Review and Outlook

Equities produced poor results for November. The S&P 500 Index dropped .69%¹

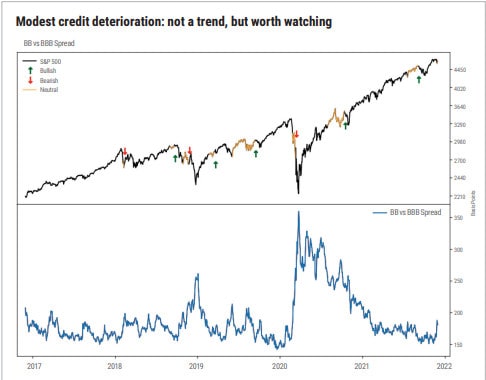

for the month. Outside the S&P, most other readings were lower in the 3-4% range. Small company stocks were particularly weak. On a sector basis, technology was the leader, with energy and financials the laggards. The day after the Thanksgiving holiday, Black Friday, saw significant fear come into the market in reaction to news regarding the newest COVID variant: omicron. In that short, low-volume session alone, volatility pricing skyrocketed as the CBOE Volatility Index (VIX) gained over 50%. This spike in fear is dramatically above 200-day and YTD moving averages for context. Unlike previous pullbacks over the last year, credit also shook somewhat on that day. Credit stress looms large in our work as the canary in the coal mine for larger equity drawdowns. It is an effective and early indicator of panic. Credit gets ahead of a lot of potential market problems. Our preferred measurement of credit stress is the yield spread between high yield, junk bonds versus investment grade. A widening of spread indicates a flight to safety, stress in the market, and potentially new credit flow dissipating for lower-rated credits. BB versus BBB spreads widened on Black Friday, and Credit Default Swaps (CDS) also ticked up, the deterioration extending into the last few days of November trading. Black Friday was a lack of liquidity event for credit, but this key data point of credit is wobbling and bears a close watch going forward. We do not want to see spreads trending wider. So far, the deterioration is modest.

Source: Renaissance Macro Research

The trigger for the selling of risk assets on Black Friday was the aforementioned

omicron COVID variant. This is a new variant first identified in South Africa (although it may not have originated there), that carries a large number of mutations. It appears to be very virulent, although to date symptoms seem to be relatively mild. The variant has been seen in Europe and is likely already in the U.S. There is concern that any variant could evade existing vaccines, and it will be a few weeks before vaccine makers can determine the efficacy of current vaccines versus omicron. An important reminder—vaccines are not binary. This is not a case of the current vaccine working or not working. The issue is the degree of efficacy. The percentage of efficacy versus omicron is potentially less than the current efficacy rates in excess of 90%. One of the amazing features of mRNA vaccine technology is how quickly it can be adapted to improve efficacy if needed. Estimates from Pfizer are that it would take about six weeks to adapt existing mRNA vaccines to the variant and about 100 days to start shipping. Another potential solution is greater booster dosage. Greater clarity on omicron, the efficacy of vaccines, and the COVID pill treatments should come during December. Until we get greater clarity on omicron, market volatility is likely to remain elevated.

Economics

Outside of the potential impact of COVID, the economy and inflation are both running hot. Q4 growth is strong so far, consumption is strong, and surveys of business sentiment point to robust growth and investment. Incomes are exploding. Inflation is certainly a clear and present issue. The two Fed benchmarks, core CPI and core PCE were both hot through October. Core PCE was up 4.1% year over year, core CPI up 4.6% year over year. There are some signs of the well-known supply chain issues being sorted out by the market, but sticky, persistent elements within the data remain problematic. Rent has been surging, is very sticky, and comprises about 40% of CPI. Rental inflation of 5.5% to 6% would be consistent with 2.3% core CPI growth, assuming the contribution from everything else is zero, a very unlikely, conservative assumption. Bottom line is that underlying inflation looks much closer to 3% than the Fed target of 2%. In response, the Fed will begin tapering its monthly bond purchase program (QE) by approximately $15 billion per month, bringing it to a conclusion around mid-year. There is also discussion among Fed officials regarding a faster taper and opening the door to interest rate hikes immediately following the conclusion of the bond-buying program.

¹ Marketwatch

All market and economic data is sourced from Bloomberg.

Past performance is no guarantee of future results.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

This information was prepared by or obtained from sources believed to be reliable, but Cary Street Partners does not guarantee its accuracy or completeness. Any opinions expressed or implied herein are subject to change without notice. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. An investor cannot invest directly in an index.

CSP2021226 © COPYRIGHT 2021 CARY STREET PARTNERS LLC, ALL RIGHTS RESERVED.