Review and Outlook

May has been miserable. As equity markets broke downside support found at 4200 on the S&P 500 Index, they quickly added on approximately another 8% to the downside, testing secondary support at 3800. This tipped the market briefly into bear market territory as measured by the S&P 500. A bear market is defined as a decline of 20% from peak levels. Year-to-date figures are very similar in comparison to peak-to-trough as the market peak coincided with the onset of 2022. The tech-heavy, long-duration NASDAQ is well beyond the S&P in terms of loss, approximating 30% as of this writing. There are short-term, downside exhaustion signs at this point—potentially pointing to an oversold rally. While that would be a welcome relief, it will likely take longer for the vicious downside momentum to meaningfully reverse. The equity market is currently overwhelmed by downside momentum. Consequently, a timeline for the beginning of any sustained upturn is probably pushed out to the fall. Prior to that, this will likely be a time that continues to test investors’ nerves.

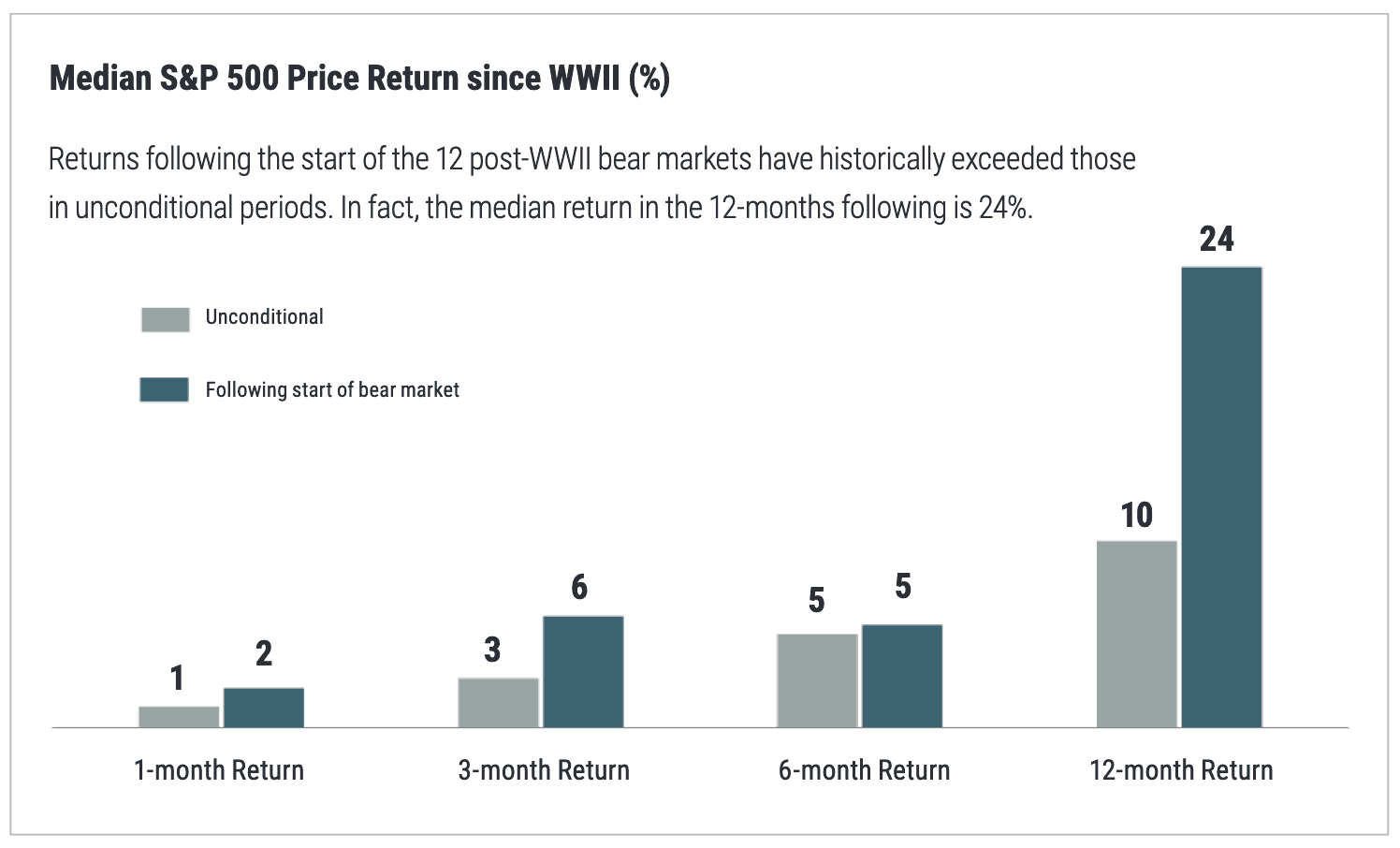

We remind investors that the best days in the equity markets often come at its worst moments.

More important at this juncture, the opportunity cost of exiting the market may be greater than the risk of a deeper drawdown from current levels. Going forward from the point equities hit bear-market territory, the odds are historically favorable for above-average returns on risk assets. There is money to be made on the other side of every decline.

Source: Bloomberg and Goldman Sachs Asset Management. As of May 20, 2022

Past performance does not guarantee future results, which may vary. An index is unmanaged and not available for direct investment.

Economics

The clear and present issue remains inflation, which is triggering belated Federal Reserve tightening, leading to the great debate around the potential for a recession. Going forward, a deceleration in inflation is our base case. Money supply growth was a key element of our viewpoint a year ago regarding the onset of a higher inflation dynamic. That growth in money supply reached levels of around 35% during 2020 and early 2021. In 2020 alone, it was higher than any year since 1943. Money-supply growth has diminished dramatically, down to about 3% annually over the last three months. The recent moderation is encouraging. War or pandemic-induced supply chain issues can result in some inflation, but it takes expansionary monetary policy to have this spill over into general inflation. The moderation in money-supply growth has lags that likely keep inflation in the mid-single digits this year and next, but is another factor (along with easing supply chains) that should lead to a deceleration.

All economic and market data is sourced from Bloomberg.

Past performance is no guarantee of future results.

This material has been prepared or distributed solely for informational purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions expressed or implied herein are those of the author(s) and do not necessarily reflect the opinions of their respective firms and are subject to change without notice. Any mention of specific investments, asset classes, or market sectors are intended for general discussion and should not be misconstrued as investment advice. Investors must make decisions based on their specific investment objectives and financial circumstances. Economic and market data figures stated in this material have been compiled from sources believed to be reliable, but Cary Street Partners makes no claim as to their accuracy or completeness. Additional information is available upon request.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

CSP2022125 ©2022 CARY STREET PARTNERS LLC, ALL RIGHTS RESERVED.