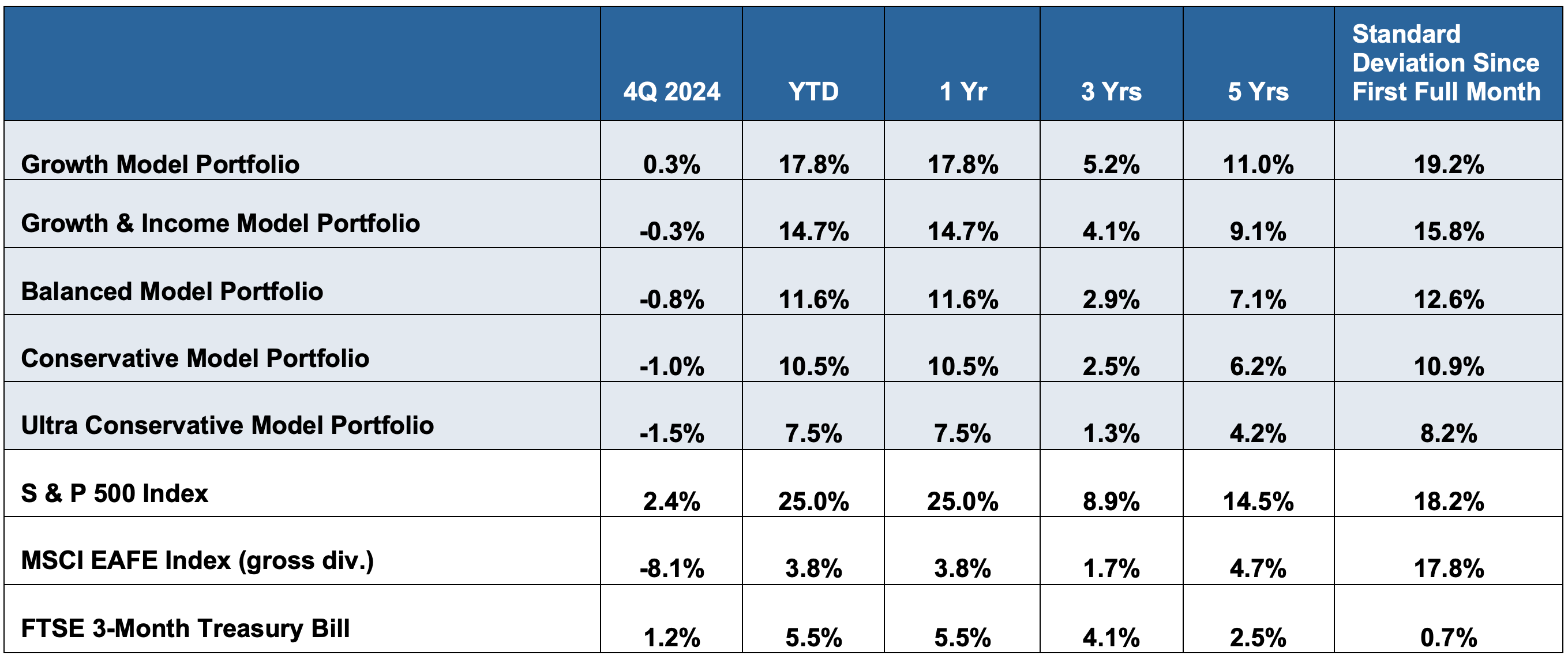

Model Portfolio Quarterly Performance

As of December 31, 2024: Past performance is no guarantee of future results. (Portfolio returns are net of fees.) Data sources: Morningstar and DFA Returns 2.0

Past performance is no guarantee of future results. (Portfolio returns are net of fees.) Data sources: Morningstar and DFA Returns 2.0

Do More With Your Retirement

Cary Street Partners Secures New Institutional Partner to Accelerate Growth | Read More

The results portrayed here are hypothetical model results for the period December 31, 2017 to the present. There are limitations inherent in model results, particularly the fact that such results do not represent actual trading and that they do not necessarily reflect the impact that material economic and market factors could have had on the advisor’s decision making if the advisor were managing clients’ money. This material has been distributed to a limited audience that includes sophisticated investors capable of understanding hypothetical model results.

The results portrayed are net of investment advisory fees. A fee of 1.0% per annum, the highest model fee, was used to calculate the net of fees results. The results shown reflect the reinvestment of dividends and other earnings.

The model portfolios are compared to the S&P 500® Index, MSCI EAFE Index (gross dividend) and the FTSE 3-Month US T-Bill Index. The S&P 500® Index is widely used as a benchmark and is often considered as representative of the domestic equities market. The MSCI EAFE Index is commonly recognized as a benchmark of international equity performance. The FTSE 3-Month T-Bill Index is a market value-weighted index of public obligations of the U.S. Treasury with maturities of 3 months. The S&P 500® Index, MSCI EAFE Index and FTSE 3-Month US T-Bill Index are unmanaged indices and reflect no trading costs, management fees or expenses which would reduce the index performance results in comparison to the model portfolio results that reflect investment advisory fees and trading costs. An investor cannot invest directly in an index. The volatility of the indices is materially different from that of the model portfolios.

For various reasons (tax, personal preference, restrictions, etc.) some clients of the adviser have had investment results materially different from the results portrayed in the model portfolios. Model portfolios assume no further investment other than initial investment. However, model portfolios are typically used by 401(k) Plans whose participants make contributions into the models on a semi-monthly basis. Participants who make contributions and/or make withdrawals during the year could have materially different results than the model portfolios.

The model portfolios are allocated among a group of equity and fixed income mutual funds depending on the advisor’s view of expected return and volatility. The model portfolios are managed to be globally diversified. The fixed income or bond component of the model portfolios are largely invested in intermediate and short-term bonds.

The conditions, objectives or investment strategies of the model portfolios did not change materially during the time period portrayed.

It is not our intention to indicate that past performance is any indication of future results. As with any investment, returns will vary and there is a potential to lose money.

The standard deviation of the model portfolios is presented since July 2012, the first full month of the model portfolios; the higher the number, the higher risk associated with that model portfolio. The standard deviation of return measures the average deviations of the return from the mean and is often used as a measure of risk. A large standard deviation implies that there have been large swings in the return series of the advisor.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only. The source of certain market data is Morningstar and DFA Returns 2.0. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information contained herein without consulting a tax professional or an attorney. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment related services.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.