Did you know that you can get a match on your 401(k) contributions when you file your taxes (if you qualify)? It’s called the Retirement Saver’s Tax Credit.

What is Saver’s Credit?

Retirement Saver’s Credit is a tax credit for workers who contribute to a retirement plan.

With this savings credit, you can get a credit of up to $1,000 if single or the head of household and $2,000 if married filing jointly on your taxes, just by contributing money into your company 401(k) plan.

Unlike employer match contributions, this Saver’s Credit is included in your refund each year when you file your taxes.

If your employer offers a match and you qualify for this credit, then your 401(k) contribution gets you a matching contribution plus a credit match of up to 50% on your taxes.

Who is eligible for Saver’s Credit?

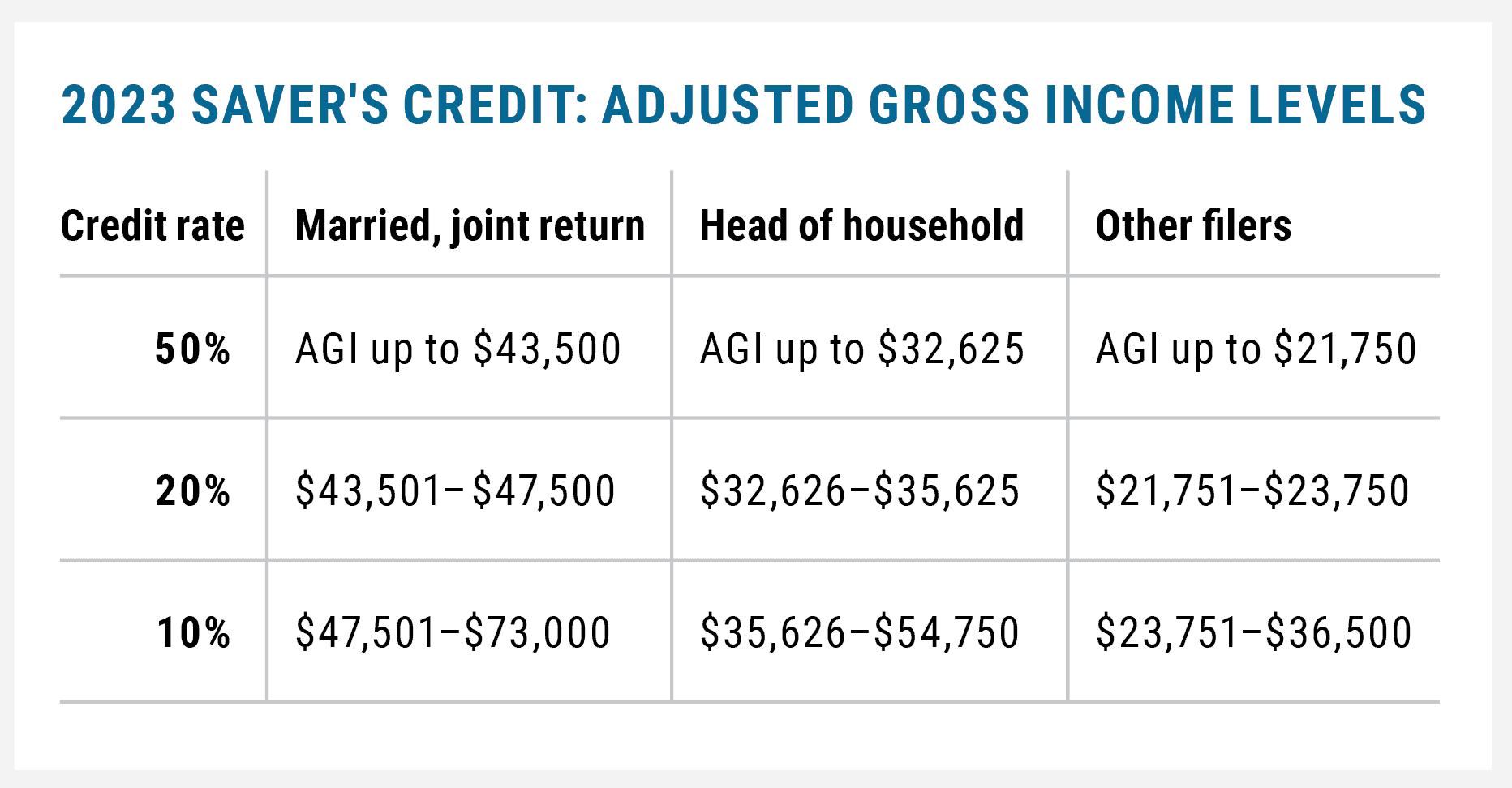

You qualify for Saver’s Credit if you are 18 or older, not claimed as a dependent on another person’s tax return, and not a student. You also must meet the income limits listed below.

Your Adjusted Gross Income (AGI) must be below the following levels:

When reviewing if you qualify, please consider the limits above are on your Adjusted Gross

Income, which is after all deductions so you might be surprised that you qualify. The credit is

claimed using IRS Form 8880.

Take credit for your retirement!

Interested in learning more about retirement planning? Contact our retirement services professionals today so they help you make smart choices about retirement savings.

Raymond James (R.J.) Reibel

Raymond James (R.J.) Reibel

Financial Advisor, Retirement Benefits, Director

Call | Email

Paula Megan, CFP®

Paula Megan, CFP®

Client Relationship Manager, Retirement Benefits, Assistant Vice President

Call | Email

Scott Bussells, AIF®

Scott Bussells, AIF®

Financial Advisor, Retirement Benefits, Vice President

Call | Email

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information contained herein without consulting a tax professional or an attorney.

IRAs, 401(k)s and other retirement plans may have fees associated with them in addition to the costs associated with investing the assets of the retirement plan. These fees may include, but are not limited to: annual account fees; administrative fees that may include recordkeeping of the plan; legal fees; accounting fees; and termination fees. Please consult with your advisor or plan sponsor to learn more about the fees associated with a particular plan.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results. CSP2023047