Market Update and Comments

Equities turned broadly lower last week. The S&P 500 Index declined .55%¹ on the week. Broad performance was weaker, the Russell 2000 declining 2.47%¹ as one example. For context, the S&P has not experienced a 5% pullback yet this year and furthermore has not experienced an actual 10% correction since last September. The market has experienced several 3 to 5% pullbacks this year that have quickly rebuilt a wall of worry for the market to move higher. Fear is only an inch away in this COVID-dominated environment. The CBOE Volatility Index (VIX), known as the fear index in some circles, spiked higher through Thursday last week, trading well into the 20s, well above all recent moving averages. This was an approximately 50% increase in just a few sessions. On Friday, markets rallied to cut losses for the week as fear dissipated.

The market this year has repeatedly found support at the 50-day moving average. The buy-the-dip character of 2021 continues to be driven by the mountain of liquidity. Historic data indicates pullbacks characterized by a spiking VIX, absent credit stress, as a bullish setup for forward S&P returns. We have seen this dynamic play out several times this year. Credit stress is the canary in the coal mine for larger equity drawdowns, something beyond normal pullbacks and corrections. Credit markets are wide open. In summary, this is the data behind a fear-driven market move that rebuilds a wall of worry. The speed and shallowness of this dynamic have been surprising, and at some point, the dip will mature into a larger 5%+ pullback.

Source: Renaissance Macro Research, Macrobond

Economic News

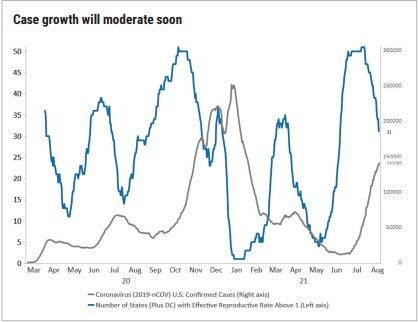

The significant negative development now is the delayed return to the office due to the COVID Delta variant concern. At a minimum, this rotates growth away from urban core markets. While the peak of the Delta surge is still not here, vaccinations are picking up, particularly in high-case-load states. Nationwide vaccinations are hitting one million per day on some days — rates not seen for months. The number of states with a virus reproductive rate above 1 has been declining. It was 50 at the end of July and is currently 31. A reproduction rate below 1 means that an outbreak is subsiding since each infected person is transmitting the virus to fewer than one other person. This is the data that leads case growth.

Source: Renaissance Macro Research, Haver Analytics

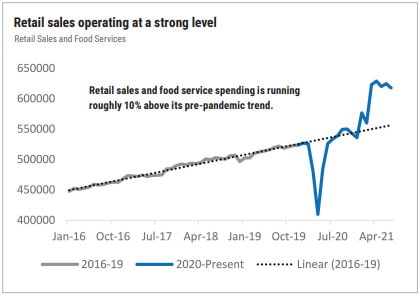

The July retail sales report disappointed on Tuesday last week, declining 1.1%. An important source of weakness within the data was online sales dropping 3.1%, the biggest drop since February. This is likely due to timing around Amazon Prime Day. Core sales were down .6%, and exonline core rose .1%. The conclusion is that retail sales are not nearly as weak as headlines.²

¹ MarketWatch

² All economic news data sourced from Bloomberg

Past performance is no guarantee of future results.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

This information was prepared by or obtained from sources believed to be reliable, but Cary Street Partners does not guarantee its accuracy or completeness. Any opinions expressed or implied herein are subject to change without notice. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. An investor cannot invest directly in an index.

CSP2021168 © COPYRIGHT 2021 CARY STREET PARTNERS LLC, ALL RIGHTS RESERVED.