2022 1Q Market Review and Commentary

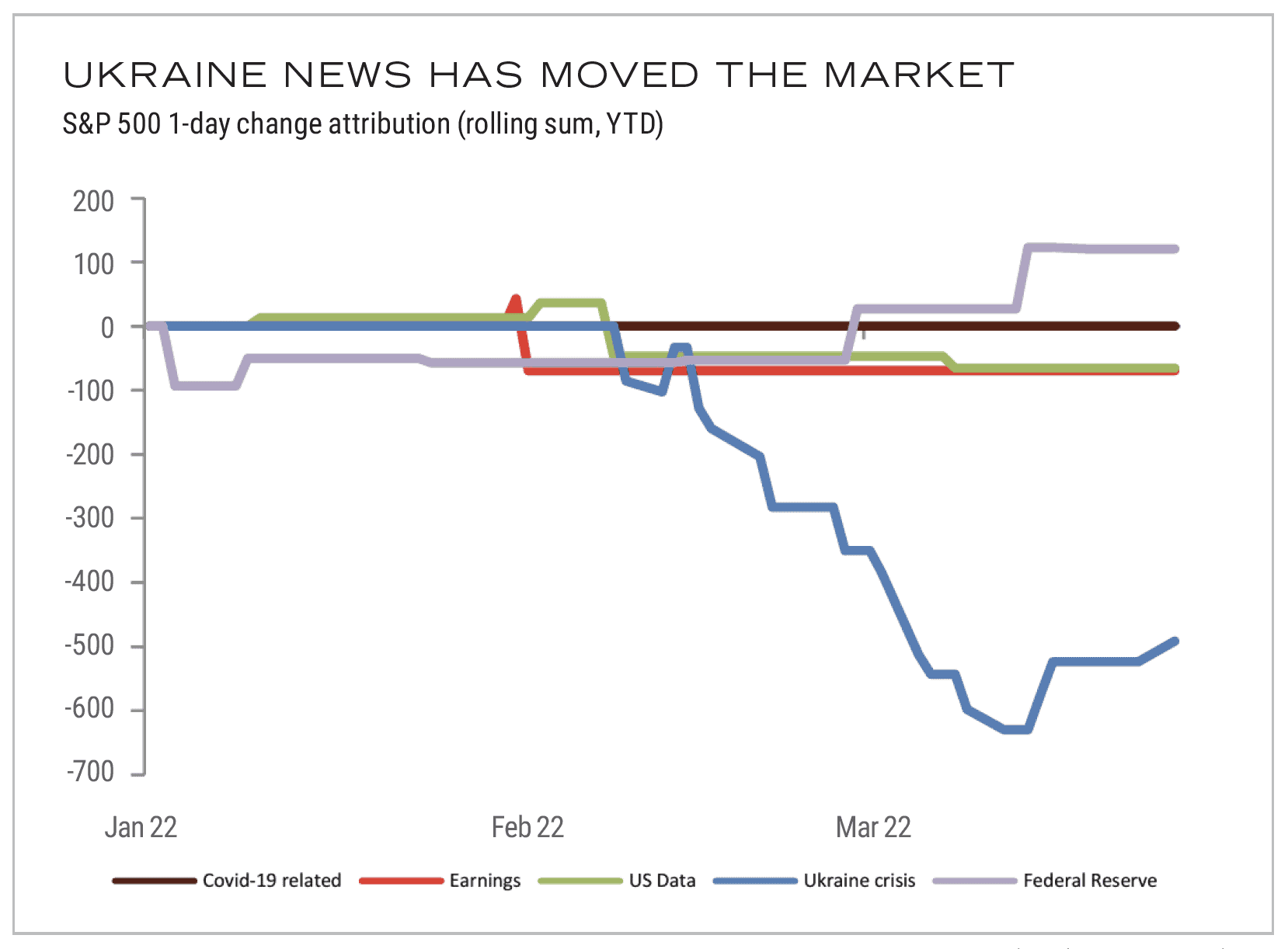

Equities and bonds both experienced a great deal of volatility since our last Update, February 24th. The S&P 500 Index closed on February 24th at 4288. Over the first quarter, the stock market has repeatedly and successfully re-tested a market low found around 4200 for the S&P. This occurred in late January/late February, and during the second week of March. At their low, equities have been down as much as 12.82% from their high as indicated by the S&P, and more than 20% for the long-duration, technology-laden NASDAQ. Over this stretch of challenging performance, the advent of liquidity normalization and the invasion of Ukraine have proven to be heavy market influencers. Of the two, the invasion has been far more impactful. Ukraine has fought magnificently against Russian aggression while western democracies have instituted effective sanctions, announced intentions to get off Russian natural gas, and supplied Ukraine with weaponry. The invasion is evolving into a disastrous miscalculation on the part of the Russian dictator and the stabilization of this front is a short-term victory to date.

