There is a good deal of media chatter these days regarding the possibility that the global economy is entering a great depression due to the COVID pandemic. While we certainly agree that the global economy is in the midst of a sharp contraction, there is a powerful countervailing force being brought to bear.  That is the response from central banks, led by the U.S. Federal Reserve. This response has been unprecedented in both size, and more importantly speed. Economic depressions are characterized by deflationary events, followed by either slow or incorrect monetary response, creating a deflationary spiral. Price declines are followed by lower production, lower wages, decreased demand and still lower prices. They were common in the nineteenth century when the world operated on an inflexible monetary system, the gold standard. There is also a good case to be made that the deflationary roots of the Great Depression of the thirties were also found in the gold standard.

That is the response from central banks, led by the U.S. Federal Reserve. This response has been unprecedented in both size, and more importantly speed. Economic depressions are characterized by deflationary events, followed by either slow or incorrect monetary response, creating a deflationary spiral. Price declines are followed by lower production, lower wages, decreased demand and still lower prices. They were common in the nineteenth century when the world operated on an inflexible monetary system, the gold standard. There is also a good case to be made that the deflationary roots of the Great Depression of the thirties were also found in the gold standard.

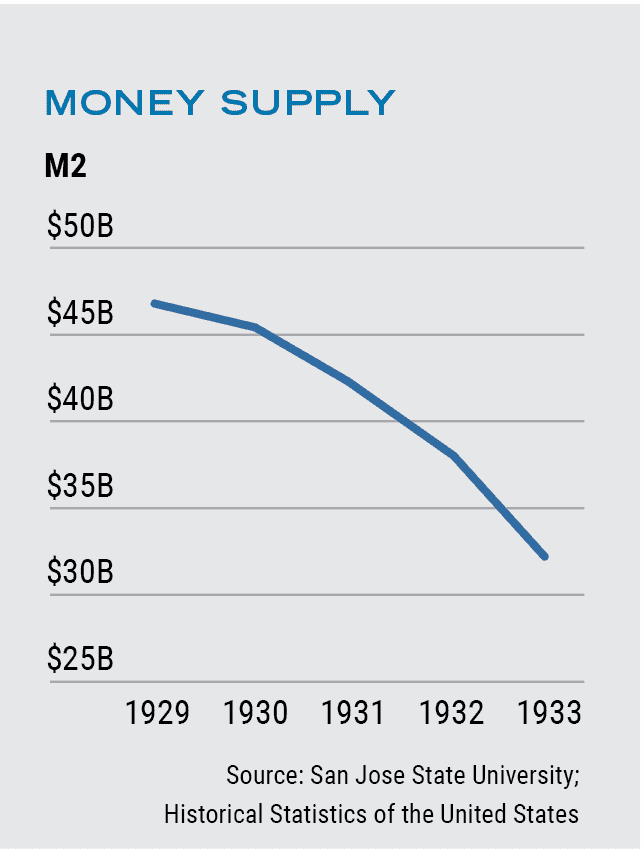

In any event, what is empirically certain is that the Federal Reserve response to the 1929 crisis was completely the opposite of what was called for. The Fed literally shrunk the money supply by approximately a third between 1929 and 1933, a period of thousands of bank failures and plummeting prices. It was as though they treated a patient for a fever that was freezing to death.

Index of the General Price Level for United States

The Federal Reserve response to the COVID pandemic, undisputedly a global deflationary event, can be seen below. These measures were instituted in a matter of days, followed by forceful communications to the market. Communicating a “whatever it takes approach” of unlimited ammunition is often as effective as the actual execution of that program. For example, the Fed’s announcement of intervention in bond markets narrowed spreads far in advance of them purchasing a bond. Many of these Fed measures were also part of the 2008-2009 toolbox.

Total Federal Reserve Assets

Current central bank policy stands in stark contrast to that of prior economic depressions. The chart above illustrates the expansion of the Federal Reserve balance sheet resulting from asset purchases. This is a powerful means of money creation.

In conclusion, the shape of our economic recovery from this horrific pandemic will be determined by vaccines, treatments, and economic re-openings of countries and states. Progress or setbacks related to COVID will drive whether that recovery looks like a V, a U, or some other visual. The correct response from the U.S. Federal Reserve, and other central banks, ensure that we do not compound and prolong the pain.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisors.

This information was prepared by or obtained from sources believed to be reliable, but Cary Street Partners does not guarantee its accuracy or completeness. Any opinions expressed or implied herein are subject to change without notice. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. CSP2020540