Equity Outlook

The best thing that can be said for the 2021 outlook is that it is not 2020 anymore. The overriding feature of the new year will be the same as the last year — COVID. The good news is that the end of this horrible pandemic is now in plain sight thanks to the remarkably effective messenger RNA vaccines that are rolling out to the broad population over the next two quarters. While the development of COVID vaccines using this technology has occurred at a historically fast pace, messenger RNA development work by companies such as BioNTech and Moderna has been going on for the last decade. That long-term development work has been quickly applied to COVID. Mitigation efforts will need to remain vigilant prior to widespread distribution over the first two quarters of 2021. Current hospitalization rates in the U.S. are statistically high and verge on overwhelming capacity. Europe has seen improvement as mitigation has taken effect, and Asia has experienced much less infection for the balance of 2020.

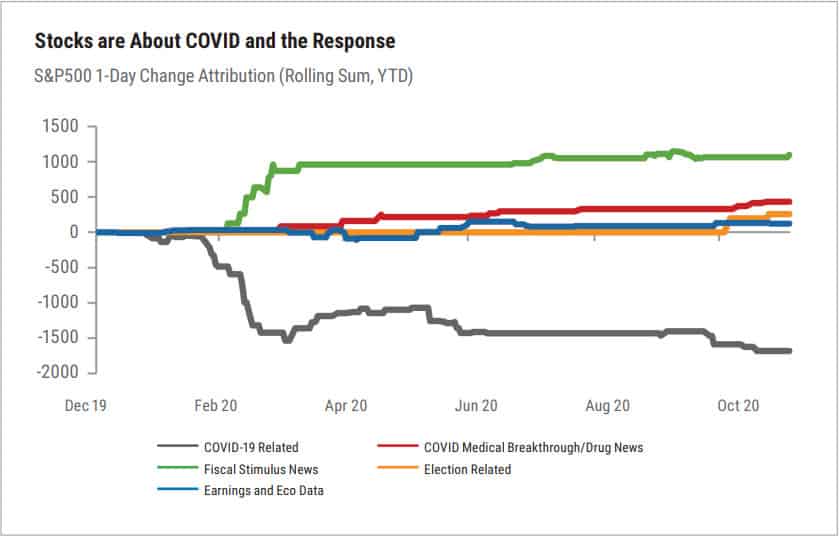

Stock markets in 2020 experienced a historically rapid recovery from the large decline in March triggered by the onset of the pandemic. From the March low, tactically important indicators for equities of trend, momentum, liquidity, credit, and until recently sentiment, have all been positive. Over the balance of the year rapid and massive liquidity provided by the Federal Reserve, coupled with medical improvements, have resulted in risk premia declining from historic levels reached in March. Credit stress has disappeared. The long-term trend for equities is higher heading into 2021.

Valuation, while important from an equity selection standpoint, is not an efficient market forecasting tool. That said, market valuation, as measured by the price to earnings ratio, is higher than normal, but comes with an important caveat. Valuation always needs to be observed within the context of interest rates, which are low and a long way from concerning. Low rates allow for markets to trade at high valuations, and 2021 is a year in which the earnings portion of the ratio will grow into the price side.

Source: Renaissance Macro Research, Haver Analytics

A key impediment at the outset of the new year is the extreme level of bullish sentiment, an inverse negative. While sentiment readings are often early, current levels are historically troublesome for stocks in the near term. A lot of positive developments regarding vaccines are already priced into equities. The flip side is that any near-term pullback should be buyable given strength in all the other tactically important readings.

Our summary outlook for equities — short-term wary, longer term for the balance of 2021, very positive.

Equity Positioning

For the bulk of 2020, large-capitalization growth stocks such as Amazon, Microsoft, Google and Netflix were market leaders as their business models were not negatively impacted by the pandemic. Economically sensitive cyclical stocks, commonly found in value strategies, were significant laggards for the year. However late in the year, as economic reopening has become more evident, cyclicals have rebounded.

The recent relative strength in cyclicals has additional room to run on the back of vaccine and relief legislation news, but this move is not in the first inning any longer. Prices move early and fast. Investors should ensure they have exposure to cyclicals as they are at least likely to do better than they did in 2020. Adequate portfolio diversification is always good advice and may be particularly important in the coming year as leadership rotates. Smaller-capitalization stocks are also beneficiaries of the reopening. International small-cap names are particularly appealing and underowned. Investors that want equity market participation with a less volatile ride should continue to look at very predictable hedged equity strategies.

