Review and Outlook

Markets began 2022 by moving decisively lower, with both stocks and bonds enduring continuous selling pressure throughout January. In our 2022 Market Outlook, we featured the pending contractionary policy shift by the Federal Reserve as the significant headwind for 2022. Indeed, this was the culprit behind January’s weakness as markets rapidly priced in a series of Fed rate hikes and balance sheet run-off with a strong likelihood overnight rate hikes commence by the end of Q1. Persistent inflation has made mincemeat of any remaining doves within the Fed voting mechanism, the Federal Open Market Committee (FOMC). There is a unified viewpoint within the Fed, as there should be, that they are deadly serious about their intentions to drive inflation back down toward target. Markets have followed script, with the most significant negative impact felt where it should — low-quality, high-beta, longer-duration equities characterized by companies with poor current profitability, high leverage, high volatility in revenue, and most significantly, a high portion of their future cash flow in the distant future. Long duration is vulnerable to a higher short-term, risk-free rate environment as far-off cash flow is valued lower.

Persistent inflation has made mincemeat of any remaining doves within the Fed voting mechanism, the Federal Open Market Committee (FOMC).

These long-duration names have been market darlings for a decade, benefiting from an ever-lower rate environment. Consequently, many trade at lofty price-to-earnings levels and represent significant weights in market indices. The technology sector is a poster child for long- duration stocks and was a downside leader during the January decline. The poster child of short-duration stocks, energy, was the only sector to post meaningful gains in January.

The positive as we enter February is that much is priced in at this point. Prices always move faster than events. The S&P 500 declined over 10% from the beginning of January to its lowest point just shy of month end. The technology laden NASDAQ fell over 15% during the same period. A host of indicators now show the equity market to be massively oversold short term. Most important in our work during pullbacks is a focus on credit. As highlighted in our 2022 Outlook, credit stress is a necessary component of dramatic market declines beyond corrections, something that looks like March 2020 or 2008. This canary in the coal mine is alive and well as credit has remained solid, with no evident stress as indicated by tight spreads. The divergence between credit and fear, as indicated by the CBOE Volatility Index (VIX), is a very bullish set-up within historical data, strongly associated with bullish three month forward returns. We see a similar set-up in CDS (Credit Default Swaps), with the VIX again worse and diverging from CDS. All the above supports a buyable pullback.

This will be a year in which market entry points matter a great deal. With an outlook for high volatility and modest returns at best, adding exposure at tactical market lows takes on added importance. When adding equity exposure, focus on quality factors and short duration, as a normalizing liquidity regime will continue to favor these factors. Technology is likely to remain vulnerable throughout 2022 but is currently the most oversold sector. Given this tactically oversold condition, a relief rally is likely, which will also show up in growth strategies given the overweight. The longer- term technology trend suggests not to overstay that welcome following a tactical bounce. Favor quality factors in both growth and value strategies and lean toward value as they will have a greater percentage of short-duration equities as constituents. Liquidity normalization and impact is following script; do not fight the Fed.

This will be a year in which market entry points matter a great deal.

As for assets beyond long-only stocks: 1. Bonds continue to struggle, with the Bloomberg U.S. Aggregate down 2.15% for January. Despite intermittent pauses, rates are moving higher across the duration curve and it’s hard to construct a positive outcome for bonds in 2022. Rates move opposite price. 2. Equity volatility is high, hedging strategies that take advantage of a higher VIX continue to perform well relative to long only exposure and are an excellent choice for investors seeking equity participation with a smoother ride. 3. Commodities are posting solid gains reflecting a vastly different supply/demand dynamic than we have seen for decades.

