Equity Market Review and Comment

Equity markets spent the last six weeks rallying from deeply oversold conditions reached in mid-June. The S&P 500 Index is approximately 10% higher than the June low. The support level we see at 3815 for the S&P has held up to now. Although the index has traded lower than 3815, there has not been a confirmation of a break in support as indicated by consecutive weekly closes below that level. While oversold conditions have powered the bounce, we still have not seen a shift in market momentum indicators that would provide us comfort that a long-term bottom has been put in. Indicators such as the percentage of issues above recent moving averages are the reference here. Short term, we are likely still in a backing and filling market. Longer term, as we published in our second half 2022 Outlook last month, our capital markets assumption for stocks is higher than average. Once markets reach bear market territory, historically, median returns for stocks go higher especially for holding periods of 12 months or longer.

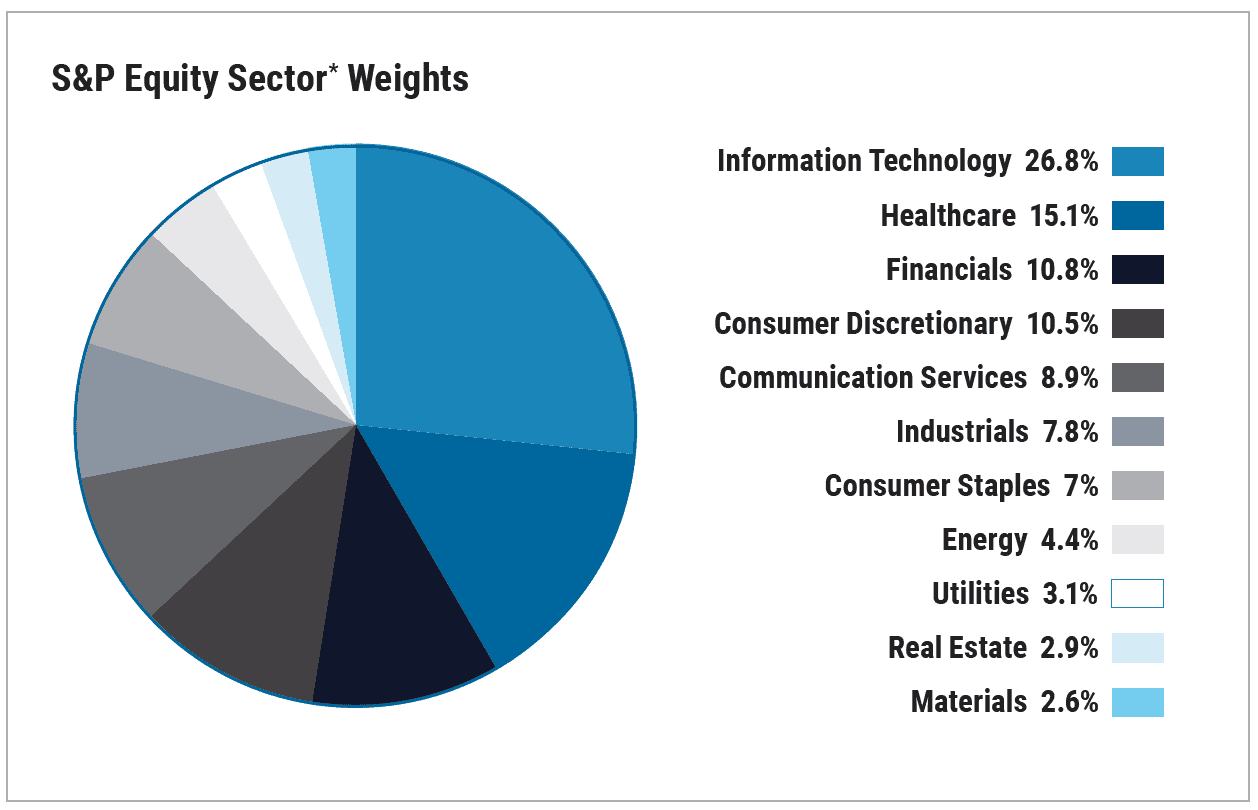

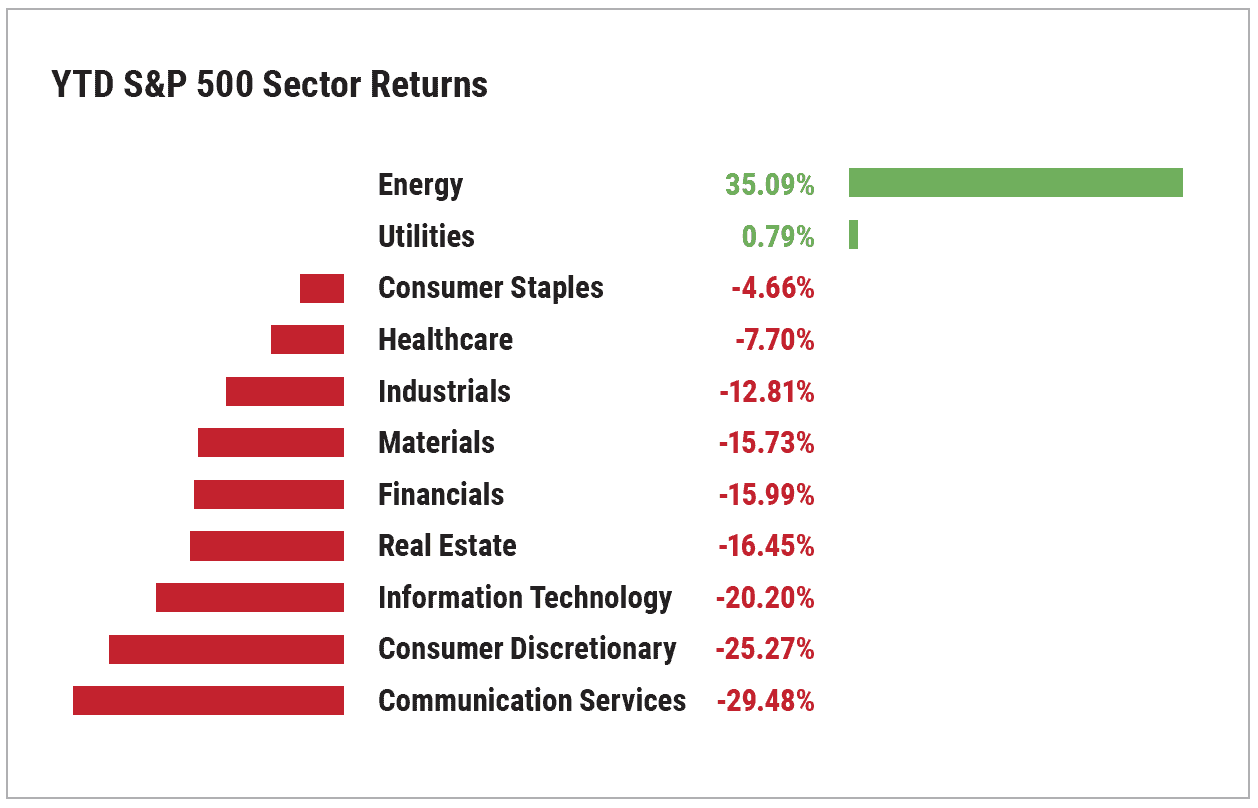

Internally, equity sectors tell a significant story this year. Investor performance varies widely in 2022 contingent on sector exposure. The S&P index heavyweights—technology, communications, and consumer discretionary—are significant underperformers in 2022. And this is where most investors have been and are still too heavily allocated. Energy has been the only meaningful winning sector this year, with a 35.09% gain YTD. Investors that have been overweight to this relatively small sector, have had a much different experience in 2022. Going forward, sectors that outperform in this portion of the market cycle are defensives—utilities, healthcare, and real estate. Energy still has good relative strength, but likely hands off leadership over the next quarter or two to those defensive sectors. While the media continues to breathlessly look for technology to resume sustained leadership, historically the sector struggles for relative strength in this portion of the cycle. The recommendation here is straightforward, ensure ample exposure to those defensive sectors.

What people own is not where the performance has been.

*based on GICS® sectors

*based on GICS® sectors

Source for both charts: Fairlead Strategies. As of 7/27/22.

Source for both charts: Fairlead Strategies. As of 7/27/22.

Economic Review and Bond Market Comment

