Equity Outlook

To begin, let us recap our 2021 Outlook against the year’s results. At this time last year, we held three primary viewpoints going forward:

Our report card was very good on number one, as equities have put in a strong performance over the last twelve months. All domestic equity indices are up during that period, with the S&P 500 Index particularly robust. On number two, the results are a little nuanced. Cyclical exposure was indeed important at various times during the year, especially in the first quarter. Leadership changed hands multiple times during the year, with large company growth stocks, embodied in technology names, coming out on top over large cap cyclicals for the full twelve months. From a wider perspective, cyclicals dominated within the mid- and small- cap space, significantly outperforming growth names. Diversification was even more important than normal during the last year. Regarding number three, we were spot on, as aggregate bond indices were indeed challenged in 2021, posting losses over the last twelve months. Much of the heavy lifting on higher long-term interest rates was accomplished in the first quarter. Over the last year, the ten-year Treasury yield has increased from .91% to around 1.5%, trading as high as 1.77%. Rates and bond price move opposite.

Much like 2020, the most surprising development to us has been the rapidity of stock market rallies. A mountain of liquidity has fed a very strong “buy the dip” mentality, and while we have had pullbacks along the way, the hallmark of this uptrend has been the exceedingly quick recapture of market declines.

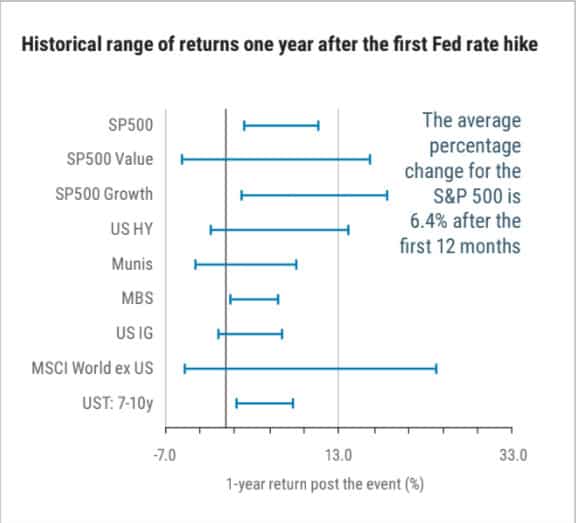

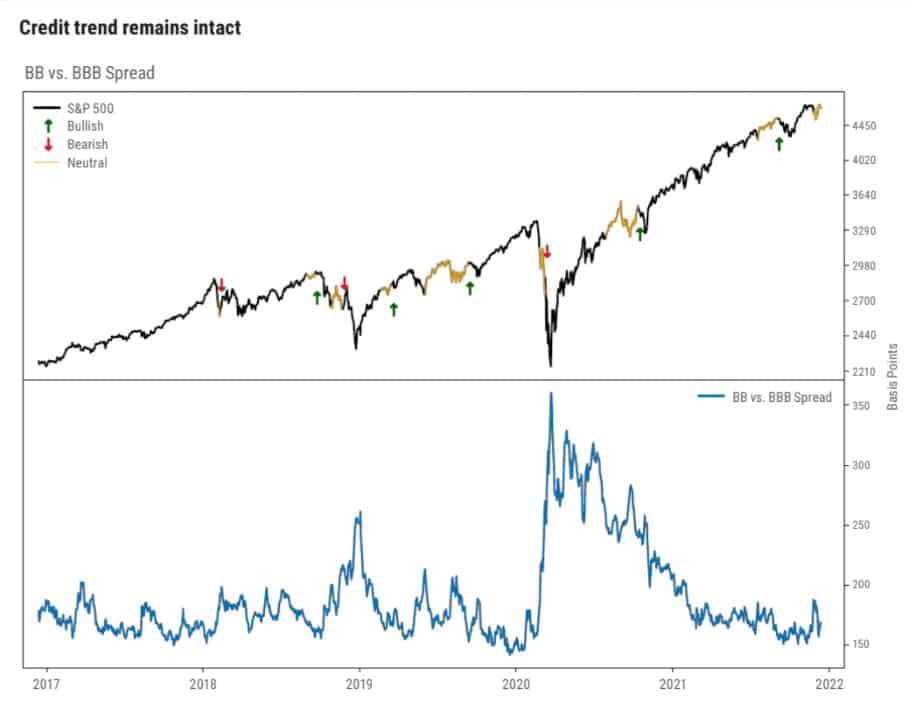

Going forward, the tactically important data indicators for equities remain intact. Liquidity, credit, and sentiment are all bullish relative to historical forward returns. The caveat in that outlook is that liquidity, while ample, is going to contract to some degree going forward. The Federal Reserve is unwinding its pandemic-era quantitative easing, the monthly bond purchase program. This tapering of purchases should conclude toward the end of the first quarter, setting up short-term rate hikes as an additional tightening option for the Fed should the inflation situation warrant. Currently the Fed forecast is for three rate hikes in 2022. As the Fed takes on a more hawkish stance, the upward