Economics

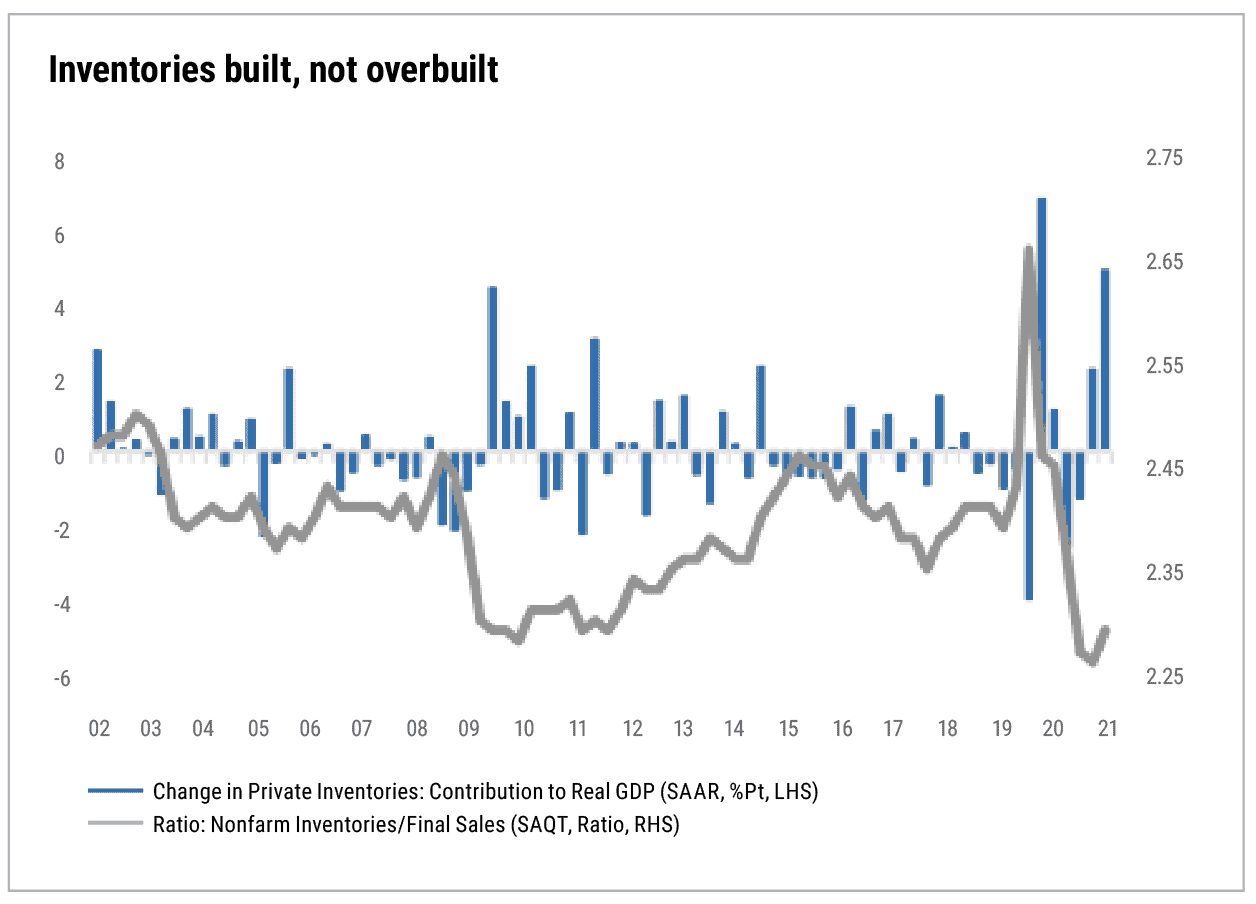

The economy finished 2021 hot, with Q4 GDP up a dramatic 6.9% annualized in Q4. The contribution from inventories during this quarter was significant, but it’s important to understand inventories were rebuilt not overbuilt. The ratio of inventory to final sales still stands below pandemic figures. The mix of economic activity will normalize following a peak in the Omicron COVID surge, which is likely about February 1. Underlying growth in GDP remains firm.

