A 529 college savings plan is a tax-advantaged account that is commonly set up and funded by the beneficiary’s parents. While they are primarily known for being a college savings plan, the funds can also be used for a variety of other educational expenses, including trade school, vocational school, graduate school, and even K-12 programs.

In this article, we’ll cover the basics, including 529 plan contribution limits, benefits, how to set one up, and holistic financial planning to help you navigate 529s in the context of your broader financial goals.

How Does A 529 Plan Work?

Once you open a 529 account (further details provided below), you can contribute after-tax dollars to the account. A 529 is a relatively simple investment account in that it has:

- No annual contribution limits (though large contributions may trigger gift tax rules — we can help you assess if this is relevant).

- No income restrictions (anyone can create and contribute to one, regardless of income level).

There are lifetime contribution limits that vary by state but are usually over $300,000.

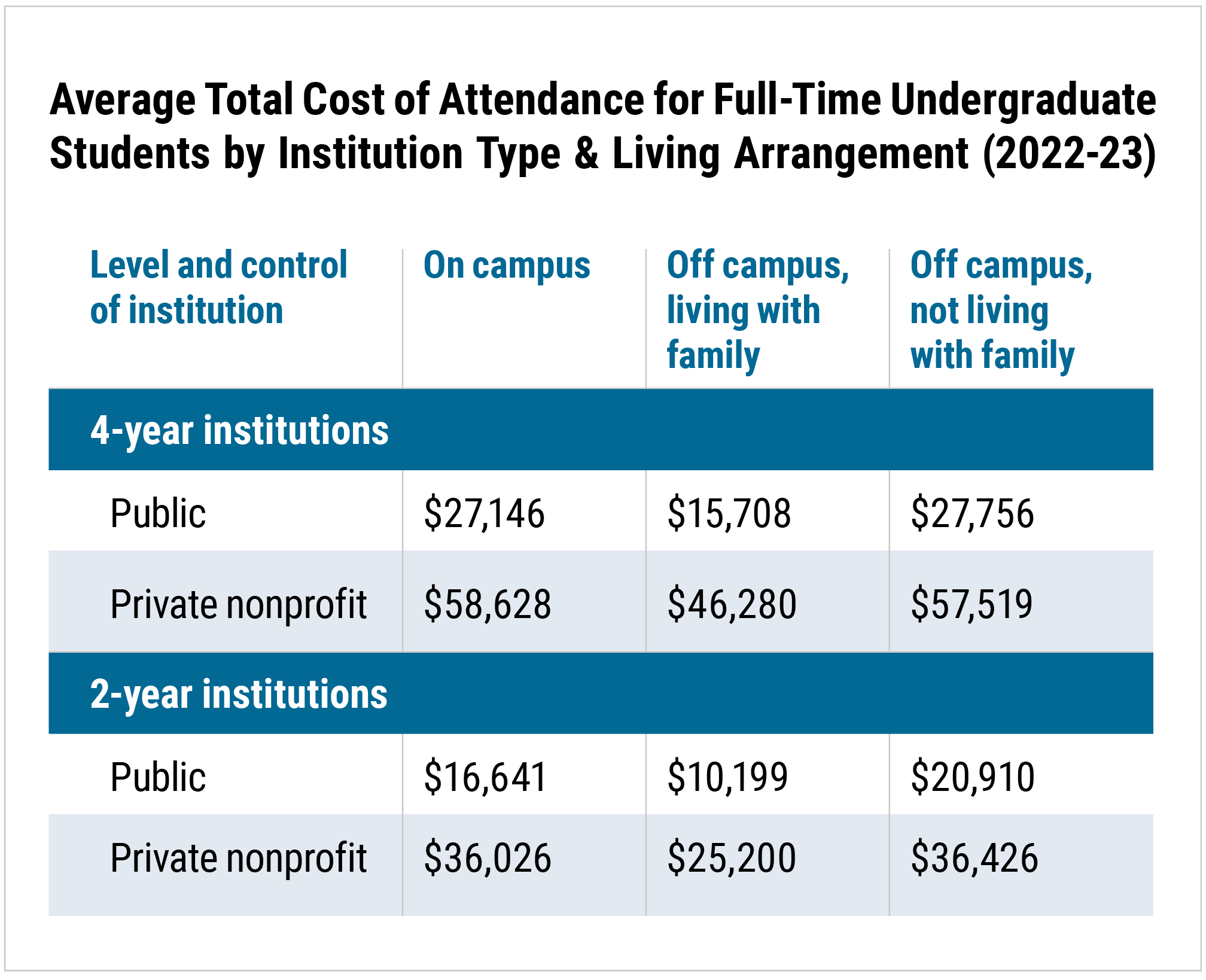

Given the rising cost of higher education — with average annual costs totaling $27,100 at public institutions and $58,600 at private colleges based on the 2022-23 academic year1 — starting a 529 plan as early as possible can be crucial. The earlier you begin, the more time your investments have to potentially grow and benefit from tax-advantaged compounding.

