|

|

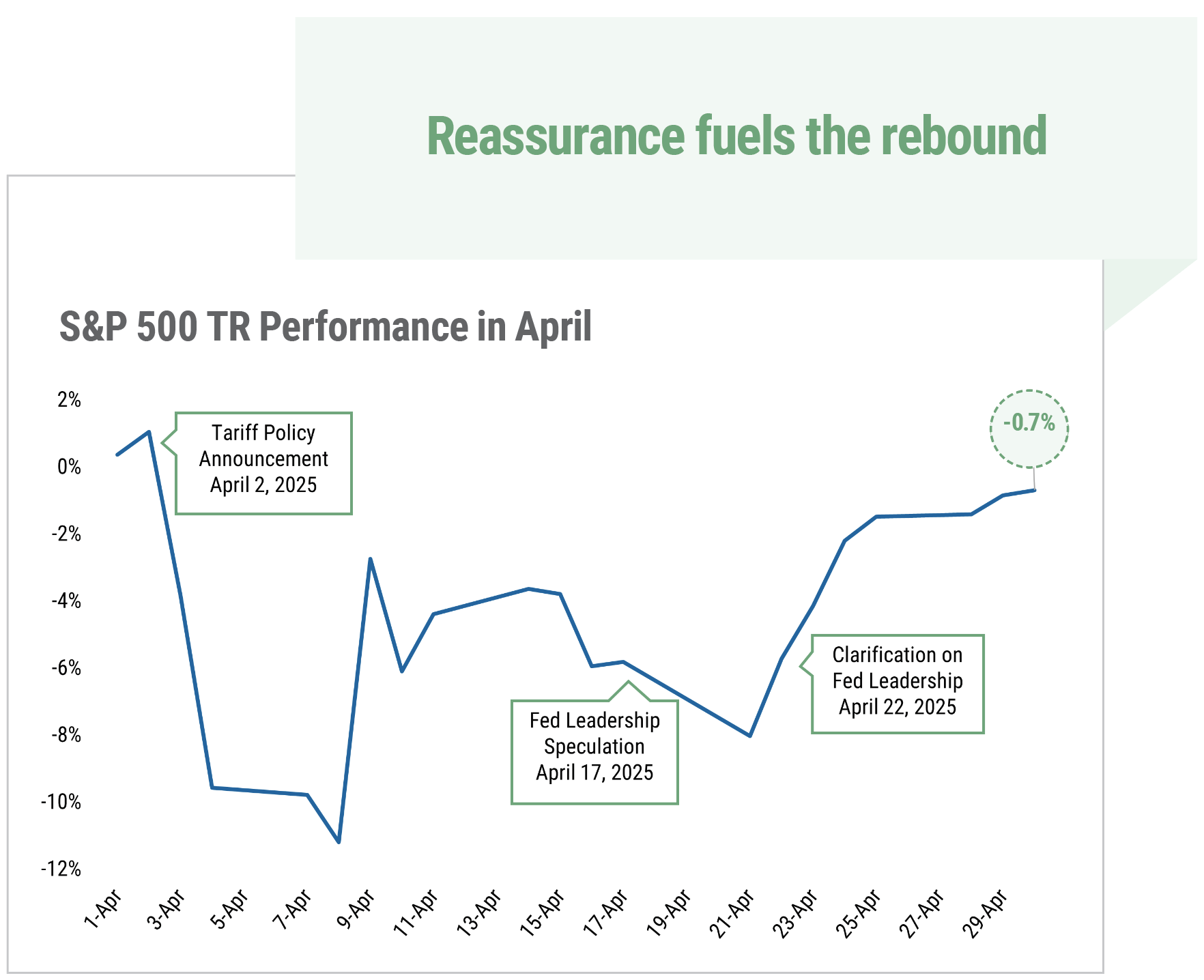

April offered investors a stark reminder that the markets dislike uncertainty. The S&P 500 Index plunged 11% early in the month, enduring some of its most volatile days since the COVID-19 pandemic, then staged a multi-day rally to end April down only 0.7%. International developed market stocks outperformed the U.S. during the month, with the MSCI EAFE returning 4.6%.

