

The best thing that can be said for the 2021 outlook is that it is not 2020 anymore.

Business Retirement Plans

Raymond (R.J.) Reibel, CRPS®, discusses the tools and resources available through Cary Street Partners’ Business Retirement Plans.

Dividend Reinvesting Reconsidered

Market wisdom has generally dictated that dividends are to be reinvested, but does that still hold up?

Is a Depression Inevitable?

There is a good deal of media chatter regarding the possibility that the global economy is entering a great depression due to the COVID pandemic. Here's our take.

CIO Conversation Series: Sean E. Heron, CFA

Hear from Tom Herrick and Sean E. Heron, CFA.

CIO Conversation Series: Katie Stockton, CMT

Hear from Tom Herrick and Katie Stockton, CMT.