By Thomas O. Herrick

Chief Investment Officer, Managing Director

An underappreciated characteristic of Nobel prize-winning monetary economist Milton Freidman was that he could turn a phrase. In fact, he wrote a well-read column in Newsweek for years. Freidman is said to have likened central bankers to fools in the shower: When the water from the shower is too cold, we turn on the hot tap to compensate. Some of us know that it takes the water heater a few seconds to get up to temperature, so we wait to feel the ultimate effect of our tap-turning before taking further action. But the fool reacts purely to the fact that the water still feels cold. He cranks the hot tap fully open, enjoys a blissful three seconds of “just right” water—and then gets scalded.1 Freidman often made the comment that the best central banker would be a computer that avoided this all too human problem of responsive overshoot—and that was before the advent of generative AI!

FOMC policy = fools in the shower

The contemporary problem at the US Federal Reserve’s policy-making body, the FOMC, is an inflation genie that was let out of the bottle with massive money supply creation well beyond the end of the pandemic economic crisis. Remember the phrase transitory? Ignoring massive M2 growth and substantial growth in large sticky components such as shelter resulted in headline CPI inflation topping out at around 9% early last fall.

Since peaking, headline CPI has declined most recently to 5% as money supply growth has completely flatlined and, in fact, has fallen to negative figures for the first time since data was collected in 1959.

Further support for lower inflation prints is found in the shelter component, which accounts for 40% of CPI, and is poised to fall over the next two quarters. Unfortunately, 5% is still quite far from the target of 2%. This leads us to conclude that the reactive FOMC will stop its rate hike campaign soon but will not ease rates or liquidity until we see a 2 handle on core inflation. This is what being data-dependent looks like, especially when the policy-making body only looks at rear-view data. They are responding to how the water feels.

Source: Axios

Source: Axios

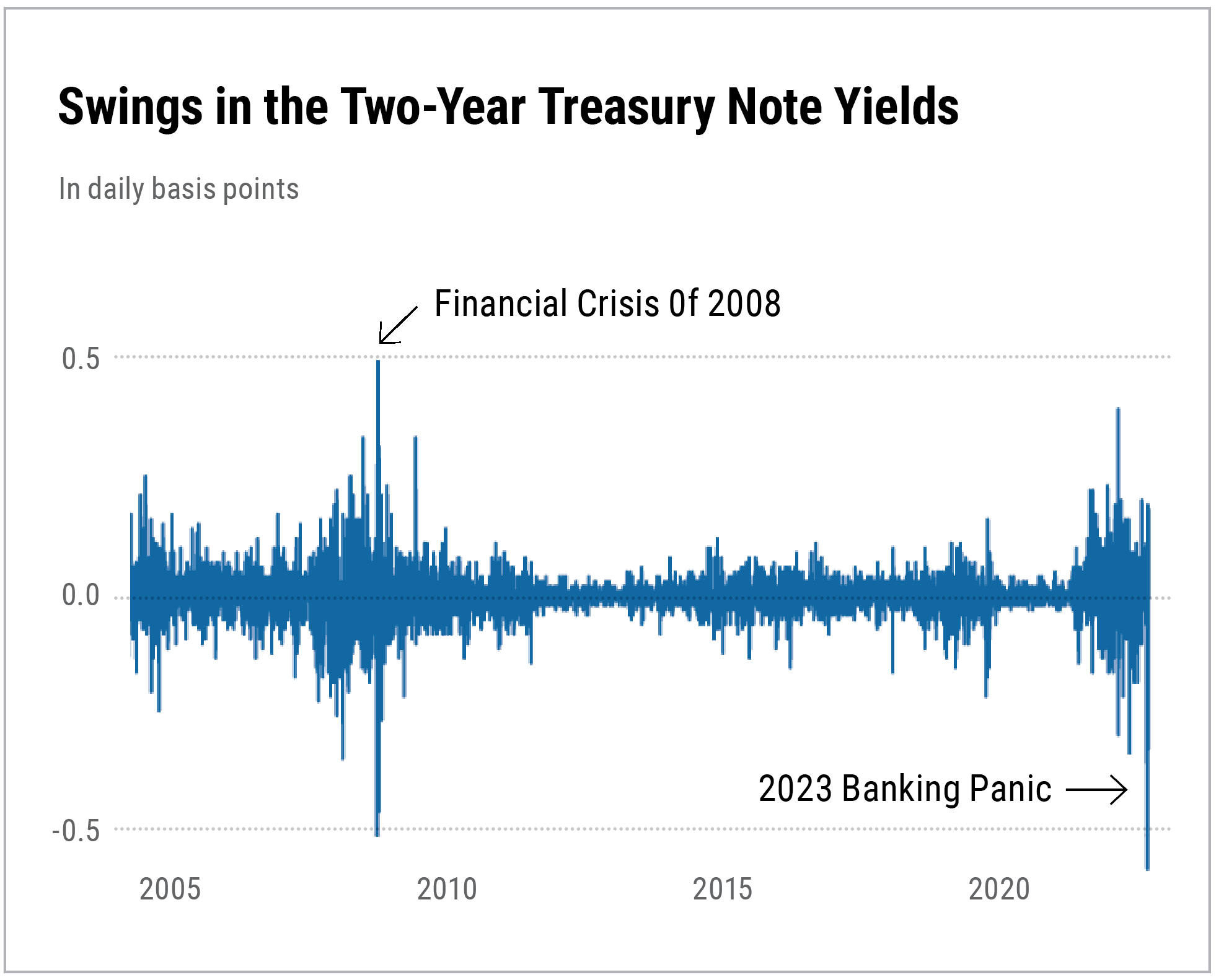

From a market perspective, messaging this policy uncertainty, the FOMC creates additional volatility, most apparent in yields. The 2-year Treasury yield, which is the maturity most closely associated with Fed rate policy, has swung wildly in recent months. The ICE BofA MOVE index, a measure of bond volatility, has surged to its highest levels since 2008. Some of this volatility can certainly be attributed to the regional bank runs triggered by Silicon Valley Bank. But those bank runs themselves have roots in the dramatic and rapid rise in rates the Fed has had to initiate to counteract the inflation genie.

Among our recommendations published in the 2023 Market Outlook back in December was to focus bond positioning with Treasuries, leaning into longer duration. Long-duration positioning within the context of an inverted yield curve has historically been a smart move, as that curve inversion signals a move down in yields over the next 12 to 24 months. Bond prices move opposite yield as a reminder. Despite giving up some ground recently, long-duration Treasury positioning has been a positive in 2023. The recent move up in yields is offering up another entry point.

1 https://www.nb.com/en/global/insights/cio-weekly-perspectives-what-data-dependent-feels-like

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

Any opinions expressed here are those of the authors, and such statements or opinions may not represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. This information may contain future predictions that are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

These materials are for illustrative purposes only. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment related services. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of the portfolio’s holdings. It should not be assumed that any of the securities transactions or holdings discussed were, or will prove to be, profitable, or that the investment recommendations or decisions made in the future will be profitable or will equal the investment performance of the securities discussed herein. A complete list of every holding’s contribution to performance during the period and the methodology of the contribution to return is available by contacting Cary Street Partners Marketing.

CSP2023096 ©2023 CARY STREET PARTNERS LLC, All Rights Reserved.