Source: Renaissance Macro, Bloomberg, Haver Analytics

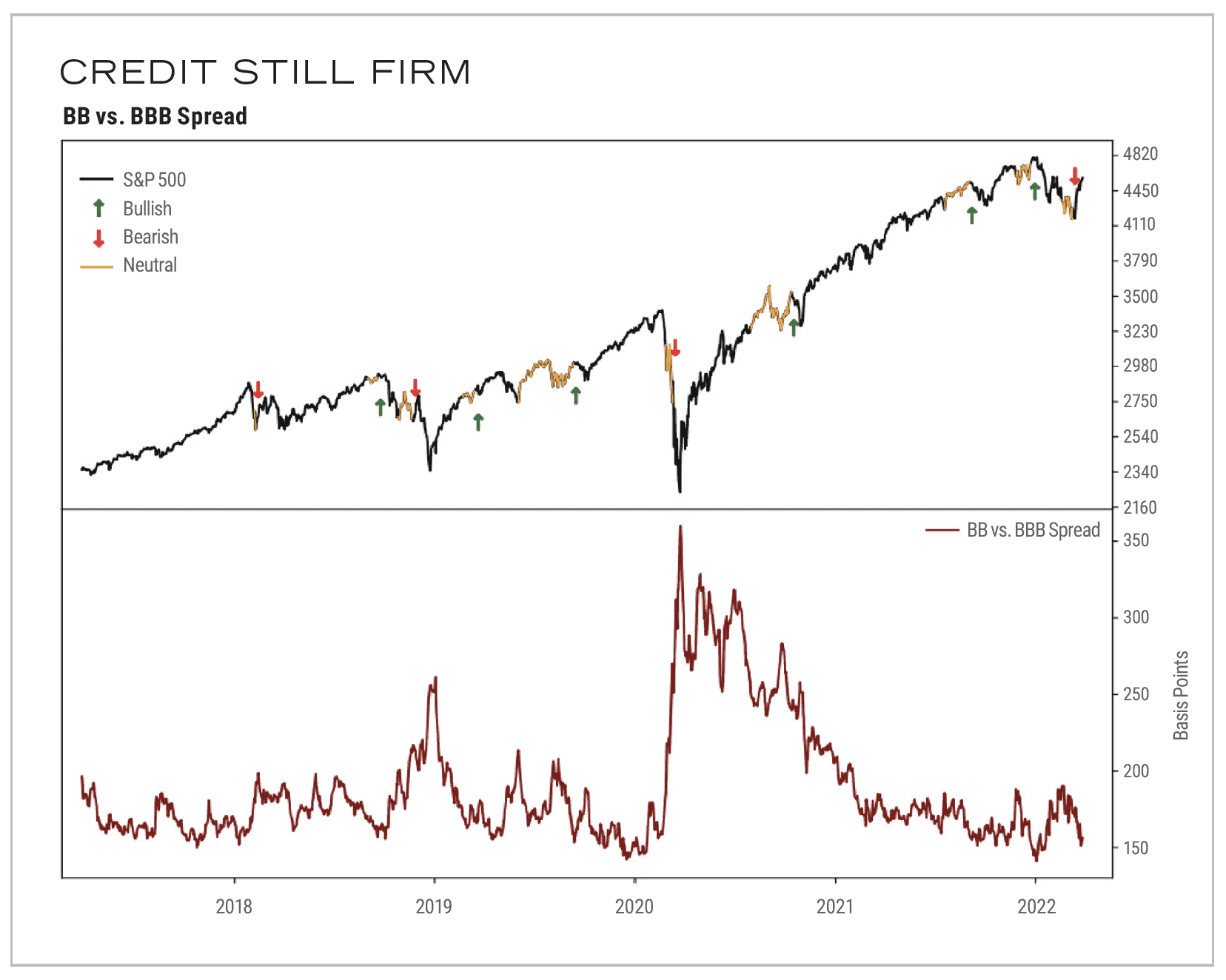

Markets have been buffeted by volatility—much as we expected this year. We did not expect the source of the volatility to be another Russian invasion (keep in mind this is the third one in that region). As fear spiked, sentiment became bearish, a contrarian positive. Once sentiment gets to extremes, pricing in all kinds of fear, that factor supports limited downside and good things start to happen to forward returns in stocks. When combined with a continued favorable credit market, one evidenced by spreads on BB versus BBB corporate paper, historical data for 3- to 6-months forward returns in stocks appears highly favorable. As the S&P held at the 4200-support level March 14th, that favorable dynamic kicked in and markets rallied for the remainder of March, the S&P closing the quarter at 4530, culminating in a 4.6% decline for the full quarter.