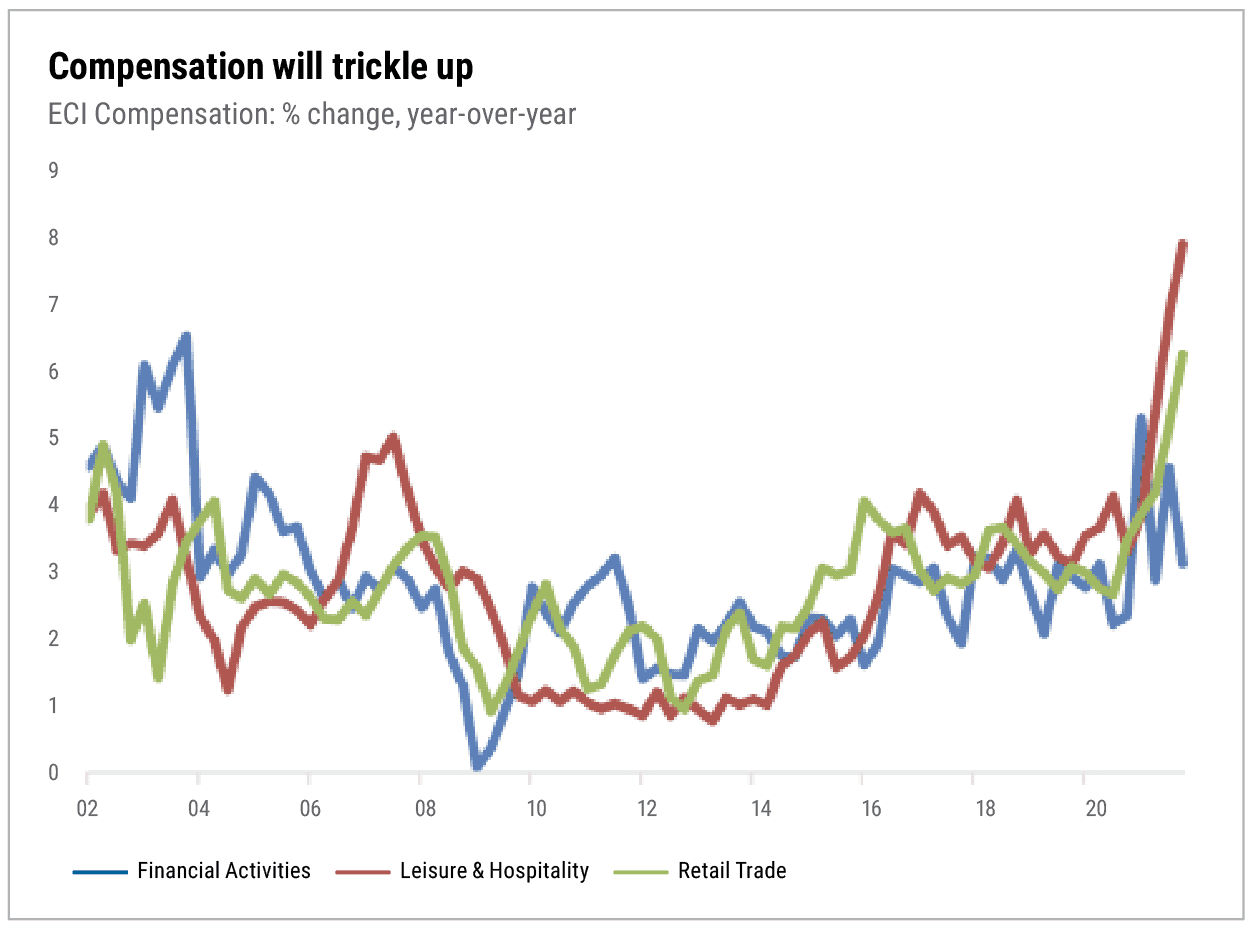

Inflation is the Fed’s casus belli. Both Fed benchmarks, the core CPI and core PCE, remain well above target. Over the last three months, core PCE inflation has advanced at a 5.8% annualized rate. This is not about reopening factors; it is a wider issue with large and sticky components such as rents. Rental inflation is running 5.3% annualized over the last three months. Labor pressures are driving a bunch of inflation, which is the rationale behind Fed focus on the Employment Cost Index (ECI) as important forward data. Over the last two quarters the ECI has advanced at an annual rate of 4.8%. Unless productivity were 2.5%, which it is not, this data is inconsistent with the Fed’s longer-term inflation objectives. Q4 ECI was lower than Q3, a positive. Whether this trend lower continues will depend on the degree of compensation pressure spreading to higher-end occupations in the quarters ahead. So far, the pressure has been primarily felt on lower-wage service occupations. Our summary: continue to expect appropriate Fed contractionary response to combat the higher structural inflation dynamic.

Source: Renaissance Macro Research, Bloomberg, Haver Analytics

Source: Renaissance Macro Research, Bloomberg, Haver Analytics

All market and economic data is sourced from Bloomberg.

This material has been prepared or is distributed solely for informational purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions expressed or implied herein are those of the speakers and do not necessarily reflect the opinions of their respective firms and are subject to change without notice. Any mention of specific investments, asset classes, or market sectors are intended for general discussion and should not be misconstrued as investment advice. Investors must make decisions based on their specific investment objectives and financial circumstances. Past performance is no guarantee of future results. Additional information is available upon request. Global/International investing involves risks not typically associated with U.S. investing, including currency fluctuations, political instability, uncertain economic conditions, and different accounting standards.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

CSP2022033 ©2022 CARY STREET PARTNERS LLC, All Rights Reserved.