By Thomas O. Herrick

Market Strategist

“Keep an eye on the bottom line.”

That is the takeaway for investors currently navigating the ubiquitous narrative surrounding potential widespread tariff policy. Setting aside the stagflationary implications of widespread tariff imposition, investors should focus on earnings impact. Stagflation is an economic situation of higher prices coupled with lower growth. Earnings expectations are the most important fundamental input to stock prices. Current 2025 earnings expectations are strong and rising. The downside risk to stocks is that tariffs — if they come about — would create a drag on those expectations.

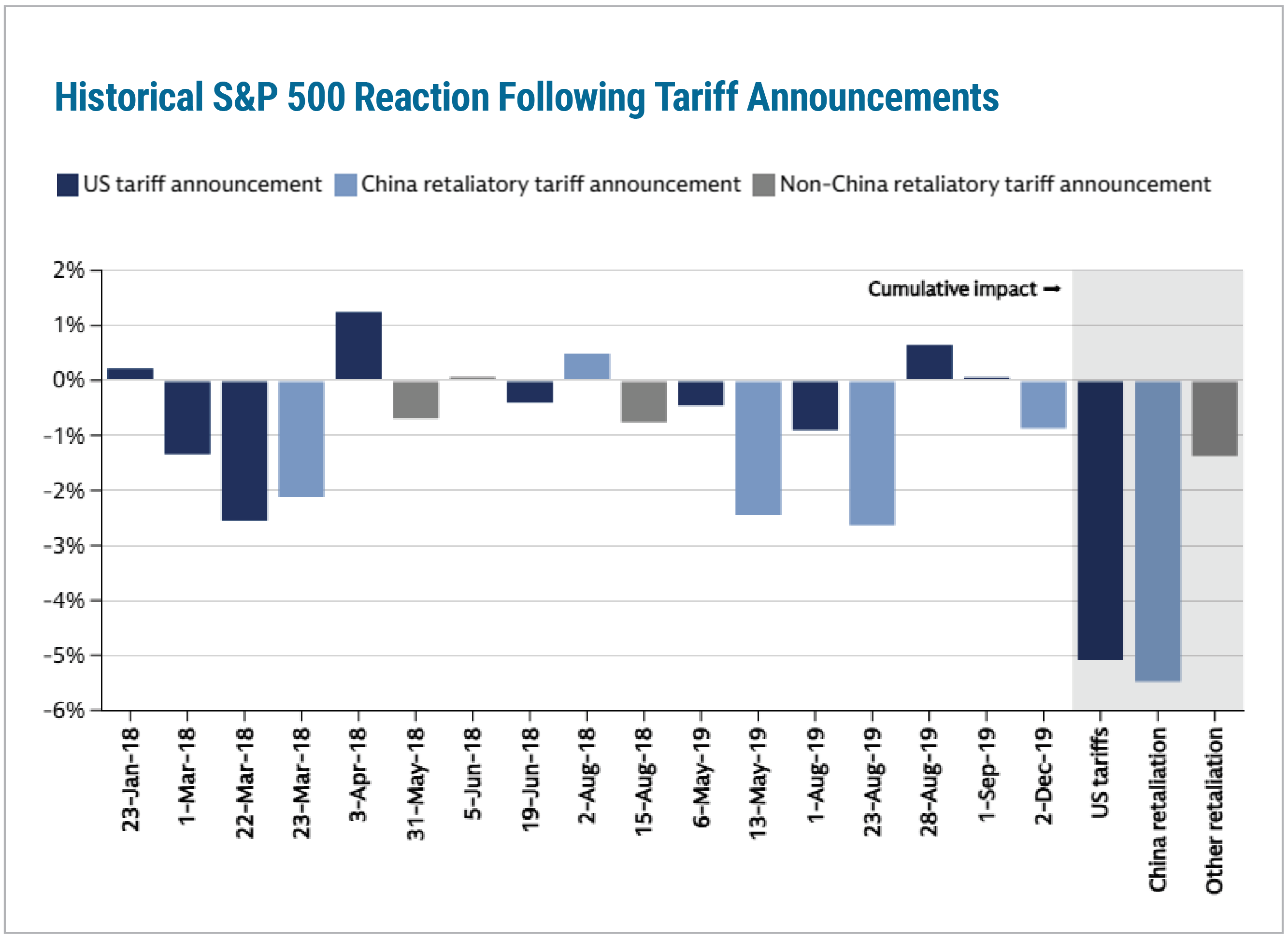

Current S&P 500 earnings expectations for 2025 are for an increase of approximately 13%, ahead of 2024’s expected increase of around 10%. Leaning on research from David Kostin’s group at Goldman Sachs, every 5% increase in U.S. tariffs would cut S&P earnings per share by roughly 1% to 2%.

Source: Haver Analytics, Goldman Sachs Research

A notable offset to a tariff-induced drag could come from a reduction in the corporate income tax rate, which also goes straight to the bottom line, in this case, creating a positive impulse. Any such reduction would have to come through the budget process, which looks like it would take place further into 2025.

Handicapping an outcome on potential public policy is very difficult. Markets are showing fatigue on the issue. Conviction has built the idea that levies are more of a tactic than an end in themselves. The dollar has weakened recently, but would almost certainly strengthen if widespread tariffs were imposed. The outcome in this case is very binary, composed of only two possible results: all or nothing. Markets are terrible at pricing this type of outcome until it happens. The market reaction to COVID-19 in 2020 is a good example of this dynamic. Despite U.S. cases emerging in early January, the market kept rising until February 19th, at which point a full-fledged health emergency was in flight. With said backdrop, risk-averse equity investors should consider hedging or adding commodity exposure.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment related services.

We undertake no duty or obligation to publicly update or revise the information contained in this letter. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

The Standard & Poor’s (S&P) 500 Index is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market. CSP2025031