By Thomas O. Herrick

Chief Investment Officer, Managing Director

There is an expression on Wall Street that the “Fed raises rates until something breaks.” Well, something broke in March: Silicon Valley Bank and Signature Bank failed, and a host of regional banks came under stress, First Republic being the poster child of the latter group. The rapid and dramatic rise in the Federal Reserve’s short-term overnight lending rate, Fed funds, has put balance sheet pressure on banks that failed to hedge rate risk. This exposure is best summarized as a bank borrowing at short maturities (deposits) and buying long maturities (bonds and loans). Rising rates have punished the value of long maturities over the last 12 to 18 months, while the cost of short-term borrowing has escalated. As this balance sheet pressure became evident, primarily in regional banks, scared depositors quickly initiated a run on Silicon Valley, resulting in rapid insolvency. Regulators quickly extended guarantees to depositors as the bank failed to stem further runs. Despite these efforts, fear spread to the rest of the regional bank sector as depositors quickly moved deposits to either large money center banks or Treasury-backed money funds. As a meaningful yardstick of stress, in the week ending March 15th, banks borrowed a record $153 billion from the Federal Reserve discount window, the long-standing source of liquidity for banks in need of operating funds.

Adding fuel to the fire, Credit Suisse, a weak link in the European banking chain, also came under pressure culminating in its acquisition by UBS in a deal engineered by Swiss authorities. The Credit Suisse situation is arguably more systemically important as it is deeply entwined in the global financial network. The upshot of all this drama has been increased volatility, as seen in CBOE Volatility Index (VIX) pricing, and a flight to safety in the Treasury market. Yields plummeted since last month as Treasury bond prices increased, making long and short-duration Treasuries the beneficiary of this stressed market. Bond yield and price move opposite. Treasuries, leaning into long duration, along with income-producing hedge strategies, were among our portfolio diversification recommendations in the 2023 Market Outlook. They remain as recommendations along with balanced value and growth positioning in equities.

Source: Bloomberg

Source: Bloomberg

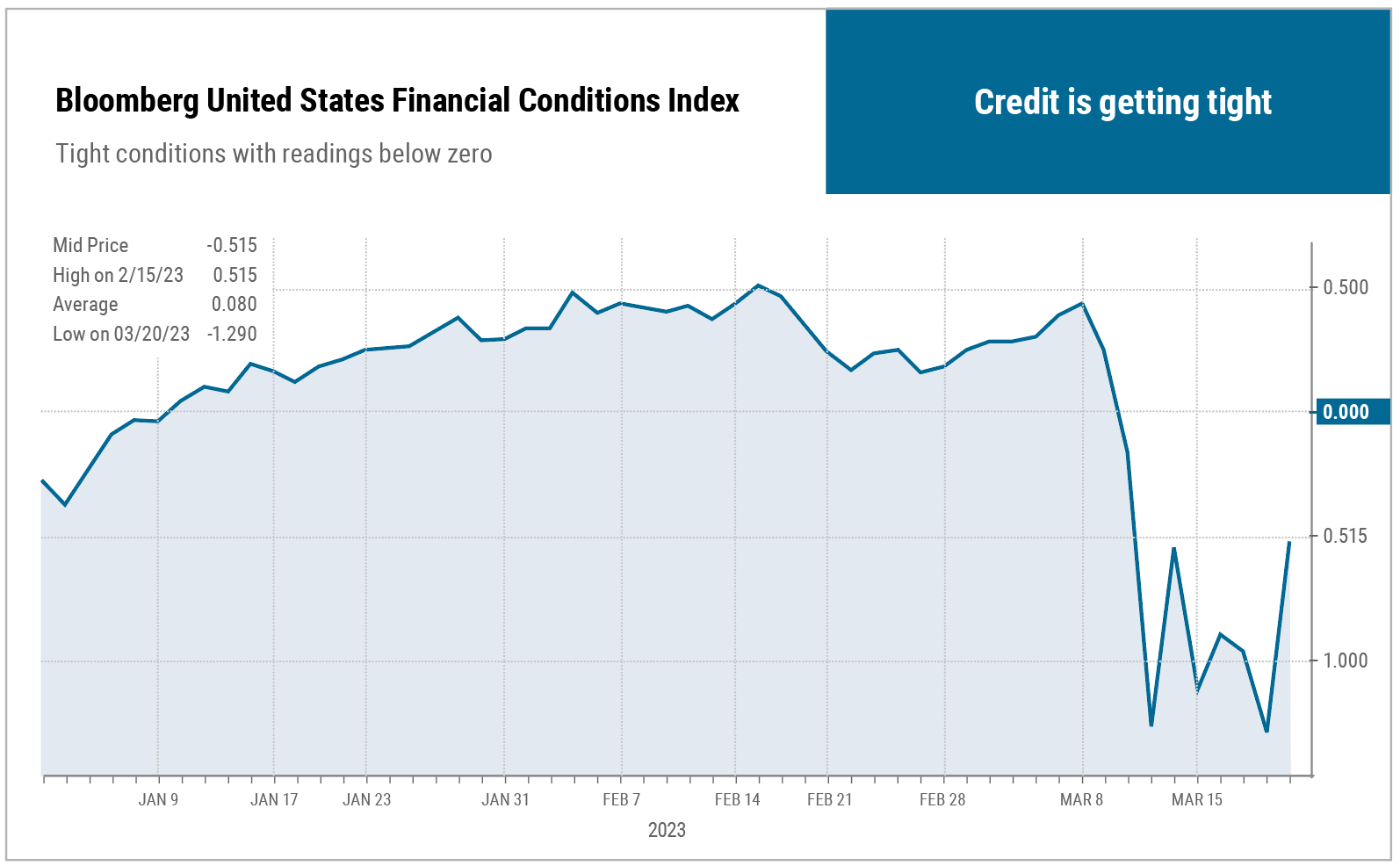

The additional fallout of bank stress is that a pause in the Federal Reserve’s rate increase campaign may come sooner than previously thought. Financial conditions have tightened significantly, which leads to tighter credit. Tight financial conditions, tight credit, bank runs, plummeting rents (which make up 40% of the CPI), falling commodity prices, zero container ships offshore in California, and most of all, negative money supply growth support a viewpoint of dis-inflation, maybe not all the way to 2% but significantly lower than the current 6%. The only thing supporting a sticky, high-inflation viewpoint is a tight labor market—the Phillips Curve1 is a dubious and backward-looking inflation indicator, although wage inputs are important. That said, the Fed is reactive and likely waits for further improved inflation prints before pausing.

1The Phillips Curve is an economic theory that essentially states that low unemployment leads to higher inflation.

General Disclosure: Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

Any opinions expressed here are those of the authors, and such statements or opinions may not represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. This information may contain future predictions that are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

These materials are for illustrative purposes only. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment related services. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed do not represent an account’s entire portfolio and in the aggregate may represent only a small percentage of the portfolio’s holdings. It should not be assumed that any of the securities transactions or holdings discussed were, or will prove to be, profitable, or that the investment recommendations or decisions made in the future will be profitable or will equal the investment performance of the securities discussed herein. A complete list of every holding’s contribution to performance during the period and the methodology of the contribution to return is available by contacting Cary Street Partners Marketing.

CSP2023068 ©2023 CARY STREET PARTNERS LLC, All Rights Reserved.