By Thomas O. Herrick

Market Strategist

For most of the last decade, U.S. equities have outperformed their overseas counterparts. In a reversal of that trend, since the onset of 2025, international markets have significantly outperformed. This is especially true of developed markets, most of which are in Europe. Through March 7th, the EAFE index of developed markets has gained 10.66% YTD. The EAFE (European, Australasia, and the Far East Index) includes Asian markets, notably Japan. Europe alone has gained 14.92%. Emerging markets have not been totally left out, with MSCI Emerging Markets gaining 5.28%, led by China, up over 20%. This compares to the S&P 500 Index and Russell 1000 Index, which have lost 1.66% and 1.83% over the same period.

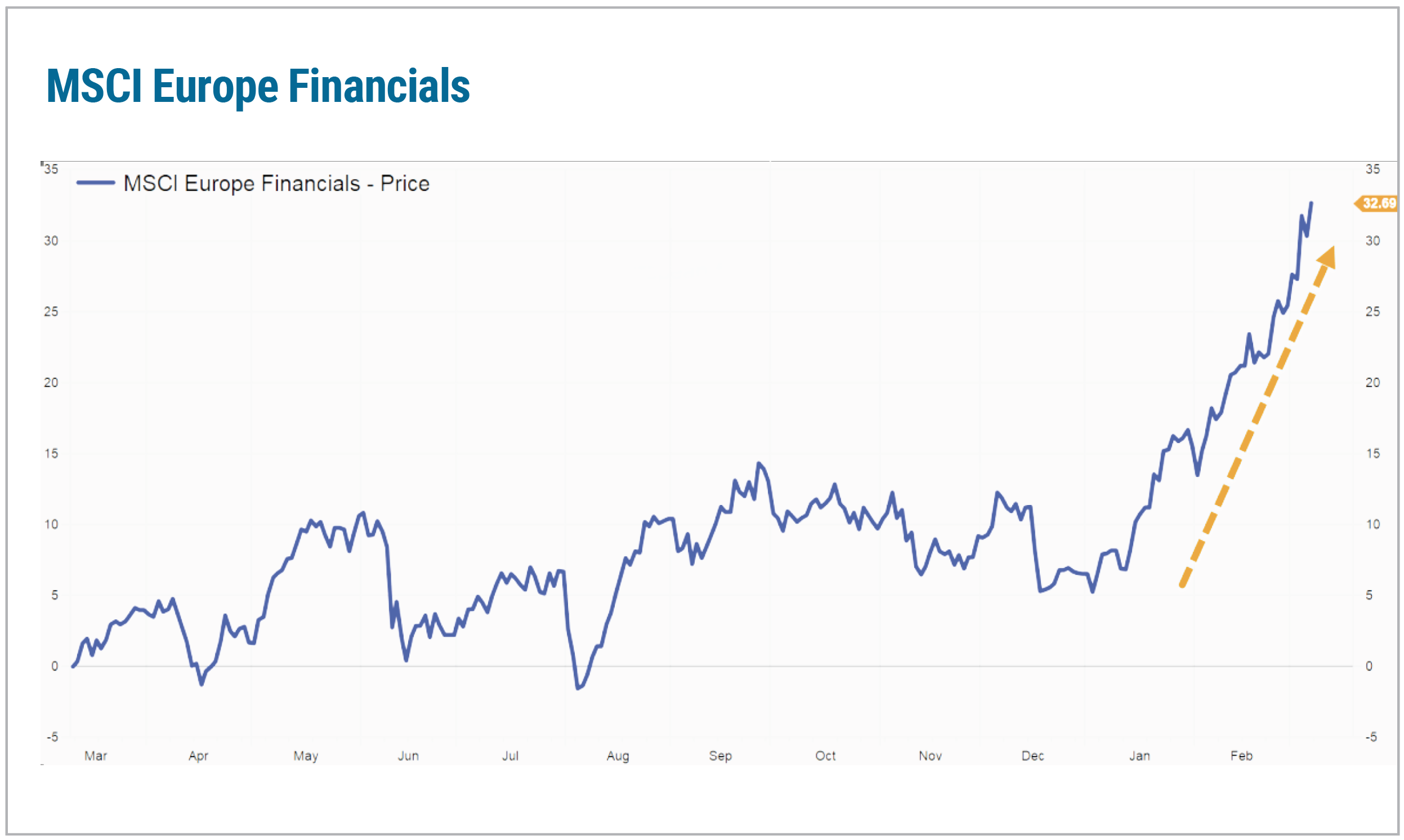

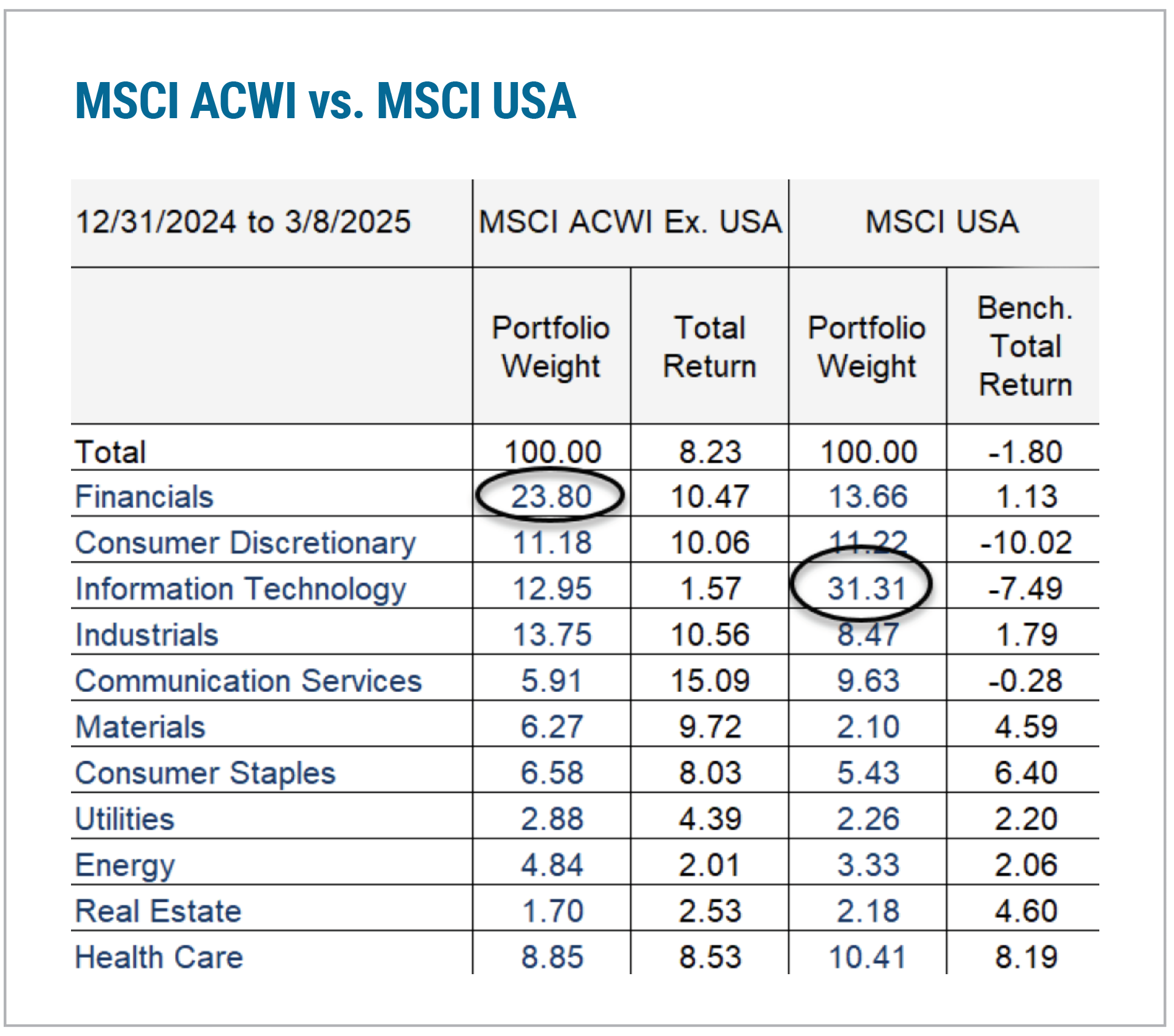

Several factors are driving this outperformance. On a macro level, Europe, particularly Germany, is pivoting toward a policy of infrastructure and defense investment. There are also proposals within the European Union to unify capital markets more effectively, a long-standing structural weakness in Europe. Most important from a fundamental investor perspective are increasing earnings expectations on the continent, some related to the defense sector anticipating greater investment, some coming on financials upgrading forecast. A lot of non-U.S. outperformance going forward will depend on European financials versus U.S. technology. Those sectors are heavyweights within their respective indexes.

Source: John Hancock, FactSet

Source: John Hancock, FactSet

Earnings expectations for the S&P 500 currently sit at around 12% in 2025, outdistancing EAFE, which has current expectations of about 8%. That said, EAFE expectations have been rising, while S&P earnings expectations may be poised to diminish because of tariff imposition. Emerging market expectations are also robust at about 13% growth.

