Review and Outlook

Equity markets sold off in the last two weeks, triggered by fear of Russian aggression in Europe followed by an actual invasion of Ukraine that commenced last night. Stock markets are currently slightly below the previous low for 2022, seen in late January. After that January low, markets responded to oversold conditions and the S&P 500 rallied about 9% to the February 9th peak prior to the onset of the recent decline that has brought us back to heavily watched support around 4200. The S&P is currently in correction territory, defined as down more than 10%, for 2022. The technology-heavy NASDAQ is in bear market territory, defined as a decline of 20% or more. While sentiment is extremely bearish, a contrarian positive, up until today we have not seen the same signs of downside exhaustion that we observed in late January. Along with bearish sentiment and a solid credit backdrop, these are necessary ingredients in building a high-conviction bottom for stock prices. We are starting to see those oversold signals today, and likely to see more given the enormous fear sparked by the Russian move on Ukraine.

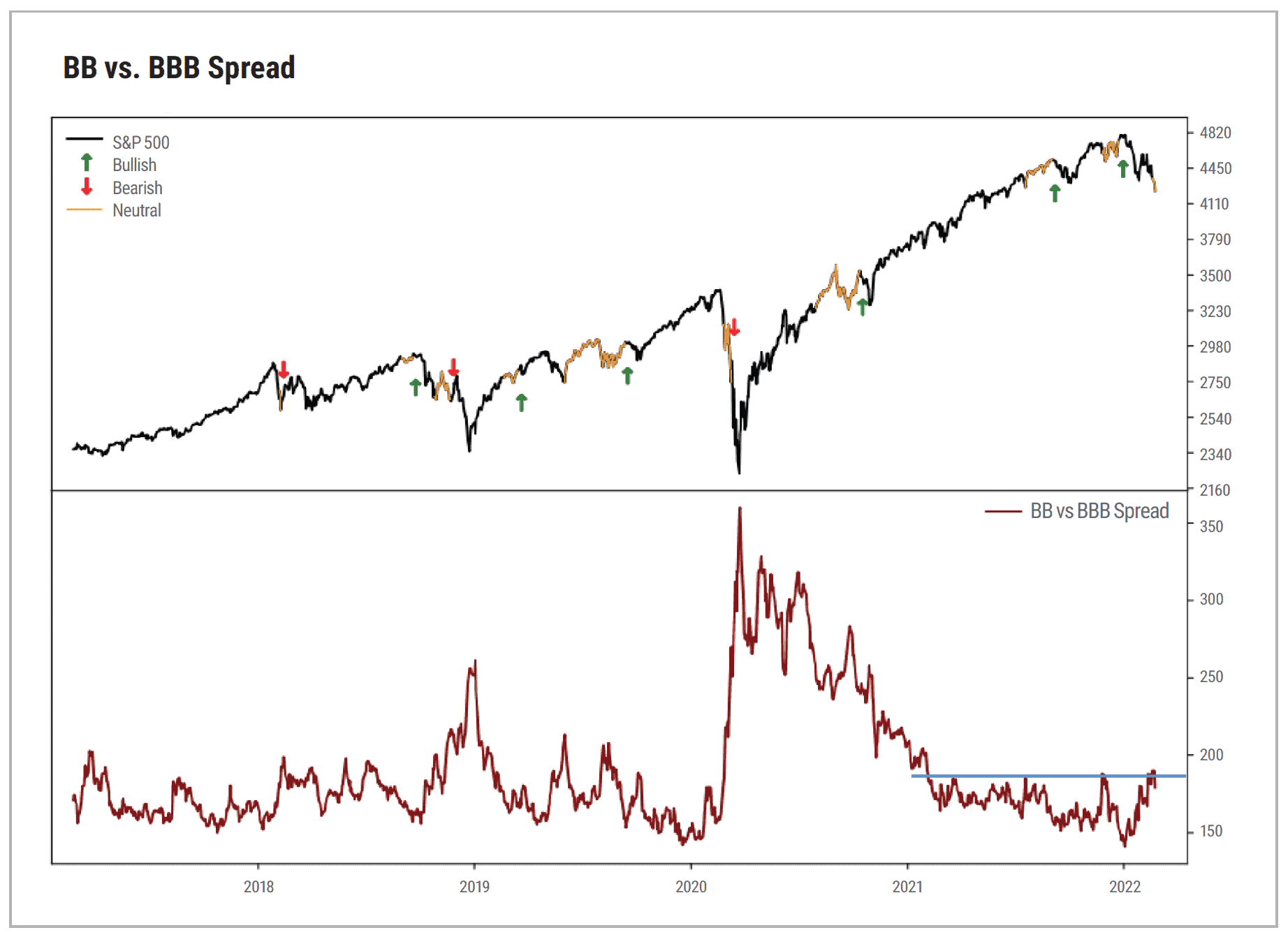

The CBOE Volatility Index (VIX) has traded as high as 37 today, encapsulating the fear leading to all this risk-off behavior. A spiking VIX accompanied by calm credit markets is a historically strong bullish data point as it relates to forward equity returns. Credit stress is our canary in the coal mine for stocks — a necessary ingredient for sizable drawdowns beyond what we are currently experiencing. Our indication for credit stress; BB versus BBB spreads, has turned up recently but not broken out beyond what we saw in November. We will maintain a watch on this important data point, but as of this writing we have a VIX that is far worse than credit. Anecdotally, Twitter announced a $1 billion junk bond offering yesterday. This is not a sign of a closed credit market. As signs of downside exhaustion become more apparent it is likely that another entry point for investors looking to add equity exposure will present itself.

