by Celia A. Rafalko / R.J. Reibel

Usually! However, in the 401(k) industry when it comes to revenue sharing can be a bad thing for employees. Revenue sharing is the imbedded additional cost above the normal operating expenses of a mutual fund. This takes the form of 12b-1 fees, sub-transfer agent fees and commissions.

These additional fees are taken automatically out of the funds and used to pay the companies that work on the plan. Not only is it difficult for employees to determine the additional cost they are paying, but often the rate of revenue sharing can vary across all the plan funds.

For example, a recent plan review for a new client showed the cost per $1,000 for employees ranged from $4.40 down to $0.37. That is a huge range of cost, and remember it is only for payments to the recordkeeper. That does not reflect the cost of the investment itself.

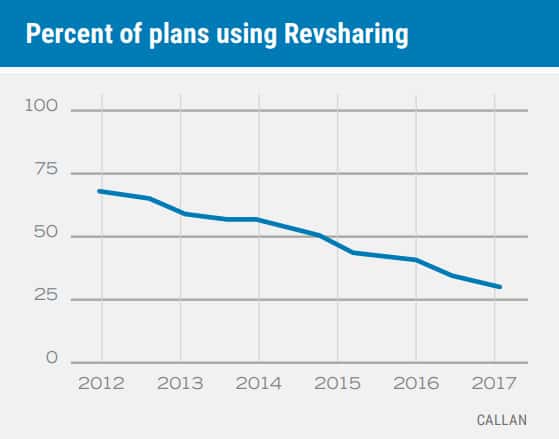

For a plan trustee, this can create conflict of interest and potential fiduciary liability. For this reason, most large 401(k) plans have moved away from Revenue Sharing in their plan’s fund lineup. A recent survey from Callan shows the percentage of plans using revenue sharing declining from 66.6% in 2012 down to 27.4% in 2017.

If you aren’t sure how the plan fees are paid in your 401k plan, then likely you have a revenue sharing plan. As an independent investment advisor, paid by our clients, Cary Street Partners can help you offer a fair plan for all employees. Learn about our retirement services.

Source: www.pionline.com/article/20180312/print/180319999/more-401k-plans-moving-fromrevenue-sharing-model

Cary Street Partners Financial, LLC is a limited liability holding company that owns 100% of Cary Street Partners Investment Advisory LLC, a Securities and Exchange Commission registered investment advisor. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy.

CSP2020519