Inflation continues to be the clear and present danger to the US economy. While we have seen tons of market signals such as copper, gold, inflation expectations, and yields indicating a peak inflation dynamic, the confirming data has yet to appear in CPI or PCE. Our viewpoint is that markets will see that confirming data shortly. Keep in mind that peak and decelerating inflation is not low inflation. The Fed is still a long way from its 2 to 3% target for core CPI/PCE. Nonetheless, the Fed is catching up to the curve having raised Fed funds significantly and instituted monetary tightening. Money supply growth has moderated.

Tighter monetary conditions have resulted in a steeply inverted yield curve where the 2- and 5-year Treasury rates are higher than the long maturity benchmark, the 10-year. This has two implications.

- A sustained, and steep curve inversion is a very strong signal of future economic weakness. The yield curve is typically a better economic forecaster than any single economist. Indeed, both Q1 and initial Q2 GDP indicate economic contraction, a common definition of recession.

- An inverted yield curve provides an opportunity in bonds, as we discussed in our 2022 second half Outlook. Combined with a three standard deviation downside move in the US Bond Aggregate Index, an inverted yield curve is a place where duration works best. Longer duration (10- or 20-year Treasuries) is an opportunity as long-term rates decline in reaction to tighter liquidity induced economic weakness. Bond prices move opposite yield. Credit may still become an issue if economic weakness is deep enough, consequently while there are opportunities in the bond market for the first time in 18 months, our viewpoint is that the opportunity is best expressed through Treasury paper, not corporate.

All economic and market data is sourced from Bloomberg.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

Any opinions expressed here are those of the authors. Such statements or opinions may not represent the opinion of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. This information may contain future predictions that are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment related services.

Cary Street Partners is a broker-dealer and registered investment adviser and does not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in this letter. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

You should not view the past performance of securities, or information about the market, as indicative of future results.

CSP2022178 ©2022 CARY STREET PARTNERS LLC, All Rights Reserved.