Spreads rising but not breaking out

Source: Renaissance Macro Research

Source: Renaissance Macro Research

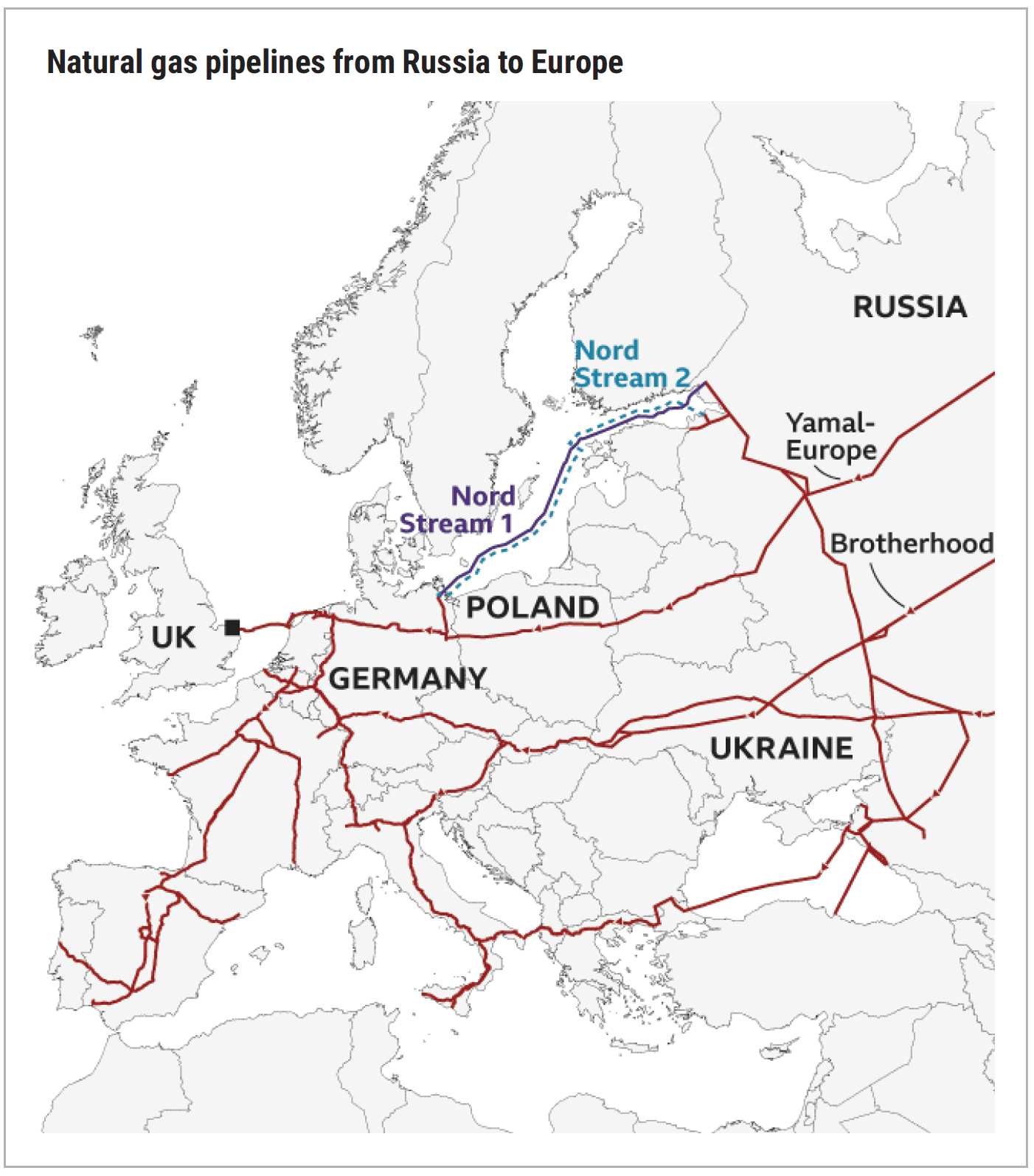

While investors woke up to a very different security situation in Europe this morning, it’s important to recall that Russia is not much of an economic actor. Beyond oil and gas, they are completely insignificant to the west. Russia is not China. The complete disregard for international law and treaties will subjugate Russia to poverty for years. Western Europeans have finally gotten the message exactly what kind of partner a dictator is and have already canceled further pipeline development that would have made them more dependent on Russian gas. While difficult, the way to impact Russia is to cut off gas to Europe, or cut off access to the payment/settlement system for gas (SWIFT). This is particularly difficult for Germany as they built in dependence on Russian gas in order to prematurely shut down nuclear production. A likely consequence of today’s events is increased demand for US oil and gas, which has been slow to ramp up production following the near-death experience of the pandemic. We expect good results from the US energy patch for some time, especially LNG.

Source: European Network of Transmission System Operators for Gas

Source: European Network of Transmission System Operators for Gas

Our 2022 Market Outlook featured a primary viewpoint that 2022 was going to be a volatile year. The source of that volatility surprises us, but not the degree.

Our summary conclusions for investors:

1. Look for signs of downside exhaustion as a last key element before adding equity exposure and focus on quality and value factors when doing so. Among others, those signs include a high percentage of S&P stocks that appear oversold, a large washout of down volume, a low percentage of S&P names that are trading above their 50-day and 200-day moving average.

2. Be light on bond exposure going forward as rates increase. Perhaps even use this moment of bond strength coming from the risk-off, fear-driven developments as an opportunity to reallocate.

3. Use hedging strategies as a tail-risk solution. These strategies are ahead of long-only equities YTD and have spiking VIX premium to work with.¹

4. For investors looking for absolute, sometimes non-correlated return, commodities should continue to benefit from different supply and demand dynamics than we have seen in decades.

All market and economic data is sourced from Bloomberg.

¹ Year-to-date performance of CSP Global Hedged Equity (-4.95%) net of advisory fees v. S&P total return of (-9.83%) and NASDAQ total return of (-13.88%). As of 2/24/2022.

Past performance is no guarantee of future results.