Meanwhile, in U.S. bond markets, investor confidence eroded through widening credit spreads early in April, particularly in high-yield bonds. Those concerns appeared to recede somewhat, as spreads began tightening again by the month’s end. Ten-year U.S. Treasury yields held relatively steady despite some sharper moves in response to headlines, ending April at 4.17%.

Policy-related uncertainty, including new tariff announcements and shifting trade negotiations, drove much of April’s volatility. Markets also reacted to speculation about the Federal Reserve’s future independence, contributing to cautious investor sentiment mid-month. Toward the end of April, however, messaging from Washington turned more reassuring, with indications of progress on trade discussions and support for Fed leadership. This helped improve market confidence and contributed to the late-month rebound in U.S. equities.

Source: Y Charts

Earnings and Economic Data Calm Rattled Investors

First-quarter earnings announcements also helped settle investors. Earnings have not yet seen a significant impact from tariffs. By the end of the month, 73% of the 180 S&P 500 companies reporting beat their earnings estimates, a slightly lower rate than the five-year average. Given the uncertainty surrounding tariffs, however, many companies are reluctant to offer guidance for the remainder of the year, and analysts are reducing earnings targets more than usual. This echoes the general consensus that the future is hard to predict given how much is unknown today.

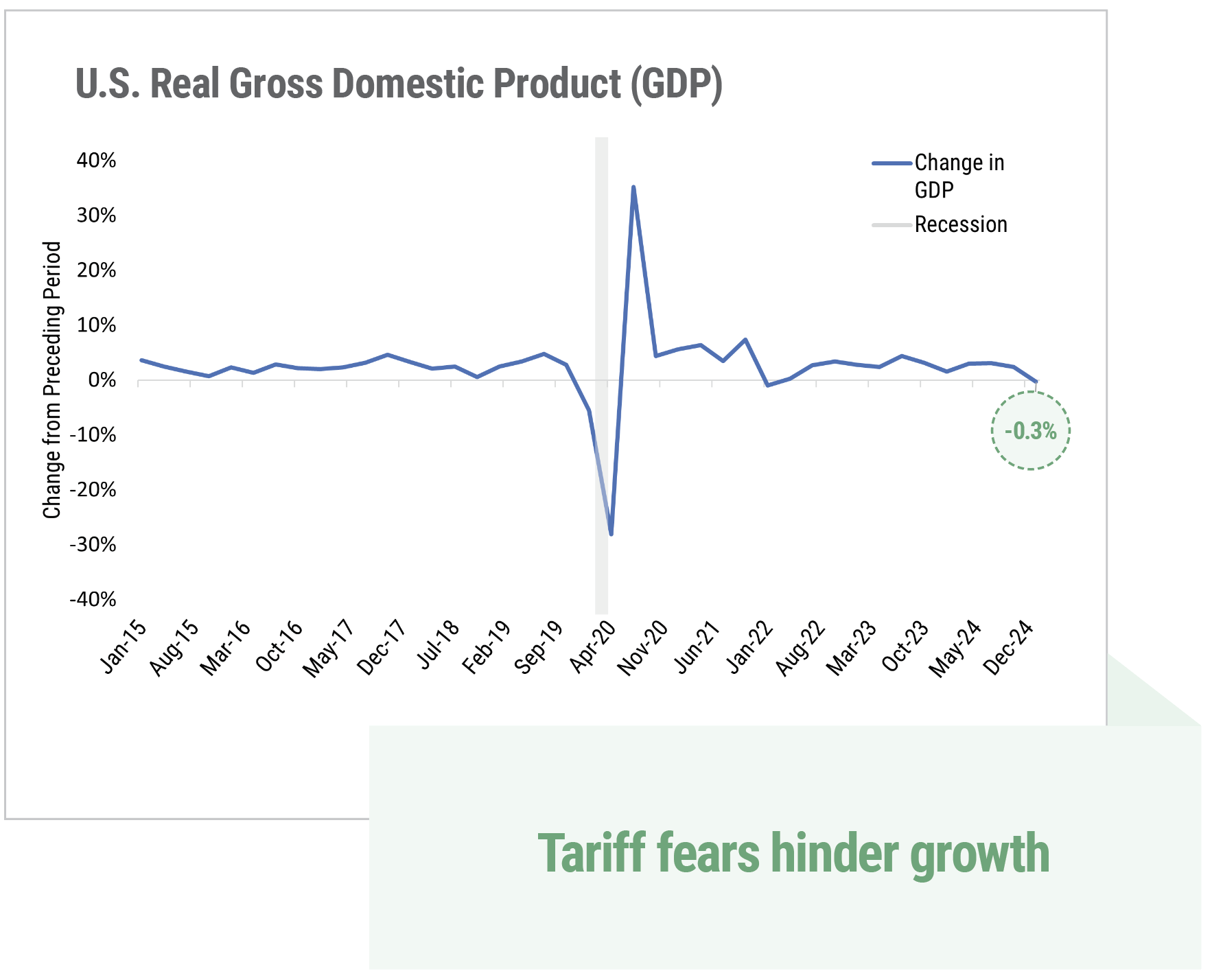

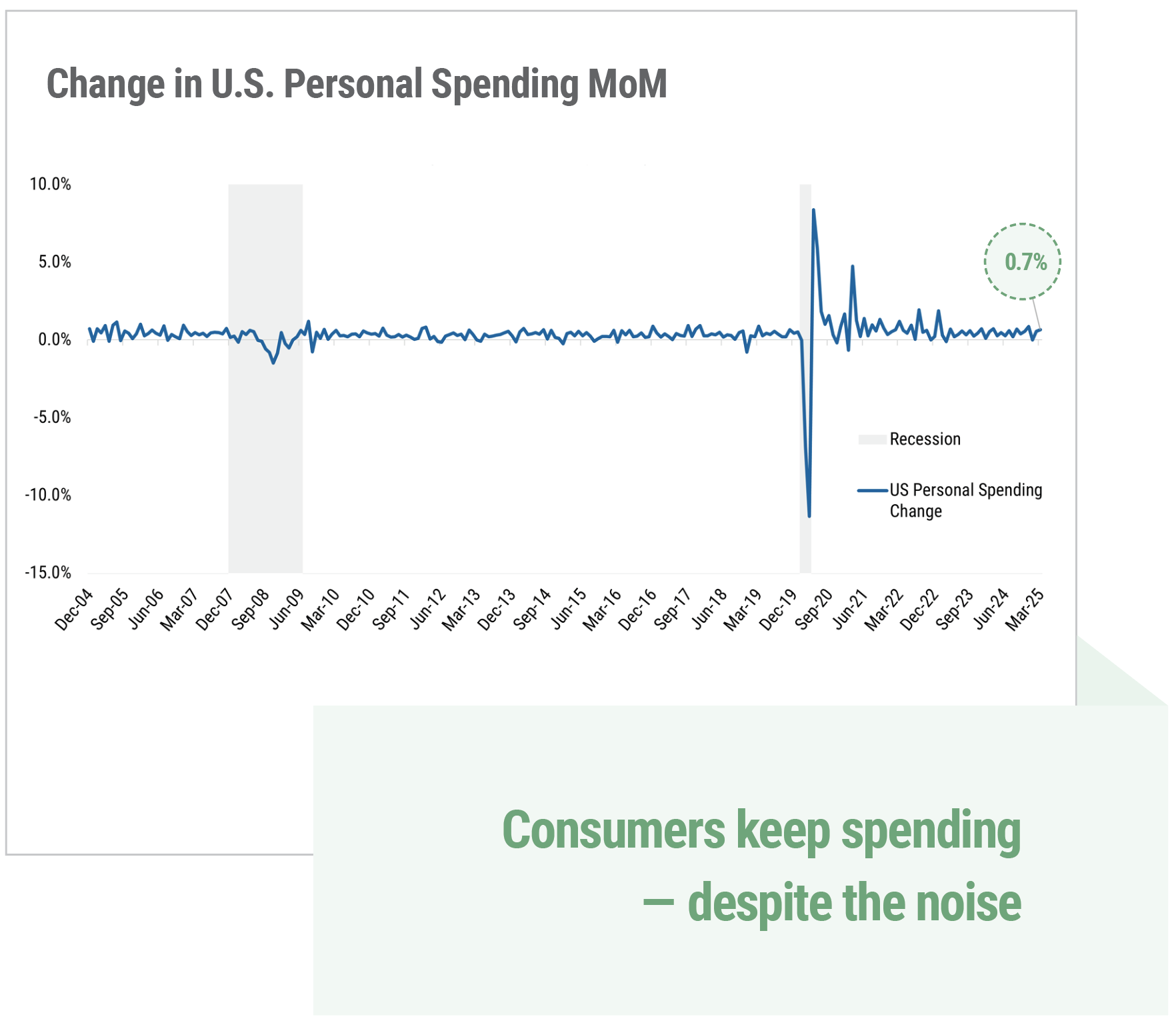

U.S. GDP growth for the first quarter came in at -0.3% annualized, the first decline since 2022. That reading was negatively impacted by a flurry of imports as consumers and companies raced to stock up ahead of tariffs. While recession risks are elevated today, largely due to concerns about the impact of tariffs on inflation and growth, the