by Celia A. Rafalko / R.J. Reibel

Ever since Dividend Reinvestment Programs, or also known as “DRIPs” started decades ago, market wisdom has generally dictated that dividends are to be reinvested. Additional shares automatically showing up without a trading cost, what’s not to like?

Well, depending on your personal circumstances, maybe quite a bit. Dividend reinvesting is popular because it is an easy way to compound your investment. Each time a dividend is paid, it goes to buy additional shares or fractions of shares of the stock that paid the dividend.

When a company pays a dividend, it is taxable income, unless the investment is in a tax-deferred account like an IRA or 401(k). The top tax rate for a “qualified dividend”1 is 20%, lower than the top tier tax rate of 37%. While taxpayers who make under $77,200 for a married couple benefit from a 0% tax rate on qualified dividends, most holders will end up with a tax bill. So, if the dividend is reinvested, the investor pays the tax but does not have the money unless he or she later sells the shares.

The bigger issue with dividend reinvestment is back to one of investment strategy and risk. The main reason to buy dividend-paying stocks is because they are perceived to be higher quality safer investments. The dividend mitigates risk by giving the investor some money. If that money is used to buy more shares of that stock, it is not mitigating risk, it is amplifying it.

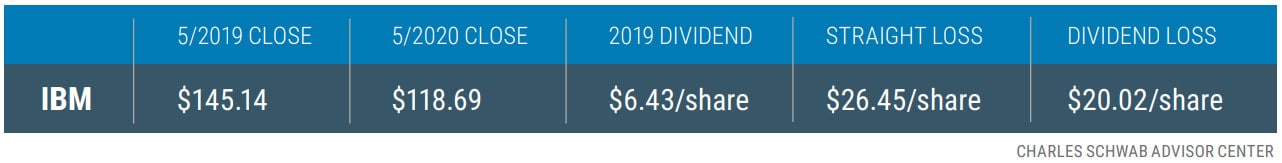

Let’s look at an example of a well-known dividend stock, IBM.

Those who took the dividend in cash would have an effective loss of $20.02 since IBM gave them $6.43 in cash for each share. Cash dividends will cushion potential losses, rather than adding to your stock position, which is always at risk.

Of course, investors with longer time frames, healthy risk appetites, and tax-deferred accounts can greatly benefit from dividend reinvestment if their preference is to increase their stock position. For everyone else, consider the alternative of taking that money and maybe diversifying into another holding.

Want more from Celia A. Rafalko? See her discuss Cary Street Partners’ retirement services.

1 A qualified dividend is usually one paid from a U.S corporation.

Cary Street Partners Financial, LLC is a limited liability holding company that owns 100% of Cary Street Partners Investment Advisory LLC, a Securities and Exchange Commission registered investment advisor. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy.

CSP2020519