Inflation Ahead — But Not the Rebirth of the Disco Era

Last year at this time we published a paper expressing the viewpoint that given the rapid and large monetary response from the Federal Reserve to the COVID pandemic, the U.S. economy would not only avoid a deflationary spiral into a depression but also experience good nominal- and real-GDP growth over ensuing years. This has indeed transpired, perhaps quicker than anticipated as historically rapid, and amazingly effective COVID vaccines have been developed that support a full re-opening of the economy.

Going forward, the clear and present topic is inflation. Near term, the odds of higher inflation are almost certain. Year-over-year monthly comparisons will be well-beyond Fed targets over the next few months. We already saw some of this in the March data. This is the easy part of the forecast, as monthly inflation at this time last year was non-existent. Consequently, those monthly comparisons, from a normalized environment this year, are going to show big gains. This is the base effect that the Fed references frequently. Nothing like a low bar to show big gains.

The difficult part of the forecast is whether inflation gains persist beyond 2021. Supply chain issues are likely to create additional wind behind inflationary sails in 2021. The pandemic induced a massive crimp among just-in-time supply chains. Massive orders were canceled in the spring of 2020, only to be re-instituted much faster than anticipated in the summer and fall as recovery occurred very fast. This has led to shortages in a variety of industries as companies are desperate to re-build depleted inventories, now at historic lows. Until inventories catch up to final demand, this dynamic will be in place and add an inflationary push.

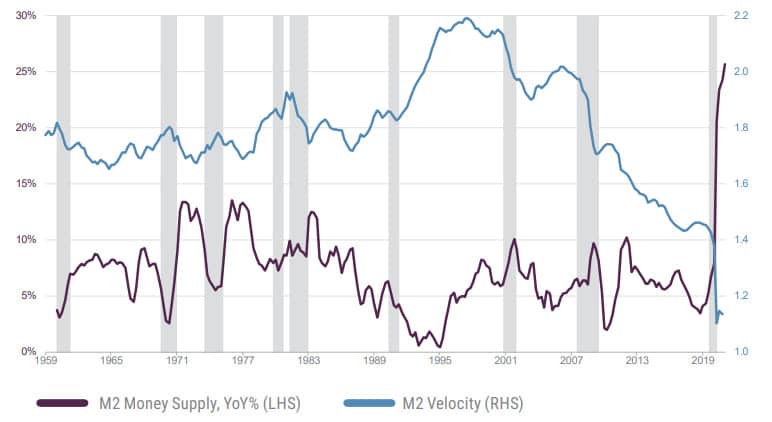

Longer term, as the market sorts out supply chains, inflation is a monetary phenomenon. Supporting the viewpoint that money supply has not been excessive, such as what we saw in the 1970’s, is the decline in money velocity. Velocity, the number of times that money in the system is used to purchase goods and services, is far lower than in the past. Consequently, what might look like an enormous monetary expansion to some, is not excessive as supported by lower velocity to others. Our take is that lower velocity may not be completely preventative in the context of 25% money supply growth. It would take very strong nominal GDP growth and an even lower velocity to soak up all these extra dollars.

Surging Money Supply Has Been Offset By Collapse in Velocity

Source: Guggenheim Investments, Haver Analytics. Date as of 03/31/2021 for M2, 12/31/2020 for velocity.

The Federal Reserve announced an important policy change last summer, which we commented on at the time. Going forward the Federal Open Market Committee (FOMC) will target 2% AVERAGE inflation, as measured by two benchmarks: core CPI and core PCE. This important change indicates the Fed will allow inflation to run above 2% for some period of time prior to reacting. Taking the Fed at its word, this indicates numbers beyond 2% for the foreseeable future will not induce a reaction from the Fed. Our conclusion is that the combination of normalizing economics and the new Fed policy creates a climate for persistent inflation, although still in a range well below the 1970’s and 80’s. The big change is from the last 10 years of inflation that almost never touched the 2% target.

What This Means for Portfolio Positioning

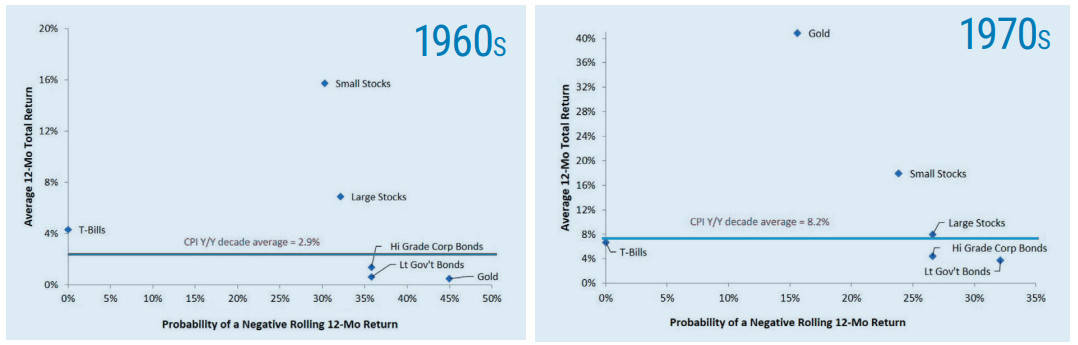

Our viewpoint is that inflation lies ahead, whether that turns out to a six-month phenomenon or a more persistent version is not the most important point. Investors should take this into account when positioning. Looking at periods of high inflation in the past offers something of a roadmap.

“Take the over on higher inflation and the under on the 1970s variety.”

Risk/Return of Asset Classes

Source: Richard Bernstein Advisors, LLC, Roger G. Ibbotson, Duff & Phelps SSBI (R) Yearbook.

The following positions going forward are important to emphasize:

1. Equities—emphasize exposure to cyclicals that are inflation beneficiaries—energy, materials, industrials are obvious examples.

2. Equities—ensure exposure to small-capitalization stocks.

3. Bonds—higher inflation puts additional upward pressure on yields, bonds will be a difficult place to make money. Floating rate mortgage paper and certain rate hedged strategies are among the best relative performers in this environment.

4. International assets—persistent inflation has a high likelihood of leading to a lower dollar. This is beneficial to international assets owned by U.S. investors. Emerging-market equity and debt may be largest beneficiaries among overseas assets. European equity markets also have relatively high exposure to cyclicals, energy, and financials in particular.

5. Real assets may benefit if inflation persists—gold could be a winner, but tends to very unpredictable. Our preference is real estate, in the form of liquid and efficient REITS, a beneficiary sector as prices appreciate and rents increase. Outside of portfolio assets, residential real estate in the form of homeownership would have additional momentum behind it.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

This information was prepared by or obtained from sources believed to be reliable, but Cary Street Partners does not guarantee its accuracy or completeness. Any opinions expressed or implied herein are subject to change without notice. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. An investor cannot invest directly in an index.

CSP2021088 © COPYRIGHT 2021 CARY STREET PARTNERS, ALL RIGHTS RESERVED