Review and Outlook

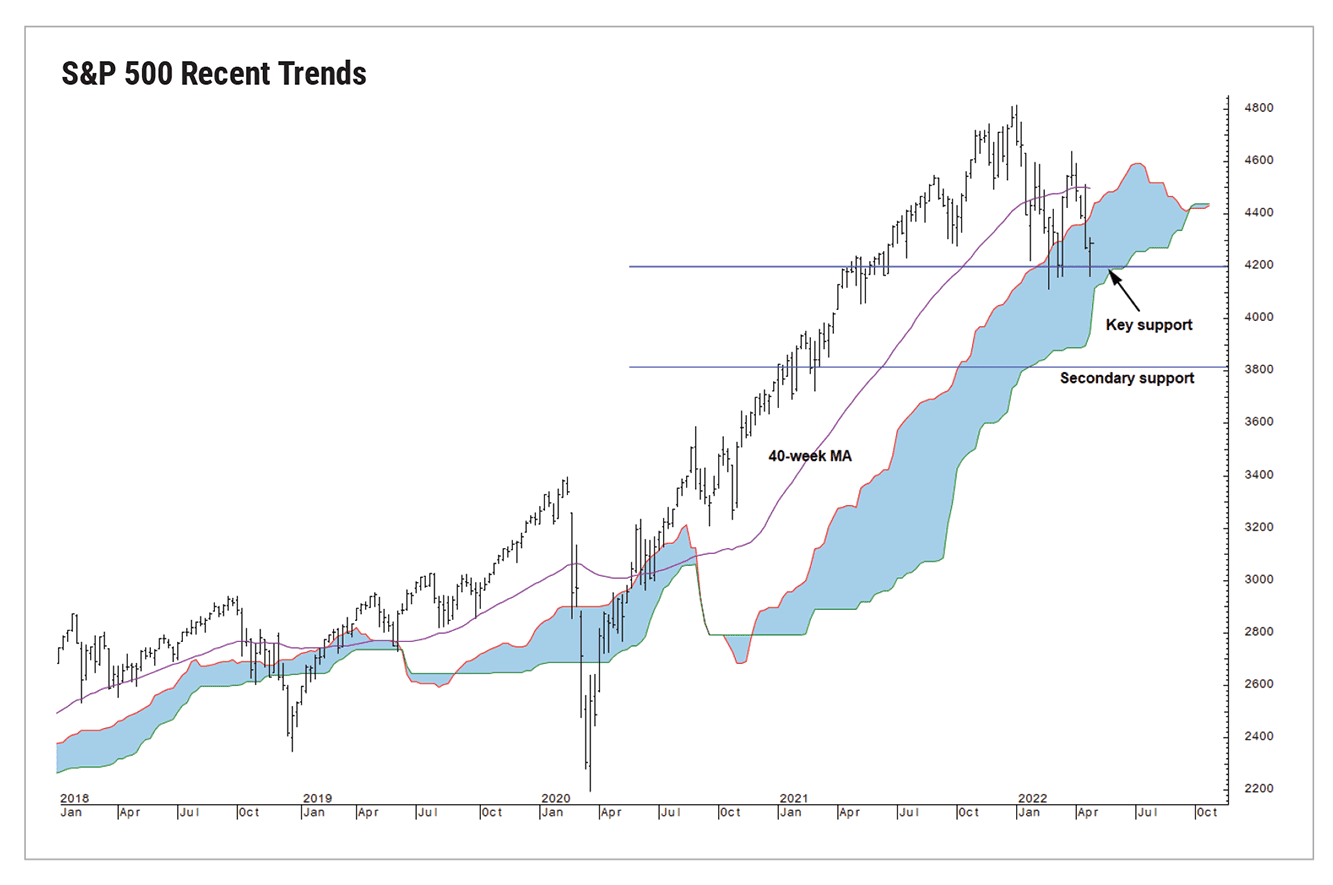

With a nod to Yogi Berra; “it’s déjà vu all over again.” Throughout 2022, the stock market has repeatedly visited a low found around the highly watched 4200 level for the S&P 500 Index.¹ As the market sold off with the onset of war in Ukraine during late February, a bottom was reached March 8th with the S&P close of 4170. Following that bottom, a zone that was also touched intraday during late January, equities rallied with the S&P trading up to 4631 on March 29th. Although we failed to challenge the all-time high found at the outset of 2022, this was still an increase of about 11% from bottom to top. During the month of April, stocks again sold off, this time predominately due to fear of aggressive Federal Reserve tightening. Equities re-tested the S&P 4200 support level yet again, closing at 4131 on April 29th. That leaves the market at this writing below critical support, needing an immediate upside response to avoid a further breakdown.

Source: Fairlead Strategies

As we forecast in our 2022 Outlook, 2022 is a challenging year for risk assets. Liquidity contraction poses a headwind for stocks and bonds, but this contraction is coming on the heels of generationally strong inflation, sparking a greater degree of hawkish Fed rhetoric. Markets have struggled as they price in very steep short-term interest rate expectations. Higher rate-increase expectations have also propelled bond yields higher, inflicting additional pain on the 16-month bear market in bonds. The first quarter of 2022 resulted in negative returns for both stocks and bonds, a rare double/double.

