By Thomas O. Herrick

Chief Investment Officer, Managing Director

Market Review and Second Half Outlook

As we approach the halfway point in 2023, investors will find global equity and bond markets considerably improved from January 1st, although still well below peaks reached in 2021. The high-level year-to-date report card for equities is the S&P 500 Index, 15.78% higher, along with the MSCI ACWI global index gaining 14.20%. Bond returns are also positive, with Bloomberg US Aggregate up 2.22% and the Bloomberg Global Aggregate up 1.97%. For context, the S&P 500 is approximately 10% below its peak in late 2021. The US economic backdrop remains solid, fueled by the massive excess savings consequent to the massive pandemic-induced money supply increase. Unfortunately, that money supply increase continued far too long. It did not cease until early 2022, creating the higher inflation dynamic that—while improved—remains the most significant economic challenge.1

As measured by CPI, inflation peaked about a year ago, with 11 consecutive declines in headline CPI reports through May. Our base case for inflation remains for improved monthly prints, and we are increasingly of the viewpoint that CPI will begin to surprise to the downside. As measured by M2, money supply growth has been negative over the last six to nine months, the only time that has happened since data began collection in 1959. This is the polar inverse of the massive M2 increase in 2020 through Q1 2022. To paraphrase Milton Friedman, ultimately, inflation is always and everywhere a monetary problem. The dramatic reversal in M2 is the driver of the lower prints recently, just as it was the driver of higher prints previously.

Within the data, most of the recent CPI increase has been found in the shelter component. Here is also a good reason to be optimistic. Shelter data is collected every six months, comprised of six sub-categories that are collected incrementally. This creates a lag as one component is collected in January, then again in July, another in February, then again in August, and so on. Real-time data on rent and shelter, such as the Redfin May rent report, show significant declines. In summary, as shelter declines begin to reflect in monthly CPI reports, expect a giant swing in this sticky component that constitutes about 40% of the index.

What has not occurred in this inflation cycle is a wage-price spiral, similar to the late seventies. Most commentators and a very confused FOMC continue to be obsessed with tight labor markets. The Fed’s own data, as demonstrated in a recent deep dive by the San Francisco bank, concludes that very little of the current inflation increase is attributed to wage growth. Confused messaging from the FOMC around this topic and future Fed fund rate policy has created large swings in yields over the last few months, creating an opportunity in bonds.