first-quarter GDP decline is not alarming. Consumer spending, the job market and industrial production continue to show strength, at least for now. In the lead up to the next Federal Reserve meeting in June, we expect significant chatter about the potential for an interest rate cut. The market has already priced in a consensus of four rate cuts over the remainder of the year, with the first in June. However, we expect any move by the Fed will come only after it receives a clear indication that inflation is moving lower and/or the broader economy is weakening.

Source: U.S. Bureau of Economic Analysis/FRED

Source: U.S. Bureau of Economic Analysis/FRED

Staying Diversified and Invested Amid Uncertainty

Even though the U.S. stock market was roughly flat in April, it was an uncomfortable month for investors. Unfortunately, the uncertainty rankling markets remains in place, and as such, we anticipate that volatility could remain elevated in the near term. Investors considering shifting away from U.S. stocks in favor of comparatively attractive non-U.S. markets should take heed. While international exposure remains an important building block of a diversified portfolio, we believe it is too soon to count out the U.S. stocks. The depth of the U.S. capital markets, the innovative and entrepreneurial nature of its companies, and the continued position of the U.S. dollar globally remain unmatched. Should the news cycle and tariff uncertainty abate, U.S. stocks may well regain their footing this year.

We are monitoring the markets, economy, and geopolitical developments to understand potential investment risks and opportunities for our clients. As always, we believe it’s important to ensure that portfolios are diversified and allocated appropriately for each investor’s risk tolerance and time horizon.

Your advisor is here to help you cut through the noise and stay focused on your goals—don’t hesitate to schedule a check-in to ensure your plan remains on track.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment-related services.

Cary Street Partners is a broker-dealer and registered investment adviser and does not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

Fixed income investments have several other asset-class specific risks. Inflation risk reduces the real value of such investments, as purchasing power declines on nominal dollars that are received as principal and interest. Interest rate risk comes from a rise in interest rates that causes a fixed income security to decline in price in order to make the market price-based yield competitive with the prevailing interest rate climate. Fixed income securities are also at risk of issuer default or the markets’ perception that default risk has increased.

International and foreign securities are subject to additional risks such as currency fluctuations, political instability, differing financial standards, and the potential for illiquid markets.

Comparative Index Descriptions: Historical performance results for investment indices have been provided for general comparison purposes only and generally do not reflect the deduction of transaction or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings do or will correspond directly to any comparative indices. An investor cannot invest directly in the indices shown, and accurate mirroring of the indices is not possible.

The Standard & Poor’s (S&P) 500 Index is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market.

The MSCI EAFE Index is a stock market index that measures the performance of large- and mid-cap companies across 21 developed markets countries around the world. Canada and the USA are not included. EAFE is an acronym that stands for Europe, Australasia, and the Far East.

We undertake no duty or obligation to publicly update or revise the information contained in this letter. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results. CSP2025107