2021 Q2 Equity Review and Forward Outlook

Equity markets moved higher in the second quarter with the S&P 500 Index picking up 8.55%.¹ Within the market there was broad participation, but growth issues—led by technology—outperformed for the quarter. As a second cousin proxy, the Russell 1000 Growth Index was up 11.93%¹ for the quarter, the Russell 1000 Value was up 5.21%.¹ This is the opposite of the first quarter when cyclical stocks associated with the value side of the market outperformed. For the first six months of 2021, the Russell 1000 Value Index is up 17.05%,¹ holding a lead ahead of the Russell 1000 Growth Index, which is up 12.99%.¹ We continue to hold to the viewpoint held entering 2021 that cyclicals are likely outperformers going forward, but the second quarter is a good reminder that viewpoints such as this should be expressed within the context of a diversified portfolio. Markets are never one-way streets, and positioning should be thought of as tilts in exposure, not binary wagers.

In addition to cyclical exposure, our other points of emphasis entering 2021 remain intact. First, stocks remain in a long-term uptrend supported by the important tactical factors-liquidity, lack of credit stress, and non-complacent sentiment. Regarding the first of those factors—a lot of ink has been spilled over the last few weeks parsing Federal Reserve policy going forward. The Fed has begun the first steps toward removing accommodation, more on that below. Money supply growth, as illustrated by M2, peaked in February. During the June Federal Open Market Committee Meeting, the Fed also communicated members are beginning to discuss a timeline for tapering the monthly bond purchase program. While these are inevitable steps toward normalization, they do indicate a nuanced policy shift in reaction to recent inflation figures. The first Fed move in this direction is historically not an equity peak, but often changes the trajectory of the trend. This is a nuanced change in our outlook. Essentially, we look for positive equity returns going forward, but more modest than the last twelve months. Credit stress remains non-existent. That is an important canary-in-the-coal-mine indicator for significant equity problems.

The final point of emphasis for 2021 continues to be a forward viewpoint that includes a steep yield curve with somewhat higher long-term rates than those seen today. The movement toward higher long-term rates was dramatic in the first quarter in terms of both pace and size of the increase. After peaking at a yield of 1.77%,¹ oversold bond prices rallied, resulting in the 10-year Treasury finishing Q2 at 1.48%.¹ Keep in mind bond prices and yields are inverse to each other. The pace of yield increase surprised us in Q1. The consequent pause in yield increase does not come as a surprise. Yields have recently lifted off of oversold (overbought in terms of bond price) conditions and should peak at a higher point driven by higher nominal GDP and inflation. This makes for a continued tough bond market.

Equity Positioning

Within the context of a diversified portfolio, we hold fast with a tilt toward cyclicals. Market sectors such as energy and REITS remain very much in leadership, not correcting much during short-term market sell-offs. Financials have also responded well to oversold conditions during sell-offs. These are all bullish implications. Technology has come off oversold conditions earlier in Q2 in an admirable manner but has not changed the broader trend. In terms of capitalization, the same dynamics are at work in mid and small caps as we see in large caps. International markets might finally be playing catch up to the U.S. as Europe is keeping pace with the S&P for Q2 and year-to-date. Both cyclicals and international assets are positioned to benefit from a higher structural inflation regime than the last decade-long cycle.

Economic Outlook

Inflation data picked up dramatically in Q2. The two primary Federal Reserve benchmarks, core CPI and core PCE, have been surprising to the upside. A pick-up has been expected, in part due to easy comparisons to the same months last year, the base effect. The debate surrounds the transitory versus persistent nature of these higher inflation figures. A large factor in recent months has been both used and new-car prices, not quite a one-off problem, but likely a short-term issue due to the semiconductor chip shortage. Additionally, a significant portion of the data points to a lot of one-offs, re-opening factors such as hotels and airlines, but there are stickier price increases as well, rents being a prime example.

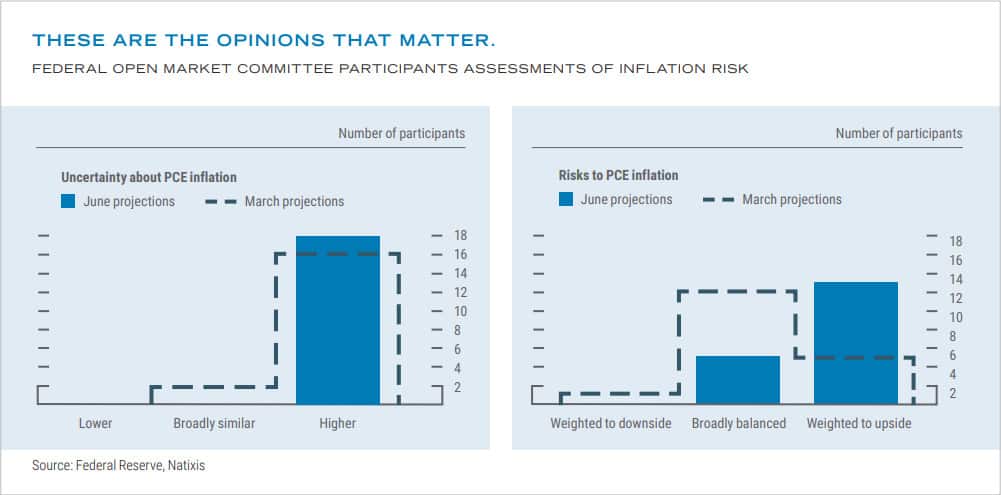

There is a greater chance of inflation surprising to the persistent side of this debate. Federal Reserve policy is targeted to a higher inflation dynamic, an average of 2% versus a previous maximum of 2%. While the Fed will be cognizant of not letting inflation get out of hand, they are oriented to allowing hotter than 2% numbers for periods of time. Greater clarity on the transitory-persistent debate will emerge as we get to the fall, with base effect comparisons falling off and the dissipating effect of one-off economic re-opening factors.

¹ Bloomberg

Past performance is no guarantee of future results.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers.

This information was prepared by or obtained from sources believed to be reliable, but Cary Street Partners does not guarantee its accuracy or completeness. Any opinions expressed or implied herein are subject to change without notice. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. An investor cannot invest directly in an index.

CSP2021127 © COPYRIGHT 2021 CARY STREET PARTNERS, ALL RIGHTS RESERVED