Source: U.S. Department of Education, National Center for Education Statistics, Integrated Postsecondary Education Data System (IPEDS), Student Financial Aid component and Institutional Characteristics component, Winter 2022–23 (provisional data) and Fall 2022 (provisional data)

Once you’ve started contributing, you’ll need to choose from a range of investment options offered by your plan. At Cary Street Partners, we specialize in financial planning and can help you review and select investments that align with your savings goals. You will also need to review and rebalance your investments regularly. Our advisors ensure you stay on track to reach your goals by helping you monitor and adjust your portfolio, providing personalized guidance every step of the way.

The Benefits of A 529 College Savings Plan

Tax Advantages

529 plan tax benefits are one of the most compelling reasons to consider establishing one.

The funds you invest in a 529 grow tax-free. When you are ready to withdraw funds for qualified educational expenses, your withdrawals will not be subject to federal income taxes — and, in many cases, may not be subject to state taxes either. Additionally, some states offer tax deductions for 529 plan contributions. The potential for tax-free growth may provide an opportunity to build savings in a 529 plan for future college expenses. We believe that starting early and investing consistently may help maximize the benefits of tax-advantaged education savings. And if you accumulate more than you need, you have the ability to use those funds for yourself or another child’s education expenses. So, starting a 529 and investing early allows you more time to enjoy the potential compounding growth.

Flexible Spending

What is a qualified educational expense? 529s are versatile. Qualified expenses include tuition, room and board, computers, textbooks, school supplies, and student loan repayments. The funds can also be used to cover more than just undergraduate college expenses. You can put them towards K-12 programs, trade or vocational school, and even graduate school programs. If you do need to withdraw funds for ineligible expenses, you may do so at a 10% penalty in addition to your regular income tax on any earnings.

Beneficiary Changes and Transfers

Although they are established for a single beneficiary (usually a child), 529 college savings plans offer options depending on your situation. You can update the plan’s beneficiary, allowing you to use the remaining money for another child, grandchild, or any qualified family member’s education expenses. For instance, if your daughter earns a scholarship and won’t fully draw down the money in the 529 account you’ve set up for her, you can choose a different beneficiary within the same family. And if you have any money leftover in the 529, you can roll over up to $35,000 into a Roth IRA for a beneficiary, though certain conditions apply here.

Account Control

529s offer additional benefits, like account control. With custodial accounts (e.g., UTMAs), you’re required to give the assets to the beneficiary at a certain age. However, as the owner of a 529 account, you retain control over the assets and investment decisions, regardless of the beneficiary’s age, until funds are withdrawn.

When & How to Establish A 529

The earlier you start, the better. That way, your investment returns have plenty of time to compound, making the most of your money. One caveat is that establishing a 529 requires the beneficiary’s SSN, so you cannot set one up for your unborn child. However, you can make yourself the initial beneficiary, transferring it once your child is born.

Once you have an SSN for the beneficiary, you will need to choose a provider. There are state-sponsored plans, in addition to private ones, offered by major providers such as Fidelity and Vanguard. Do your research, reviewing details like investment fund selection, fees, and state-specific benefits. All providers require some simple paperwork. Once complete, you may fund the account and select investment options.

Even if your child is a teenager, it is still worthwhile to establish a 529 plan for them. As a reminder, you don’t have to withdraw all funds at once; contributions can continue during college, and the funds can also be used for graduate school expenses, allowing for further investment growth.

Holistic Financial Planning

At Cary Street Partners, we act as a true partner in your wealth planning journey, taking into account your entire portfolio of investments, including retirement, insurance, savings, and beyond. These considerations enable us to provide tailored guidance based on your financial goals, allowing us to estimate how much you may need to save to meet them, assess investment strategies such as target-date funds, or build a customized investment mix to fulfill your unique needs.

We can manage your 529, help you compare providers, estimate your tax deduction for 529 contributions (if applicable), and evaluate gift tax considerations as you decide how much to contribute.

With Cary Street Partners’ knowledge and experience, we empower you to achieve your financial goals and set your young ones up for the same success. Visit our Financial Planning page to learn more, or contact us to set up an introductory meeting.

1 National Center for Education Statistics

Paige W. Garrigan

Chief Marketing & Transitions Officer, Managing Director

The Wealth Wisdom Series is curated by Paige W. Garrigan, drawing from the experience and input from Cary Street Partners’ Financial Advisors. Collaborating internally with the team she gathers pertinent and timely topics for readers. With nearly 30 years of experience in the financial services industry, she has acquired a wealth of knowledge across various facets of the industry ensuring comprehensive insights for readers.

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Cary Street Partners is a broker-dealer and registered investment adviser and does not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

We undertake no duty or obligation to publicly update or revise the information contained in this letter. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results. CSP2025126