2021 Q1 Equity Review and Forward Outlook

Equity market performance for the first quarter of 2021 was best characterized as churning higher amid a huge rotation from technology issues toward cyclicals. The S&P 500 Index was up 6.17%1 at quarter end, but underneath the top-line numbers, there is large dispersion between growth and value strategies. As these equity styles are dominated by technology (growth) and cyclicals (value), they serve as good proxies for those sectors. The Russell 1000 Growth Index finished the quarter up .94%1, and the Russell 1000 Value Index finished up 11.26%1. The same dispersion has taken place within small/mid capitalization stocks as well. An easy way to think about this rotation is a leadership movement from last year’s winners to last year’s laggards.

As we entered 2021, we held three primary viewpoints, as expressed in the 2021 Outlook, published in December. First, the equity trend going forward remained intact. We expected some short-term hurdles to higher prices as sentiment was overly bullish entering the year. But the longer trend supported by tactically important factors, massive liquidity and a lack of credit stress, was strong. Second, we urged equity investors to ensure exposure to cyclicals as a positioning imperative. And finally, we looked for a steepening of the yield curve, that would make it hard to produce positive bond returns for 2021. That final viewpoint is where we have been somewhat off course. We were correct on the steep curve, surprised however by the speed in which it has occurred.

Equities remain in a long-term uptrend, that began with the March 2020 low. Sentiment, which began the year in frothy territory, burned off the froth during the January ebb and flow, and is no longer complacent at this writing. Reasonable sentiment, combined with massive liquidity and wide-open credit markets, lead to a conclusion that any equity pullbacks should remain typical corrections, in the 5%–10% zone.

Equity Positioning

The big story for the first quarter was the continuation of a leadership rotation that began in November of 2020. Prior to that point, market leadership was dominated by technology centric companies, whose business models were either immune to, or benefited from, the COVID pandemic. These are the well-known names, primarily in the large-capitalization space, such as Amazon, Microsoft, Apple, Google, Facebook, and Netflix. This former leadership unsurprisingly represents the priciest of names, particularly when companies such as Tesla are added to the list. At the end of October 2020, one of the most under-owned sectors, energy, comprised less market size than one or two of these tech names.

Late in 2020 the market began to recognize that enormous earnings increases were on the horizon for cyclical companies. These are companies whose earnings are levered to the economic cycle, which is now exploding to the upside as vaccinations portend light at the end of the pandemic tunnel. We continue to emphasize exposure to cyclicals. Prices move fast, and sooner, than fundamentals. Consequently, we have seen a good deal of out-performance from cyclicals already, but there seems to be ample runway left for this trend to continue for the foreseeable future. Further accentuating this rotation has been the increase in longer-term yields, which on a relative basis, negatively impacts long-duration equities — companies with bright futures that happen to be trading at high prices relative to current earnings.

Economic Outlook

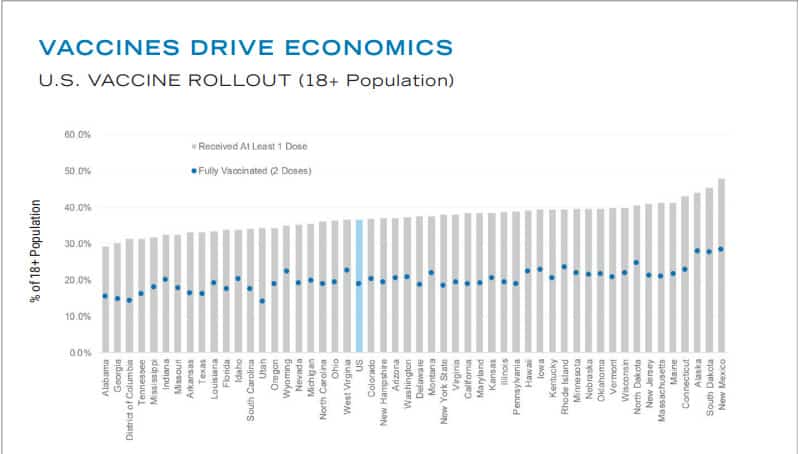

Source: Natixis PRCG, CDC, as of 3/29/21

U.S. economic performance is surging to the upside. Massive liquidity provided by the Federal Reserve over the last year, coupled with the amazing development of multiple,

highly effective COVID vaccines, puts the U.S. in an enviable position for 2021. High-frequency, forward-looking tracking data indicates Q1 GDP well in excess of consensus estimates. As the mountain of excess savings, estimated at 1.8 trillion dollars, is

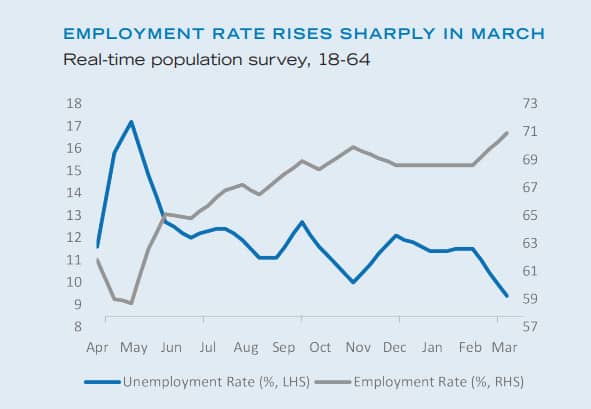

unleashed in the form of consumer spending, expect this to combine with an already robust manufacturing sector and result in huge GDP and job gains for the remainder of 2021. Of course, much of this is the other side of the valley related to the COVID driven GDP decline last year. At some point economic forecasting will get back to arguing over an outlook of 2.4% versus 2.6%, but not this year. Expect GDP in the high single-digit range for a while, accompanied by multiple monthly job increases in the millions. Also expect to see higher inflation figures in the months ahead, as reports will easily lap comparisons to last year’s deflationary period. This is the base effect that the Fed references frequently. Fed policy is targeting an average inflation rate of 2%, so there is no likely change in Fed liquidity if inflation runs in the 2%–3% range for a few quarters. Through February, signs of inflation as indicated by the Fed benchmarks of core CPI, and core PCE, remain muted.

Source: Renaissance Macro Research, Haver Analytics

Source: Renaissance Macro Research, Federal Reserve

Bond Market Outlook

Longer-term yields have moved dramatically higher in the first quarter of 2021. While we expected this steepening of the yield curve, the rate of change has been faster than we anticipated. Long term rates, as commonly referenced by the 10-year Treasury yield have moved from .92%1 on January 1st, to 1.73%1 at quarter end. This is a very large percentage increase at a breakneck pace. Bond prices move inversely to yield. Consequently, bond performance has been awful, with the Barclay’s U.S. Aggregate down 3.37%1 and the Barclay’s Global Aggregate down 4.46%1 for the quarter. To push back against the yield curve steepening would be to push back against normalizing economic growth, which we are not going to do. While we continue to hold to the view that 2021 will be a negative year for bond performance, the pace of change should moderate in the short term, as selling exhausts itself and consolidates somewhat.

1 Bloomberg

Past performance is no guarantee of future results.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

This information was prepared by or obtained from sources believed to be reliable, but Cary Street Partners does not guarantee its accuracy or completeness. Any opinions expressed or implied herein are subject to change without notice. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. An investor cannot invest directly in an index.

CSP2021058 © COPYRIGHT 2021 CARY STREET PARTNERS, ALL RIGHTS RESERVED