2022 2Q Market Review and Commentary

As we begin the second half of 2022, investors likely feel a lot like a football or basketball team hanging on by their fingernails just trying to get to the locker room for a halftime regroup. That sentiment alone might be meaningful going forward. Before a forward look, let us first review our viewpoints heading into 2022. In the 2022 Outlook and monthly publications since the onset of the new year, we have expressed essentially four primary viewpoints. Those are summarized below:

- Equities are likely to be challenged by a tighter liquidity dynamic, but returns should be tolerable if modest. Look for signs of downside exhaustion as a last key element before adding equity exposure and focus on quality and value factors when doing so. Among others, those signs include a high percentage of S&P stocks that appear oversold, a large washout of down volume, and a low percentage of S&P names that are trading above their 50-day and 200-day moving average.

- Be light on bond exposure going forward as rates increase. Perhaps even use moments of bond strength coming from risk-off, fear-driven developments as an opportunity to reallocate.

- Use equity hedging strategies as a solution to the challenged 60/40 allocation problem. These strategies have a similar risk profile to a balanced stock/bond portfolio and spiking CBOE Volatility Index (VIX) premium to work with.

- For investors looking for absolute, low-correlated return, commodities should continue to benefit from different supply and demand dynamics than we have seen in decades.

We pride ourselves on accountability. A reasonable self-assessment for the four primary viewpoints so far in 2022 would lead us to the following grade estimates:

- The equities outlook was too optimistic. Although we did identify liquidity as the essential headwind and warned that “If the Fed moves harder than expected, markets may struggle,” we did not take enough of our own advice and not fight the Fed. We concluded that stocks could turn in a tolerable return this year, and the first half of 2022 has been anything but tolerable with a YTD return of -19.96% for the S&P 500. GRADE: A Gentlemen’s C