direction of equity prices often remains intact, but the trajectory is less pronounced. If the Fed moves harder than expected, markets may struggle. Fed intentions are to react to upside surprises to inflation, hopefully getting ahead of this issue. Forward policy guidance from the Fed could serve to mitigate market impact. In summary, liquidity is not in the danger zone at this writing but is directionally bearish. As such, the Fed will be less supportive of equity prices going forward.

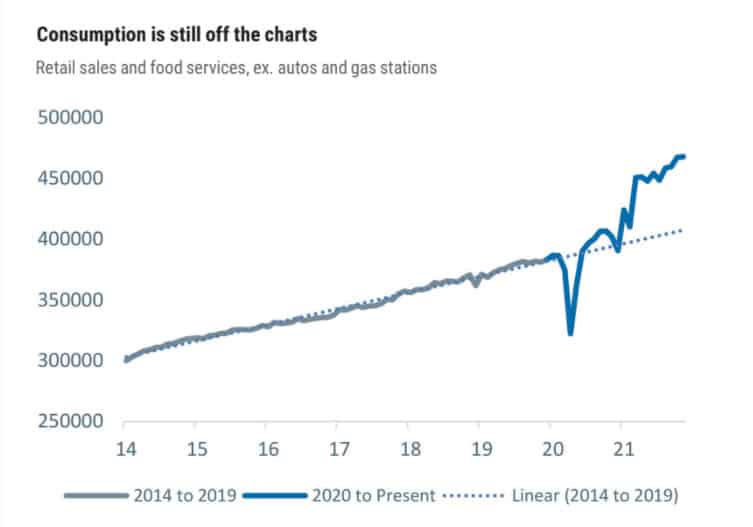

Source: Renaissance Macro Research

Credit stress is an early indicator of major equity problems, market drawdowns beyond typical corrections. Consequently, it figures large in our work as a canary in the coal mine. Credit markets have been wide open for quite some time, with no stress evident in spreads. That is still the case. There was a wobble during the Omicron scare immediately following the Thanksgiving holiday, but that appears to be a result of low liquidity during the holiday-shortened week. Sentiment is best embodied in the CBOE Volatility Index (VIX), commonly referred to as the fear gauge. That index moves inverse equity prices and has traded within a range of 15 to 29 during The primary takeaway on the VIX is that we want it to stay within its current range; we do not want to see it establishing a higher trend beyond 29. It follows that the resistance level of 29 is very important.

Source: Renaissance Macro Research

Beyond an increasingly hawkish Fed, COVID is still with us as a risk factor. The Omicron variant first identified around Thanksgiving is a potential driver of fear and volatility. Early data indicates symptoms are relatively mild, but the variant is highly transmissible and evades existing vaccine efficacy to some degree. It appears that booster shots for existing vaccines are effective against severe illness. Vaccine makers are also working on a vaccine targeted to Omicron should it be necessary. 2022 is likely to be a tolerable year for risk assets such as stocks, but accompanied by a lot of volatility.

Portfolio Positioning

The greatest challenge to portfolio positioning is the lack of potential upside returns within the bond portion of a typical balanced portfolio. This is tied to the higher structural inflation dynamic. Investors have benefited from a 40-year bull market in bonds that essentially ended in Q1 2021.

