By Thomas O. Herrick

Chief Investment Officer, Managing Director

Last month we highlighted the strong relationship between calmer yields and better risk returns. That dynamic held in place from late October until approximately three weeks ago. Since that point, markets have been rattled as yields, measured by the 10-year Treasury bond, retraced higher from around 3.25% to a current 3.95%1. In other words, the opposite market backdrop: more volatile bond markets equaling poor risk asset performance. Both stocks and bonds have had a tough month, with the S&P 500 Index giving up about two-thirds of its YTD gain and the US Aggregate Bond Index giving up virtually all of its YTD gain. Within stocks, the mega-cap growth leaders in January have proven weakest. Those sectors (technology, consumer discretionary, and communications) are long-duration in nature and particularly sensitive to yields, benefiting when they decline and suffering when they move up. The best attribute of current market conditions is that the move in the 10-year Treasury yield has been very steep, which typically leads to exhaustion. That provides rationale for the 10 to at least consolidate around current levels. A move higher is also likely to be met with large, institutional buy-side pressure as those purchasers see value in long-duration bonds when real yields approach 2%, around trend GDP. The current 10-year real yield is a little over 1.5%, defining a potential top around 4.25 to 4.5%, much as we saw in October. Bond price and yield move opposite.

Yields have reacted to hotter-than-expected January inflation data released in February. While inflation is trending lower, this process will not be linear, and the pace and size of the decline are still up in the air. The S&P 500 Index is currently sitting at 3970, about 1.75% above initial support at 3900. This support level is not a major level. A successful break below that level results in a trading range that could reach down to 3500, the major support tested in October. Holding 3900 will be predicated a lot on the 10-year calming down short term. Additionally, sentiment remains complacent and has a great deal of room to get worse, adding to downside pressure. Sentiment is contrarian and inverse to equity returns.

