Market Review and Outlook

Don’t fight the Fed. If there was one market mantra to live by, 2022 has reminded us that “Don’t fight the Fed” is it. As of this writing, the market continued to pull back from the mid-summer bear market rally that culminated on August 18th. Over the last month, the S&P 500 Index is down about 10.5%, bringing the YTD figure to a minus 21.61%. While the market trend continues to be down, there are abundant short-term oversold signals that should provide some relief as we enter the fourth quarter. Sentiment is not quite as complacent as last month, although still not at a bearish extreme either. Reaching a sentiment extreme could support a limited downside viewpoint. The CBOE Volatility Index (VIX), commonly known as the fear index, is trading around 32, an elevated price, but not a YTD high and not even reaching resistance at 35. For context, bear markets typically do not end until the VIX is trading in the forties. In summary, equities are still firmly in the grip of a bear market and subject to additional volatility until we see some relief on yields.

Higher yields induced by Fed tightening signals continued equity and bond weakness. While both short and long maturities have moved up dramatically in the last month, the short end of the curve has been stunning. Bond prices move opposite yield as a reminder. The 10-year Treasury is currently trading at 3.9% at this writing, with the 2- and 5-year maturities yielding 4.33% and 4.17% respectively. The curve remains in a steep and sustained inversion, with short-term yields higher than longer duration maturities. The gap has widened between short maturities, which are influenced by Fed policy and longer maturities, which are more reflective of economic outlook. The yield curve has a strong history of predictive accuracy regarding future economic growth and right now, it’s strongly indicating recession.

The current challenging dynamic is expected to remain in place until there is some notable progress on inflation which results in the Fed beginning to lighten up on the tightening cycle. There is reason to be optimistic about inflation as money supply growth, the clear and present cause of widespread inflation has dropped to zero from stratospheric levels of around 35% in late 2020 and early 2021. For context, money supply growth in the mid-single digits would be considered the normal ideal. Fed tightening works with lagging effect and the big question is how much work they have left to do. It’s important to remember the Fed is a reactive institution, and regardless of outlook, they likely do not let up until we see some improvement in month-over-month inflation data.

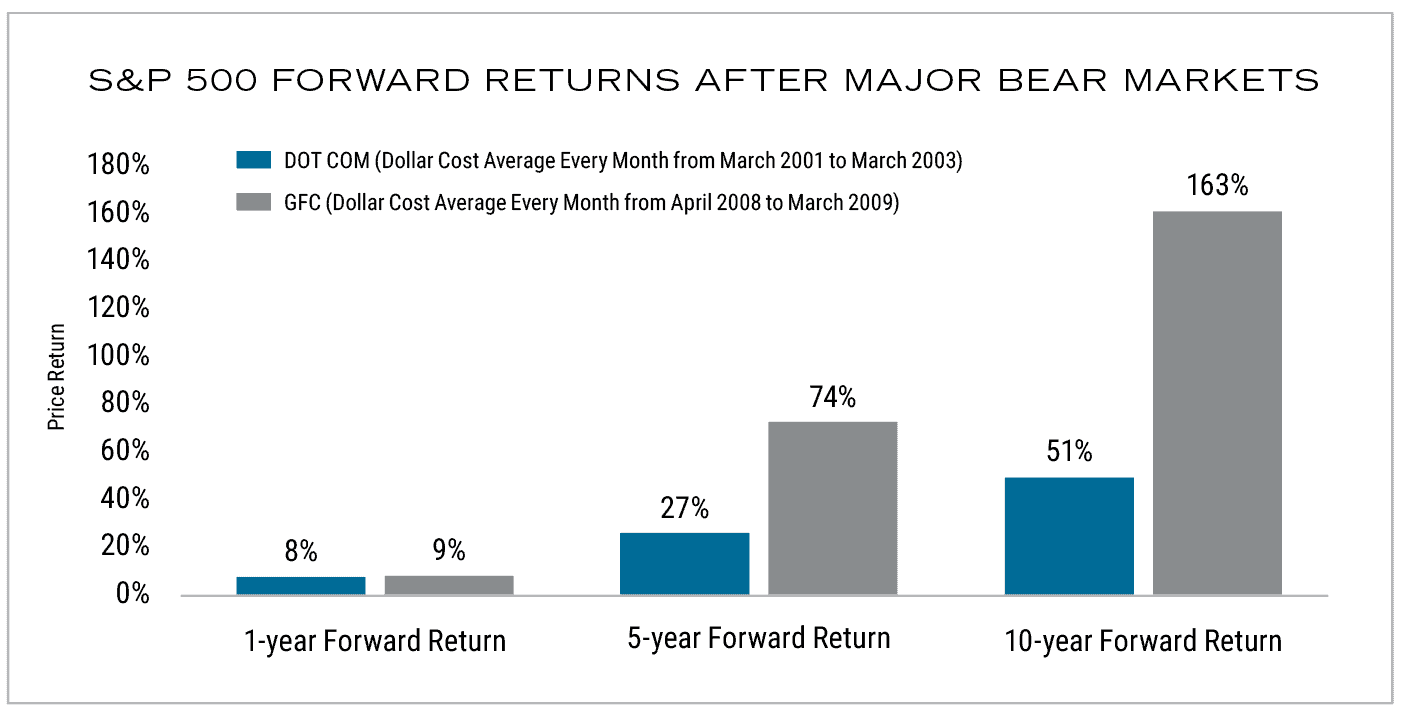

Stepping back from the current market outlook, it’s helpful for investors to remind themselves of long-term objectives. Investors can essentially be broken down into two very broad categories. The first is wealth accumulators, investors building wealth toward long-term goals such as retirement. For this category of investor, a prolonged bear market is their best friend in the long run. Buying consistently through a bear market as illustrated below creates long-run results. Buying on a monthly basis in a 401-k looks a lot like this.