Source: Renaissance Macro

Synonymous with our 2022 and 2021 Market Outlooks, bonds have just put in one of their worst quarters ever. Yields have increased across the curve, and there are no major bond asset classes with positive results for Q1. The U.S. Aggregate Index closed the quarter with a 5.93% loss, and the Global Aggregate was down 6.16%. Our viewpoint on bonds remains bearish — as it has been for 15 months. One significant factor driving higher rates will be the fallout from the Fed ending Quantitative Easing (QE). Had we not had QE, Fed purchases, reasonable evidence suggest long rates, the 10-year Treasury yield, would be something like 3½% today, not the current 2½% zone. Fed liquidity expansion, QE, was the right policy two years ago with the world facing a pandemic; it’s not the correct policy with inflation at 40-year highs. The Fed has finally ended QE and intends to scramble with Fed-fund rate hikes and balance sheet run-off.

Portfolio Positioning

Positioning is much the same as we emphasized in late February. With a challenging bond market to say the least, the major challenge for investors remains how best to replace the broken, autopilot view of balanced, 60/40, stock/bond asset allocation. Our solution in recent publications has been hedged-equity positioning that replaces balanced-portfolio bond allocations with similar risk characteristics but has a different source of return. A high volatility market further supports this type of positioning as it favors hedging strategies. In the first quarter this approach generated better results than either long-only stocks or bonds1. Additionally, commodities could play a role for investors seeking a low correlation alternative to equities or bonds. Broadly speaking, commodities have a more favorable supply/ demand dynamic than we have seen in decades. This is a longer-term dynamic that has been further accentuated by the Russian invasion of Ukraine. The BCOM (Bloomberg Commodity Index) gained 25.55% in Q1.

Entry points to add stock exposure will remain crucial in this year of added volatility and modest expectations. We maintain a close watch on credit as a canary in the coal mine bear market early indicator. With the recent improvement in market momentum, conditions appear favorable for the S&P to challenge its next resistance point, the market high of 4820.

Economic Outlook

Growth momentum remains strong in the U.S. Indeed 2021 witnessed the strongest gain in GDP since 1984. We do not subscribe to the inverted yield curve, imminent recession viewpoint. All the high-frequency data on the ground suggests continued momentum in growth and any talk of recession is premature. This yield curve is not your father’s yield curve as mentioned above. As the Fed removes itself from the market, we expect to see higher rates resulting across the curve, with some steepening or at least a maintenance of the flattish curve we presently have. When a historical data point such as the yield curve has a fundamental change to the extent we have seen with QE, we also change our mind about that data point. The Federal Reserve is once again, as it has been most of its history, behind the curve. They have an inflation policy of 2% average inflation. They have a lot to do to enforce the policy. Milton Freidman – we need you.

1 Year-to-date through 3/31/2022, total returns for the CSP Global Hedged Equity Strategy are -2.2% versus -4.6% for the S&P 500 Index and -5.93% for US Aggregate Bond Index over the same period

Past performance is no guarantee of future results. Performance figures referencing CSP Global Strategies are shown net of fees. Please refer to the Cary Street Partners Asset Management LLC (the “Firm”) Form ADV 2A Firm Brochure for a full description of the managed strategies offered by the Firm. Indices are unmanaged and used for illustrative purposes only and are not intended to be indicative of any fund or the managed model’s performance. It is not possible to invest directly in an index.

All market figures stated in this material are provided by Bloomberg.

This material has been prepared or is distributed solely for informational purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions expressed or implied herein are those of the author and do not necessarily reflect the opinions of their respective firms and are subject to change without notice. Any mention of specific investments, asset classes, or market sectors are intended for general discussion and should not be misconstrued as investment advice. Investors must make decisions based on their specific investment objectives and financial circumstances. Additional information is available upon request. Global/International investing involves risks not typically associated with U.S. investing, including currency fluctuations, political instability, uncertain economic conditions and different accounting standards.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

CSP2022076 © COPYRIGHT 2022 CARY STREET PARTNERS, ALL RIGHTS RESERVED