Persistent falling rates over those decades led to good total returns that enhanced portfolio returns while playing defense against equity declines. The defensive characteristic of bonds still has a role in portfolios, but the reversal of the inflation dynamic and interest rates makes for a challenging environment in which to generate meaningful returns. At the least, this portion of portfolios continues to face headwinds. Consequently, successful bond strategies will need to incorporate a lot more tactical thinking with wide parameters on credit and duration. Investors seeking steadier returns than found in long-only equity portfolios will also need to consider additional strategies beyond bonds.

Volatility is probably the timeliest asset class right now. Hedged equity strategies that capture the volatility risk premium embedded in stocks offer one solution. These strategies generate sizable participation in equity returns coupled with predictable downside cushion and lower standard deviation relative to broad stock indices. Hedging strategies can also be geared toward income generation. Another potential choice is real assets, which are efficiently delivered in the real estate (REIT) sector of the stock market. A similar real asset choice would be commodity strategies offering exposure to increased demand, particularly in metals.

Economic outlook

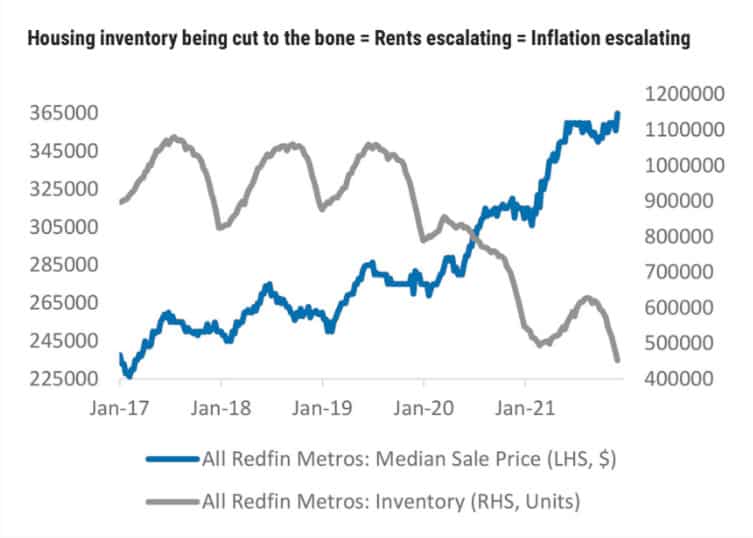

Entering 2022 the economy is running hot, from both a growth and inflation perspective. Certain high-frequency models, such as the Atlanta Fed, have Q4 GDP tracking in the high single digits. We have previously characterized the economic backdrop as an inflationary boom, similar to a post war setup. Business investment is booming, job growth is surging, incomes are exploding, inventories remain too low, particularly at small firms. Economic problems surround inflation, which is well above the Federal Reserve target of 2% average. Recent months have seen the highest readings in decades, with the two Fed benchmarks, core CPI and core PCE, running in the 4 to 5% range, and headline numbers ranging beyond 6%. Our outlook continues to forecast a higher structural-inflation dynamic than we have seen for years. Well-known supply chain issues will be with us for a while longer, although the market is beginning to sort these out. More problematic are certain sticky price increases, rent- and labor-shortage-induced wage growth. Rent is a large component of data, particularly CPI where it comprises about 40% of the total. The Fed is beginning to react to hot inflation data by ending its pandemic-era monthly bond purchase program and setting the stage for hikes in the short-term interest rate market. But even with appropriate Fed response, underlying inflation looks to remain closer to 3% than the Fed target of 2%. Expect the financial markets to expend a lot of energy parsing the Fed response to inflation data in the coming months.

Source: Renaissance Macro Research, Haver Analytics

Source: Renaissance Macro Research, Haver Analytics

All market and economic data is sourced from Bloomberg.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

Technical analysis is based on the study of historical price movements and past trend patterns. There is no assurance that these movements or trends can or will be duplicated in the future. All investing involves risks, including the possible loss of principal. There can be no assurance that any investment strategy will be successful. Investments fluctuate with changes in market and economic conditions and in different environments due to numerous factors some of which may be unpredictable. Some of this information was prepared by or obtained from third-party sources believed to be reliable, but Cary Street Partners does not guarantee its accuracy or completeness. Any opinions expressed or implied herein are subject to change without notice. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. An investor cannot invest directly in an index. Past performance is no guarantee of future results.

CSP2021232 © COPYRIGHT 2020 CARY STREET PARTNERS LLC, ALL RIGHTS RESERVED.