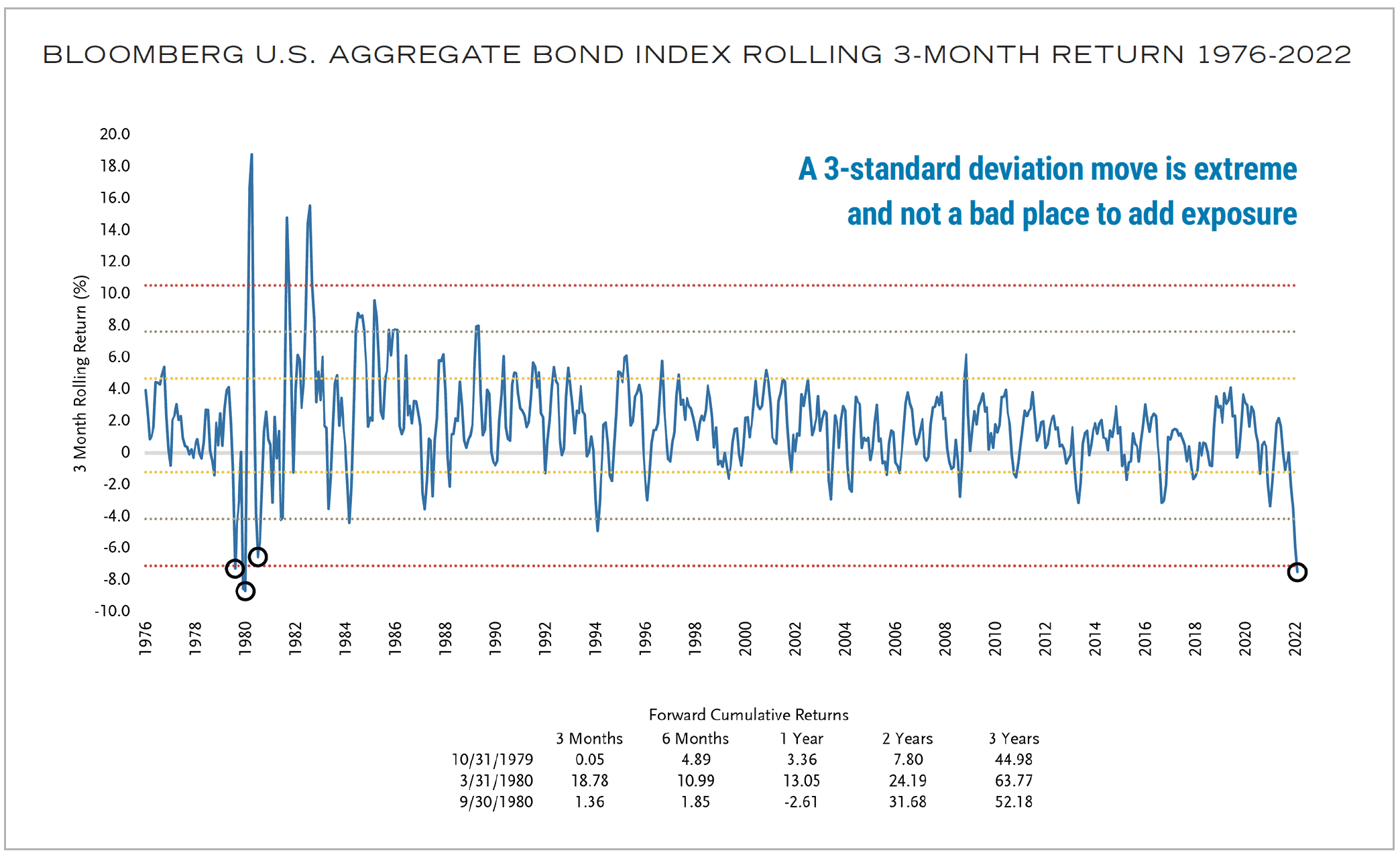

- A negative viewpoint on bonds, recommending light allocations. This one we got spot on, as we have for the last 18 months. Rates have pressured bond prices across the yield curve. The U.S. Aggregate is down 10.35% so far in 2022, and there are no bond asset classes with positive results. GRADE: A+

- Recommendation of hedged equity strategies as a solution for set-it-and-forget-it 60/40 asset allocation. This has worked very well on a relative basis, with hedged equity outperforming both stocks and bonds for the bulk of the first half. GRADE: A

- For investors looking for a low-correlation asset we have recommended real assets, primarily commodities. Commodities have been the absolute-return winner over the last 12 months. The Bloomberg Commodities Index is up 18.44% in the first half. We also mentioned the real estate sector early on, which has worked OK on a relative basis but has not generated the big positive returns of commodities. GRADE: A

Source: Bloomberg and Goldman Sachs Asset Management. As of May 20, 2022. Past performance does not guarantee future results, which may vary. An index is unmanaged and not available for direct investment.