For wealth accumulators, a prolonged bear market is their best friend.

Source: Fairlead Strategies; Returns are reflective of SPX price data

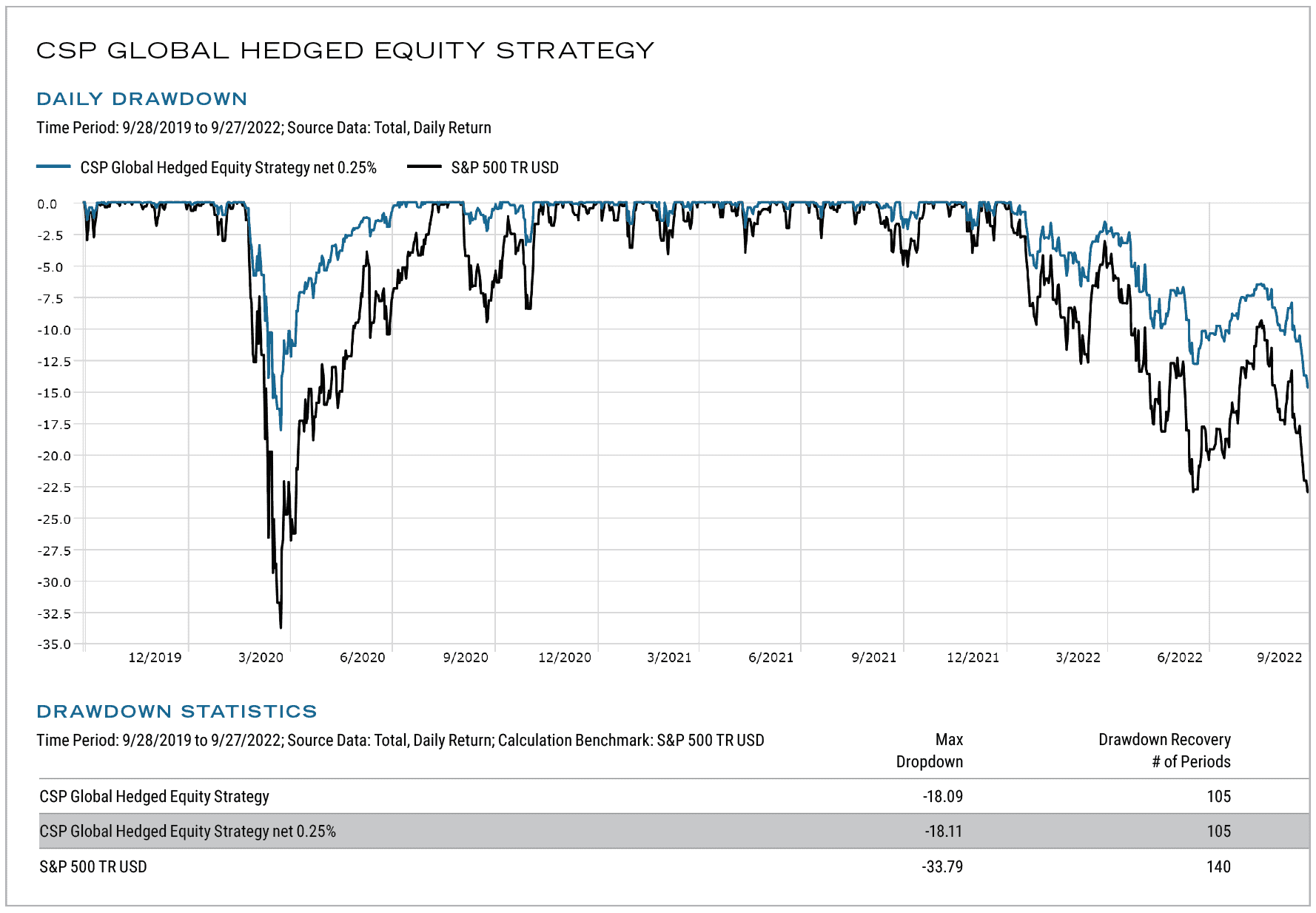

The second set of investors is those making current use of their portfolio returns. These investors have a different need, active risk management creates a sequence of returns that is as smooth as possible. For this second set of investors, we have recommended the incorporation of hedging strategies to improve risk management. The post-Great Financial Crisis (“GFC” in the above chart) market backdrop has shifted from one of low inflation, low rates, and low volatility to one exactly in opposition. Higher structural inflation, higher rates, and higher volatility. That is a much more challenging dynamic for a long-only, 60/40 stock/bond allocation.

Hedging improves risk management.

Source: Morningstar Direct

Source: Morningstar Direct

All economic and market data figures contained in this material have been provided by Bloomberg.

Past performance is no guarantee of future results. This material has been prepared or is distributed solely for informational purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions expressed or implied herein are those of the authors and do not necessarily reflect the opinions of their respective firms and are subject to change without notice. Any mention of specific investments, asset classes, or market sectors are intended for general discussion and should not be misconstrued as investment advice. Investors must make decisions based on their specific investment objectives and financial circumstances. Additional information is available upon request.

The S&P 500 is an unmanaged index of common stock. Unmanaged indices are for illustrative purposes only. Investments in stocks and bonds are subject to risk, including market and interest rate fluctuations. An investor cannot invest directly in an index. Investing in commodities involves a substantial amount of risk, including loss of the entire initial investment.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

CSP2022215