Your Full Service Financial Planning Team

In a world of confusing headlines and challenging markets, it takes more than investment guidance to help you confidently move forward. It takes an understanding of your entire financial life, your hopes and dreams. You also need a clear road map for getting where you need to go.

As your personal advocate, I can provide you with advice that is tailored to your circumstances and priorities. I’ll begin with a comprehensive plan for all you’d like your wealth to achieve. Over time, I will continue to adjust it, should circumstances change, so you can embrace your financial future with confidence no matter what the environment.

Services Provided

- Financial Planning

- Wealth Management

- Retirement Planning

- 401(k) Rollovers

- Estate Planning Strategies

- Professional Portfolio Management

- Alternative Investments

- Sustainable Investing

- Long Term Care Insurance

- Tax Preparation

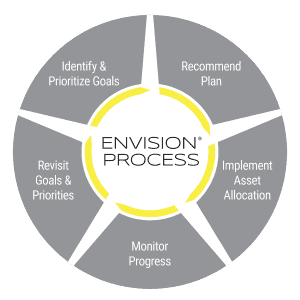

Understanding your goals is the centerpiece of our recommendations and strategies.

Envision® is a registered service mark of Wells Fargo & Company and used under license.

Meet Your Team

Investment Philosophy

Planning

Planning is a map, investments are the vehicle. Our long-term prudent investment strategy is based on 50+ years of research for our clients. Our investment philosophy is based on the science of capital markets and decades of time-tested industry research.

Research Driven

Our investment philosophy is deeply rooted in academic research, and we incorporate both strategic and tactical asset allocation to potentially deliver optimal risk-adjusted returns. We collaborate with leading financial academics to identify a sensible approach to your portfolio design. We diversify clients across a multitude of asset classes to help reduce portfolio volatility.

Measured Approach to Risk

We believe that clients’ risk tolerance should be determined by the level of return necessary or desired to achieve clients’ objectives.

Importantly, we believe that risk should only be undertaken to the extent necessary to achieve a client’s goals.

Timing the Market Doesn’t Work

“I can’t recall ever once having seen the name of a market timer on Forbes‘ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.” – Peter Lynch

Lower Cost Investment Structure

Portfolio costs have a direct impact on portfolio performance; we seek to keep the total expense structure low by utilizing low cost institutional class mutual funds.1

1 Investment return and principal value of mutual funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.