This material has been prepared or is distributed solely for informational purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Any opinions expressed or implied herein are those of the speakers and do not necessarily reflect the opinions of their respective firms and are subject to change without notice. Any mention of specific investments, asset classes, or market sectors are intended for general discussion and should not be misconstrued as investment advice. Investors must make decisions based on their specific investment objectives and financial circumstances. Additional information is available upon request. Global/International investing involves risks not typically associated with U.S. investing, including currency fluctuations, political instability, uncertain economic conditions, and different accounting standards.

CSP Global Hedged Equity Strategy (the “Strategy”) is designed to complement traditional equity/bond allocations by seeking to buffer against losses in volatile markets, which may limit its upside potential. The Strategy invests only in liquid, registered investment company securities and funds. All investment strategies have the potential for profit or loss. Any performance information included herein represents the performance achieved by Cary Street Partners Asset Management as a discretionary investment manager with trade implementation responsibility for the accounts included in the performance composite. The performance shown does not reflect the performance of Strategy-Based Program accounts managed by a Sponsor utilizing CSP’s non discretionary investment recommendations. In Strategy-Based Programs, although it is generally contemplated that the Sponsor will implement CSP’s investment recommendations in Program accounts, the performance of such accounts may differ from the performance shown for a variety of reasons, including but not limited to: the Sponsor, and not CSP, is responsible for implementing trades in the accounts; differences in market conditions; client-imposed investment restrictions; the timing of client investments and withdrawals; fees payable by Strategy-Based Program accounts; and/or other factors.

Cary Street Partners Asset Management acts as a discretionary investment manager or non-discretionary strategy provider in a variety of separately managed account or wrap fee programs (each, an “SMA Program”) sponsored either by CSP or a third- party investment advisor, broker-dealer or other financial services firm (a “Sponsor”). When acting as a discretionary investment manager, CSP is responsible for implementing trades in SMA Program accounts. When acting as a non-discretionary strategy provider, CSP’s responsibility is limited to providing non-discretionary investment recommendations (in the form of strategies) to the SMA Program Sponsor, and the Sponsor may utilize such recommendations in connection with its management of SMA Program accounts. In such “strategy-based” SMA Programs (“Strategy-Based Programs”), it is the Sponsor, and not CSP, which serves as the investment manager to, and has trade implementation responsibility for the Strategy-Based Program accounts.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC are SEC registered investment advisers.

CSP2022054 © 2022 CARY STREET PARTNERS LLC, ALL RIGHTS RESERVED.