As we forecast in our 2022 Outlook, 2022 is a challenging year for risk assets.

The best attributes of the stock market at this point are the pervasive negative sentiment (a contrarian positive) and the lack of stress in credit. Both serve to support a limited downside viewpoint from current levels. A lot of bad news, especially regarding liquidity coming in, is already priced into the market. However, we always listen to the message the market is giving us. Downside momentum has not reached low tide yet. Should support around 4200 break down, the odds of a more prolonged and deeper decline go up.

The S&P is 14.3% off its high, the NASDAQ 100 is over 23% below its high. At current levels, short-term oversold indicators are firing off all over the place. An oversold rally, while welcome relief from a larger drawdown scenario, still leaves equities challenged to get back to the 4820 S&P high longer term, but there is a fair amount of room to that level. To the downside, secondary support is about 3800 S&P. That is roughly 8% below the April end-of-month close.

Positioning

We would look to add equity exposure at nearby support if it’s held at the current levels, or closer to 3800 SPX if the current level does not hold. Longer term, there is a solid case for adding exposure immediately, but momentum can take markets further than commonly thought in the short term. To have higher-conviction short term we want to see that downside momentum broken.

Within the equity market, value strategies have performed best this year, particularly those with a late cycle bias. That trend is still intact. Sectors in these strategies such as energy, utilities, and consumer staples have been YTD winners. Real estate is another sector that is trending well more recently.

As mentioned above, this year has been particularly challenging as both stock and bonds have posted negative results, highlighting a massive problem in the autopilot method of asset allocation commonly known as 60/40. Other than commodities, volatility has been the timeliest asset class over the last 12 months.

Strategies that capture the volatility premium, properly executed hedged equity strategies,² have provided a solution as a replacement to the broken 60/40 stock/bond allocation – outpacing stocks, bonds, and consequently the 60/40 blend this year.³ Indeed, longer-term, annualized returns over the last 36 months have almost equaled global equities with just a little over half the risk as measured by drawdown. An elevated level of fear, as priced in an elevated CBOE Volatility Index (VIX), provides a good backdrop for these strategies as they capture that spiking price.

Strategies that capture the volatility premium, properly executed hedged equity strategies,² have provided a solution as a replacement to the broken 60/40 stock/bond allocation – outpacing stocks, bonds, and consequently the 60/40 blend this year.

Commodities, as mentioned above, and in our previous publications, have also delivered good returns, the Bloomberg Commodity Index (BCOM) is up 30.75% in 2022. There is a supply/demand dynamic in commodities that is much stronger than anything witnessed in decades, and the strong uptrend in this space remains intact. For investors seeking a low- correlation alternative to stocks and bonds, commodities remain a good choice. During the month of April, which endured the above mentioned equity sell-off of close to 9% on the S&P, the BCOM gained 4.14%.

Economics

Following a gangbuster 2021, the best performance since 1984, first-quarter GDP growth cooled. Along with early-quarter COVID challenges a widening trade deficit had a heavy impact on this number; the initial read on Q1 GDP was a decline of 1.4% annualized. The trade gap shaved 3.2% off Q1 GDP, not surprising as the U.S. needed consumer goods, creating import demand. This is not a lasting effect as consumer goods inventories have been replenished. In fact, trade and inventories probably tell you the least about the outlook at this point. Consumer spending held up well for the quarter. Private domestic demand is strong. Households and businesses are spending a lot. The quarter looks to us like noise and not indicative of any sort of lasting trend. Underlying growth is probably closer to 4%.

Inflation is the focus, and it should be. The Fed is behind the curve in dealing with it and has messaged deadly serious intentions around hiking short-term rates and reducing its balance-sheet-liquidity contraction. Fed hawkishness combined with easing supply chains support an outlook of improvement. Improving delivery times and falling freight rates are evidence of improving supply chains. We are quick to add, while we see the case for this improvement, that still does not lead us to an immediate low-inflation expectation. Indeed, since August 2020, we have forecast a higher structural-inflation dynamic, inflation data running above 2%. But perhaps near-term data will reflect low- to mid-single-digit inflation as opposed to recent headlines in the high-single digits.

¹ All market data figures shown are sourced from Bloomberg.

² As of April 29, CSP Global Hedged Equity Strategy (-6.69%), S&P 500 (-12.92%), US Aggregate Index (-9.50%) all YTD 2022.

³ As of April 29, the 60/40 S&P U.S. Aggregate Bond Index (-11.54%) YTD.

Past performance is no guarantee of future results.

This material has been prepared or is distributed solely for informational purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions expressed or implied herein are those of the speakers and do not necessarily reflect the opinions of their respective firms and are subject to change without notice. Any mention of specific investments, asset classes, or market sectors are intended for general discussion and should not be misconstrued as investment advice. Investors must make decisions based on their specific investment objectives and financial circumstances. Past performance is no guarantee of future results. Additional information is available upon request. Global/International investing involves risks not typically associated with U.S. investing, including currency fluctuations, political instability, uncertain economic conditions, and different accounting standards.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

CSP2022112 ©2022 CARY STREET PARTNERS LLC, All Rights Reserved.