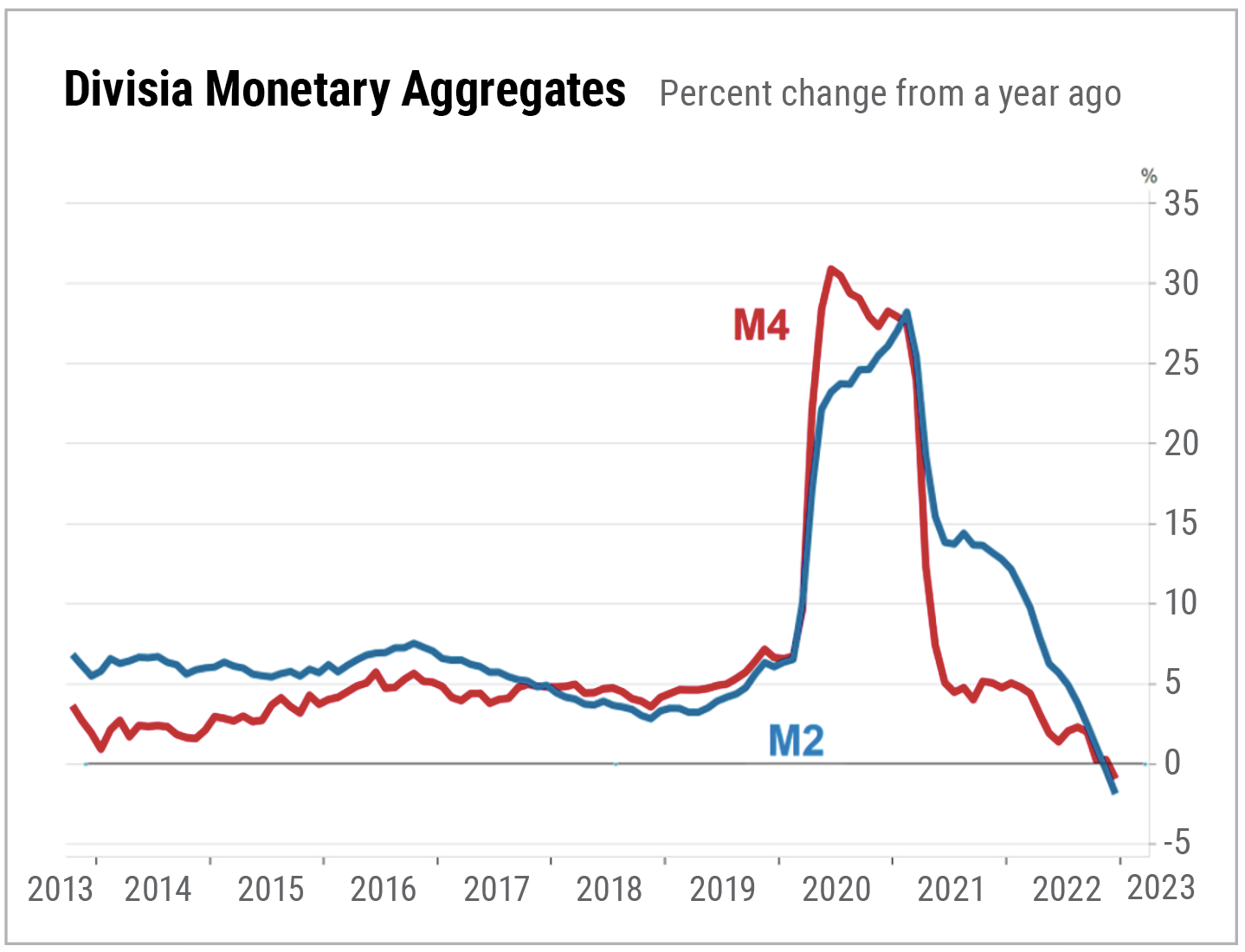

It’s been decades since we’ve seen dramatic changes in the monetary aggregates.

Source: Macrobond

Source: Macrobond

Inflation was triggered by the Federal Reserve keeping the monetary spigots on far too long coming out of the pandemic. While the Fed should be commended for its approach early in the pandemic, continuing to print money well into last year was a huge mistake. Monetary aggregates are typically boring and not that meaningful, with money supply growing about 5% per year. But monetary expansion on the scale seen in 2020 until Q2 2022 leads to inflation. Related data to money supply are nominal GDP and excess savings, both skyrocketed. Good news — money supply growth has been zero since last March, recently even becoming negative. This ultimately brings inflation down. Nominal GDP is also much lower. Bad news — the scale of increase is so large that this will take some time. The consumer really is not reacting to inflation yet and continuing to spend the $2.5 trillion accumulated in excess savings during the money printing bonanza. This figure is now roughly half its peak, but it’s estimated this cash hoard will last about another ten months assuming the consumer spends at current rates. Our base case for inflation is a dis-inflationary trend that reaches mid-single digits by mid-year.

We see a good case for risk assets to have a good 2023, especially the second half. The typical 60/40 stock/bond blend likely has a better year, but these assets are no longer non-correlated. This is still a higher volatility market. In 2022 we had 108 days of +/- 2% moves compared to an average of 38 over the preceding 33 years. This is why we have favored hedging strategies (often with high income) for over two years as an additional diversifier for portfolios. In a structurally higher inflation world dominated by yield movements, stocks and bonds move together. Everything is completely different from recent decades, especially the post-Great Financial Crisis period that ranged from 2009 to 2021.

1Morningstar

General Disclosure: Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

Any opinions expressed here are those of the authors, and such statements or opinions may not represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. This information may contain future predictions that are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

These materials are for illustrative purposes only. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment related services. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of the portfolio’s holdings. It should not be assumed that any of the securities transactions or holdings discussed were, or will prove to be, profitable, or that the investment recommendations or decisions made in the future will be profitable or will equal the investment performance of the securities discussed herein. A complete list of every holding’s contribution to performance during the period and the methodology of the contribution to return is available by contacting Cary Street Partners Marketing.

CSP2023050 ©2023 CARY STREET PARTNERS LLC, All Rights Reserved.