Second Half Outlook

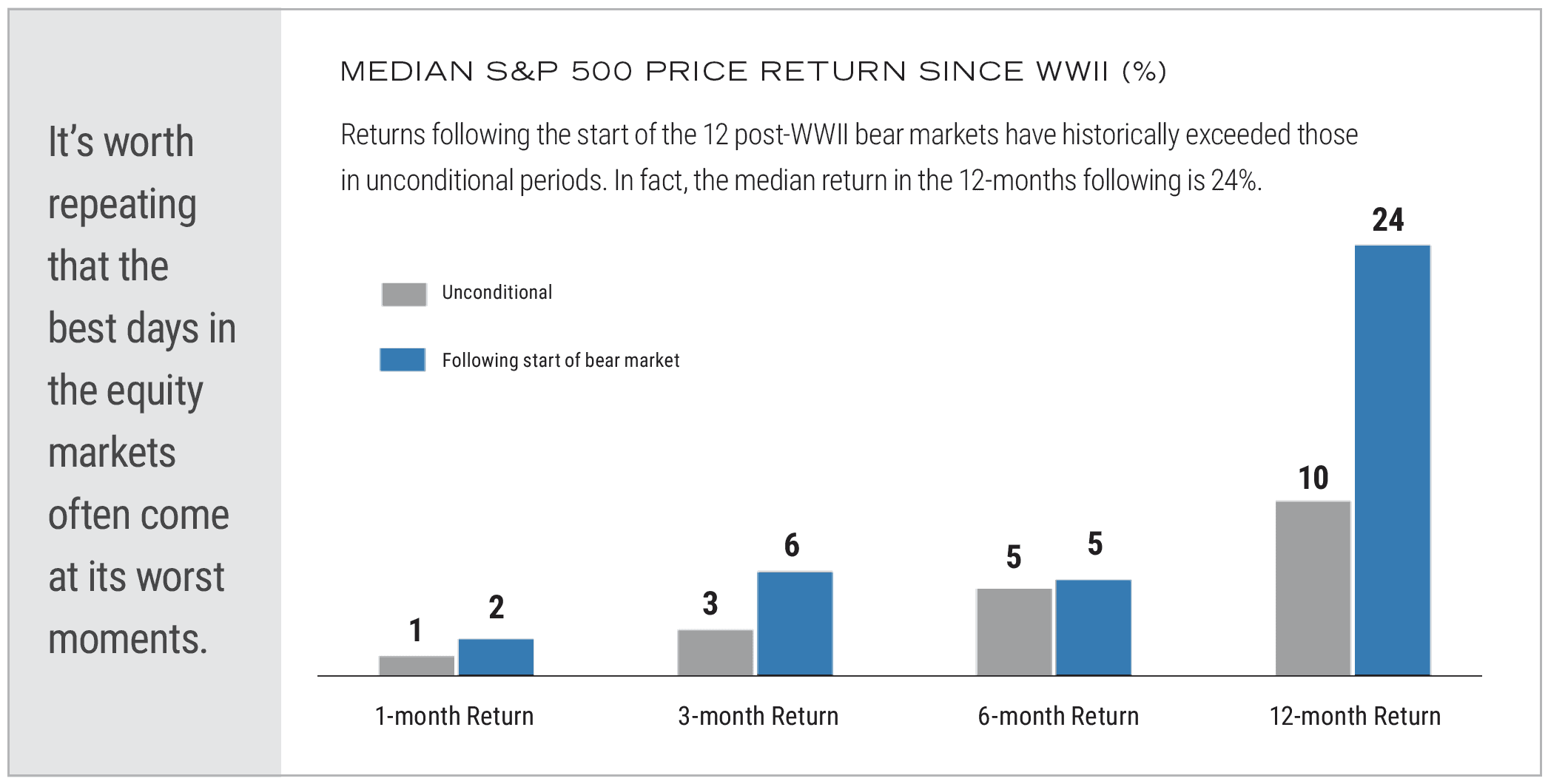

- Once equities hit bear-market territory as the S&P did in June, the opportunity cost of exiting the market outweighs the cost of additional short-term pain. Historically, looking out 12 months or more, equities have higher-than-average returns once a market enters bear territory, a decline of 20% or greater from the high. Consequently, we have a more constructive long-term view on equities than most from this point forward. Liquidity is the most important tactical driver of equity prices. There is no Fed cavalry coming to help this market near term. Without expanding liquidity from the central bank, it’s highly unlikely that the equity market recovery will look like a V. Consequently, there is probably going to be a lot of backing and filling short term. We might not get back the YTD losses incurred to date by year end, but our capital markets assumption looking out over the next one to three years is higher following a decline of this nature.

- For the first time in quite a while we are more constructive on bonds. Yields have stalled recently. Fed tightening and recession

have become the ubiquitous forecast on Wall Street. While we are unlikely to see a resumption of the dynamic that led to the 40-year bond bull market that ended in Q1 2021, bonds have enough merit at current yields to provide some downside ballast in diversified portfolios again. - Hedged Equity strategies are still a great portfolio diversifier. Markets are not the same markets that we have experienced since the GFC. Volatility and rates are higher, which leads to a much more tactical backdrop than the relatively steady state between 2009 and 2022. Volatility is a timely asset class. Hedge strategies harvesting that volatility have a tailwind with a higher VIX premium. This recommendation remains as before.

- We are moving to a neutral recommendation on the commodities space. While the longer-term supply/demand dynamic still bodes well for this low-correlation choice, we are seeing the beginnings of a breakdown in strength among metals, agricultural, fertilizers, and perhaps even energy. All these inflation trades are early-signal vulnerabilities to a peak-inflation rollover. That rollover is not evident yet, but moderating money supply should play out to that effect, even given the typical lags. This is likely a space to revisit again further down the road.

Source: TCW Portfolio Analytics, Morningstar, Bloomberg. For informational purposes only. Past performance is no guarantee of future results. Investing in bonds involves risk, including market and interest rate risks.

All economic and market data figures contained in this material have been provided by Bloomberg.

Past performance is no guarantee of future results.

This material has been prepared or is distributed solely for informational purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions expressed or implied herein are those of the authors and do not necessarily reflect the opinions of their respective firms and are subject to change without notice. Any mention of specific investments, asset classes, or market sectors are intended for general discussion and should not be misconstrued as investment advice. Investors must make decisions based on their specific investment objectives and financial circumstances. Additional information is available upon request.

The S&P 500 is an unmanaged index of common stock. Unmanaged indices are for illustrative purposes only. Investments in stocks and bonds are subject to risk, including market and interest rate fluctuations. An investor cannot invest directly in an index. Investing in commodities involves a substantial amount of risk, including loss of the entire initial investment.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.