Economic Outlook

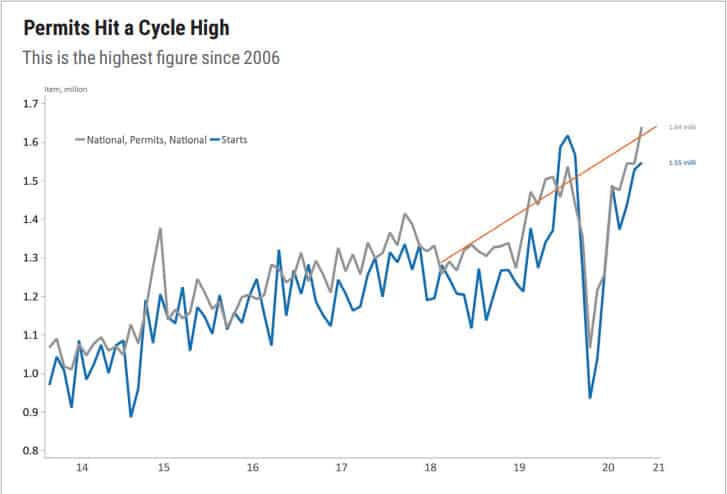

Source: Renaissance Macro Research, Haver Analytics

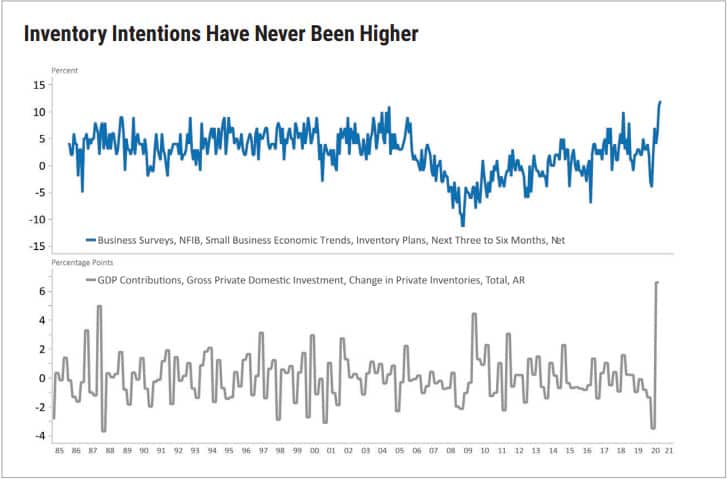

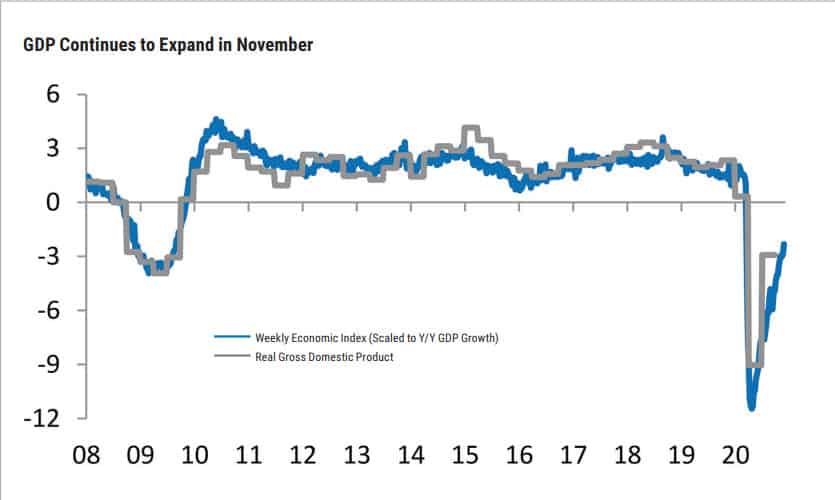

The economy has upward momentum entering 2021. A host of forward-looking positives are present — builder backlogs remain substantial, dollar weakness will provide a lift to exports, inventories are very low, investment spending is climbing, household balance sheets are very strong, and most importantly, the Fed will not short-circuit growth. The clear negative has been services spending, which also feeds into the job market. Services spending will unleash with the onset of vaccines. Job growth, always the laggard economic indicator, will pick up pace accordingly. The Federal Reserve has been heroic in its response to COVID, averting a deflationary spiral. In addition to all the other liquidity provisions, M1 money supply has grown by 45% since March, ensuring good nominal GDP growth in the years going forward. Look for economic growth to boom and surprise to the upside as we move into 2021.

Source: Renaissance Macro Research, Macrobond

Bond Market Outlook

Bonds proved to be an efficient diversifying asset in 2020, with Treasuries, in particular,

providing portfolios a cushion to equity downside in March. 2021 is likely to be a very

challenging year for bonds as the yield curve steepens due to economic normalization.

This means higher long-term rates, which means lower bond prices for longer-duration bonds. The outlook calls for shorter-duration bond positioning.

Source: Renaissance Macro Research, Haver Analytics

Not commonly understood is that the bond market is far larger than the equity market. Globally the bond market is about 100 trillion dollars in aggregate versus stocks at about 35 trillion dollars in the U.S.

2021 is likely to be a challenging year for bonds as the yield curve steepens due to economic normalization.

There are many different fixed-income asset classes, with differing characteristics. 2021 is a year in which active selection plays a large role. While we would be wary of Treasury exposure, opportunities exist within the mortgage market as well as within emerging-market debt and selective U.S. corporate debt. Active management with wide mandates, typically found in Core Plus or non-benchmarked strategies is the best place to find opportunity.

Past performance is no guarantee of future results.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

This information was prepared by or obtained from sources believed to be reliable, but Cary Street Partners does not guarantee its accuracy or completeness. Any opinions expressed or implied herein are subject to change without notice. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. An investor cannot invest directly in an index.

CSP2020703 © COPYRIGHT 2020 CARY STREET PARTNERS LLC, ALL RIGHTS RESERVED.