Source: Fairlead Strategies

Source: Fairlead Strategies

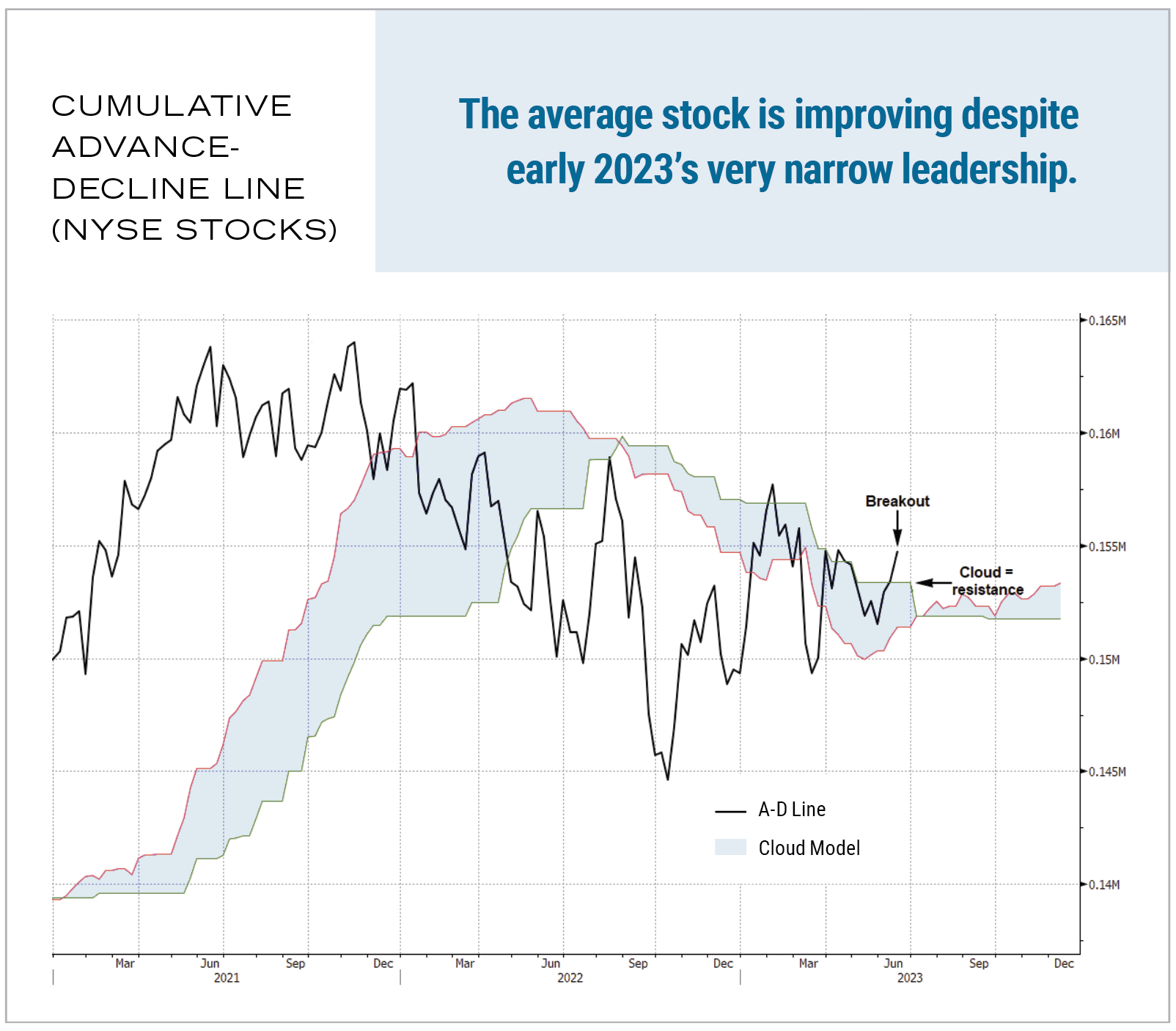

From an equity market perspective, the greatest challenge in the first half of 2023 has been the very narrow leadership characterizing most of this period. A handful of 5 to 10 mega-cap growth stocks constituted almost the entire S&P 500 gain over the year’s first five months. The challenge was resolved positively in June. There has been a recent breakout in breadth proxies such as RSP (equal weight S&P) and the advance-decline line that support much improved S&P 500 and NASDAQ 100 momentum. Continued follow-through in breadth proxies will be necessary for market advancement over the second half.

Our 2023 Market Outlook, published in December 2022, concluded with four positioning recommendations; we grade and update those recommendations as follows:

1. Constructive on bonds, emphasizing longer duration Treasuries. This would have been an A+ a month ago, prior to all the former FOMC doves that have transformed into hawks taking speaking engagements. Proxies for this recommendation, TLT and SPTL, are ahead 4.38% and 4.11% YTD and are also ahead of the broad bond market. In the last month, yields have backed up, and both proxies are oversold. This allows bond investors to act on an additional entry point for long-duration Treasuries that will ultimately respond to lower inflation prints and historically have proven to be a good purchase when the yield curve is inverted.

![]()

2. Constructive on equities, with an emphasis not to ignore the growth side of the market. This was not a common thought on the street last December and is probably our most important recommendation. Exposure to long-duration growth stocks has been vital to capturing market upside this year. As mentioned, much of the YTD return attributes to narrow, mega-cap growth leadership. This is vivid in YTD returns for the Russell Large Cap Growth (IWF) and Value (IWD) indexes, with Growth up 27.56 % and Value up a much more modest 4.25%. As we move forward, this dynamic is less of an issue as markets broaden beyond mega-cap growth. However, we would still maintain a balanced exposure to Growth and Value. Long-duration equities on the growth side still have lots of room for upside.

![]()

3. Equities and bonds strongly correlate in a higher inflation world, and the typical 60/40 stock/bond allocation does much better in 2023. Lower inflation = lower yields = improved equity/bond returns remain in place for the remainder of 2023.

![]()

4. Use equity hedging strategies to reduce risk and add portfolio diversification. The CSP Global Hedged Equity model is ahead 9.92% YTD with less drawdown, standard deviation, and beta than the broad equity market.2 This approach to diversification creates a smoother sequence of returns and high income sourced differently than long-only equity and bonds.

![]()

1 Bloomberg

2 CSP Asset Management/Morningstar

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

Any opinions expressed here are those of the authors, and such statements or opinions may not represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. This information may contain future predictions that are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, and to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

CSP2023105