Our viewpoint is one in which international diversification makes sense; however, we would be wary short term given the recent strong run. The ratio of EAFE to S&P has broken out to the upside, in a long-term positive development. But there are signs of short-term exhaustion that have accompanied the move. Adding exposure on a retracement of gains or averaging into these markets would be most appropriate.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

International and foreign securities are subject to additional risks such as currency fluctuations, political instability, differing financial standards, and the potential for illiquid markets.

Comparative Index Descriptions: Historical performance results for investment indices have been provided for general comparison purposes only, and generally do not reflect the deduction of transaction or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings do or will correspond directly to any comparative indices. An investor cannot invest directly in the indices shown, and accurate mirroring of the indices is not possible.

The MSCI EAFE Index is a stock market index that measures the performance of large- and mid-cap companies across 21 developed markets countries around the world. Canada and the USA are not included. EAFE is an acronym that stands for Europe, Australasia, and the Far East.

The MSCI Emerging Markets is a global stock market index that tracks the performance of large and mid-cap companies across 24 emerging markets. It is maintained by MSCI, formerly Morgan Stanley Capital International, and is used as a common benchmark for global emerging market stock funds.

The Standard & Poor’s (S&P) 500 Index is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market.

The Russell 1000® Index measures the performance of the large-cap segment of the US equity universe. It includes approximately 1,000 largest US stocks, representing 93% of investable US equities by market capitalization. CSP2025052