It is a deeply unsettling time around the world and here at home. With the Coronavirus still unconfined, it is hard to see how we all can return to normal, much less plan a retirement that might be fairly close at hand.

For those with lots of time ahead of them, in our opinion, continuing to hold equities, wait it out and maybe buy more along the way is still the best course of action.

For those near retirement, it is stressful to see these kinds of sharp drops, and it is natural to worry. Still, the advice is likely to be the same. Why? Because most retirees still have decades in front of them and may need to have a healthy allocation to stocks for their money to last.

In our opinion, there is one step for those near retirement that will help reduce anxiety and increase the odds of retiring on time. Map out how much cash you will need for your first 12 to 18 months in retirement. If you are really worried, plan out two or three years. Then set that cash aside in your investment allocation. We believe the ideal way to do this is with a good financial plan, one that helps you understand how you use your money over time.

Most likely on the first day of your retirement you will not need 100% of your savings in cash. If you want to build up your cash cushion, sell a bit at a time, hopefully when the stock market is having a good day. If the down days have shown that you have too much risk, you may want to use the good days to shift more to bonds.

For those invested in a target-date fund for 2025 or earlier, the allocation is likely to be 50/50 stocks and bonds, so the risk is already spread out. Historically, markets do bounce back, even after big shocks, so in our opinion riding it out makes sense.

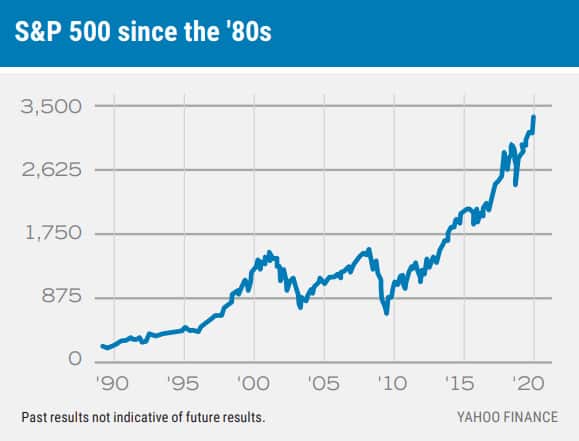

The chart above shows the growth of the S&P 500 since 1980. Despite some big drops, long-term the trend is up. Anyone who is 65 today still likely has two decades to make up investment losses. Being confident that you have your short-term needs taken care of will allow you to think further out for the rest of your assets. It is likely that things will look differently in five years.

Cary Street Partners Financial, LLC is a limited liability holding company that owns 100% of Cary Street Partners Investment Advisory LLC, a Securities and Exchange Commission registered investment advisor.

Before making a decision to invest, a prospective investor should carefully review information respecting CSP and, where applicable such investment and consult its own legal, accounting, tax and other advisors in order to independently assess the merits of an investment.

Past results not indicative of future performance. Institutional Use Only. Not for use with, or distribution to, the public. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. The S&P 500 (a registered trademark of McGraw-Hill Companies) is an unmanaged index of common stock. Unmanaged indices are for illustrative purposes only. An investor cannot invest directly in an index.

Performance data quoted is historical. Past performance is not indicative of future results, current performance may be higher or lower than the performance data quoted. Investment returns may fluctuate; the value of your investment upon redemption may be more or less than the initial amount invested. All returns are net of expenses. To obtain performance data that is current along with other information please call Celia A. Rafalko or Raymond James (R.J.) Reibel. This presentation may contain statements based on the current beliefs and expectations of CSP and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Any references herein to any of CSP’s past or present investments have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments will be profitable or will equal the performance of these investments. There can be no guarantee that the investment objectives of CSP will be achieved. Any investment entails a risk of loss.

CSP2020515