By Thomas O. Herrick

Chief Investment Officer, Managing Director

In previous commentaries, we have focused on the number one tactical driver of markets, liquidity. Commonly, this is summarized in the number one rule for market guidance— “Don’t fight the Fed”. The bear market continues to hold as the Fed continues to scramble from behind the curve to put the inflation toothpaste back in the tube. Treasury yields reflect Fed hawkishness, which will continue to lead to weaker economic performance and earnings. Yields are the focus of concern on the street, and neither stocks nor bonds will get any sustainable upside traction until we see upside yield pressure let up.

Treasuries, as of this writing, are on a 12-week string of losses, the longest such streak in 38 years.

Higher yields have been driven by relentless Fed hawkishness. Previously, when the 10-year fails to react to hawkishness or Fed funds rate increases with upside pressure — is when the dynamic changes, first in pricing for Treasury duration, followed quickly by equities. What a lot of the street is missing in this dynamic is that the Fed will still be pushing up Fed funds at this point. Watch the 10-year as the important macro data point, it will be sniffing out light at the end of the tightening tunnel. The reaction likely comes around an improving CPI data point. The good news regarding inflation is that rent, a huge driver to the upside for the last year, has hit the brakes. Downward pressure on rent will be a downward driver on CPI for the next year, and keep in mind rent is 40% of the CPI. CPI will lag actual rent data as CPI measures what renters are paying as well as owners’ equivalent rent rather than new leases, but it will show up over a few quarters, nonetheless.

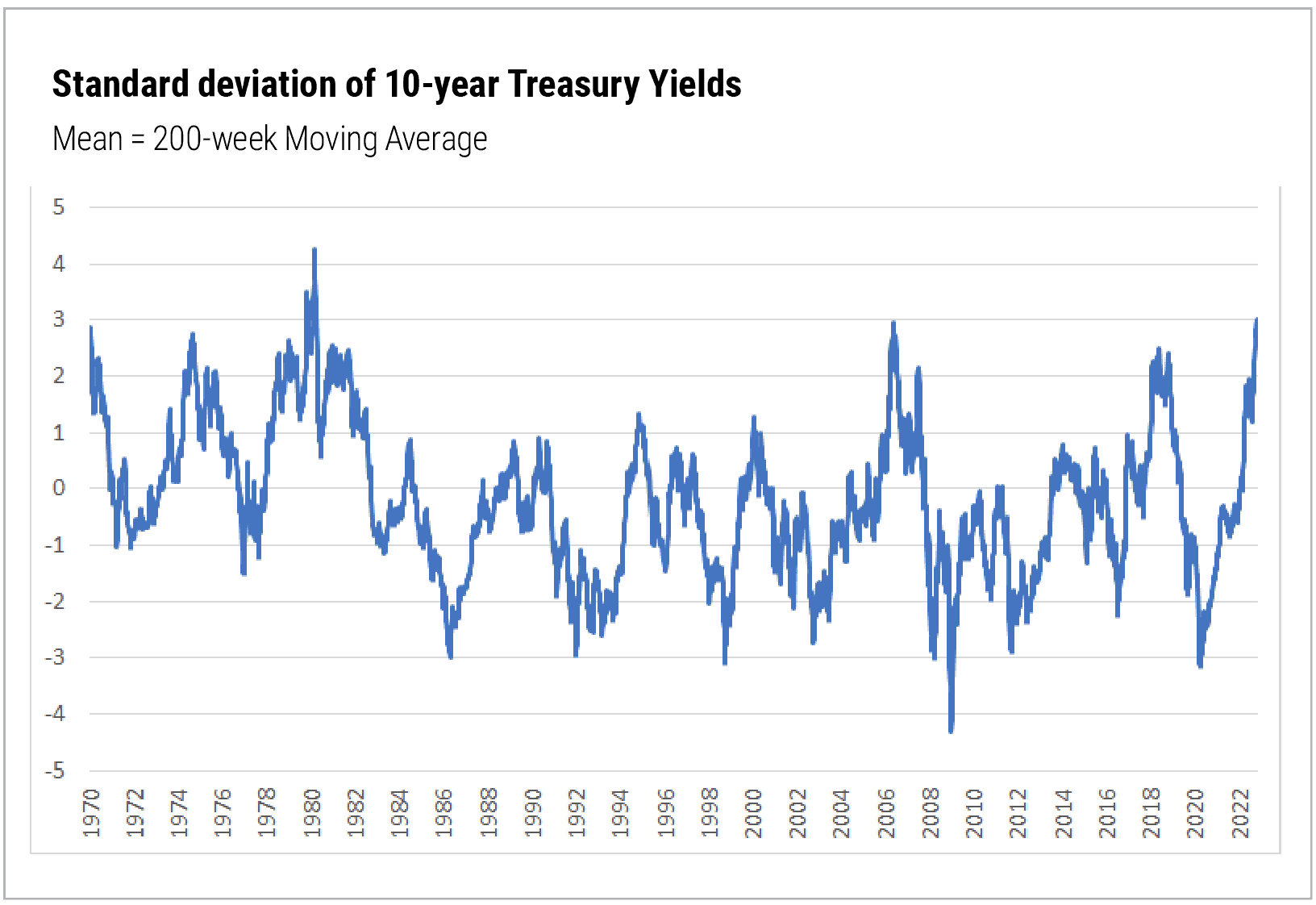

The other good news is that the move in the 10-year Treasury yield is massively extended, as seen in the nearby chart. Three standard deviation moves of this sort are far outside the norm and are often inflection points for change.

Source: Fairlead Strategies

An important takeaway that we have repeatedly stressed over the last two years remains—this is not the post-Great Financial Crisis climate. In fact, it’s the exact opposite. Markets will be dealing with a higher structural inflation dynamic, higher rate dynamic, and higher volatility dynamic for some time. Active risk management, seen as almost defunct from 2010 to 2020, is imperative. Within equities, sector positioning has been vital this year as investors remain overweight the wrong sectors—technology and consumer discretionary being the poster children. Energy continues to have the best relative strength in the market and is the only sector gainer in 2022. Health care is improving on a relative strength basis as well.

Source: Bloomberg

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

Any opinions expressed here are those of the authors. Such statements or opinions may not represent the opinion of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. This information may contain future predictions that are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment related services.

Cary Street Partners is a broker-dealer and registered investment adviser and does not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in this letter. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

CSP2022247 ©2022 CARY STREET PARTNERS LLC, All Rights Reserved.