|

|

- Stocks rose after the first trade deal was announced with the United Kingdom and diplomatic talks with China began.

- The Federal Reserve kept interest rates unchanged, opting to wait for more clarity on the economic impact of tariffs and trade developments.

- The S&P 500 has rebounded to pre-tariff levels, supported by strong earnings and trade deal optimism.

1. Stocks Rise Following Trade Deal Announcement

Last week, the Trump Administration announced a trade deal with the United Kingdom, the first with a U.S. trading partner since tariffs began to take effect. While details are still being finalized, the agreement includes favorable provisions related to U.S. beef and ethanol exports as well as U.K. exports of autos, steel and aluminum.1 The S&P 500 Index traded higher in the wake of the announcement, fueled by investor optimism that additional trade agreements would be forthcoming and that the worst of the trade war might be behind us. Adding to the positive momentum, Treasury Secretary Scott Bessent met over the weekend with officials from China, aiming to move trade talks forward with the world’s second largest economy.1

2. Fed Holds Rates Steady, Watches Tariff Impact

At their May 7 meeting, the Federal Reserve held interest rates steady, as analysts expected. Fed Chair Jerome Powell maintained that the Fed is taking a “wait and see” approach on interest rates and will seek to understand how new tariffs and future trade deals will impact the economy before making any moves.2 This is a continuation of the Fed’s vigilant, data-driven stance as the U.S. navigates economic uncertainty. Powell explained that they will not cut interest rates until inflation gets closer to the Fed’s 2% target.2 Although the job market remains strong, experts fear that trade tensions could increase prices and unemployment. Most experts believe there will be rate cuts later this year.3

3. S&P 500 Bounces Back to Pre-Tariff Levels

Following the April 2 “Liberation Day” tariff announcement, the S&P 500 dropped precipitously and experienced increased volatility. Strong company earnings and hopes for negotiated trade deals helped the market recover in the following weeks. Since Liberation Day, the S&P 500 has recovered its tariff-related losses, offering a reminder to investors to focus on long-term goals instead of reacting to short-term moves.4 While headlines can cause quick and sometimes painful changes, staying invested over the long term is generally the preferred course of action.

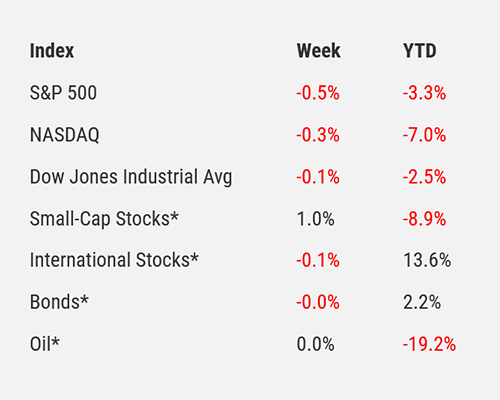

For the period ending 5/9/25.

* Small-cap stocks are represented by the Russell 2000® Index. International stocks are represented by the MSCI EAFE. Bonds are represented by the Bloomberg US Aggregate Bond Index. Oil is represented by WTI Oil (West Texas Intermediate Oil), a benchmark for light, sweet crude oil and a primary measure for pricing oil contracts and futures in the U.S.

Sources

1 The Wall Street Journal

2 BBC

3 CNBC

4 NBC

Disclosures

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

Additional Disclosures: International and Foreign Securities, Fixed Income Investments, the Consumer Price Index, the Producer Price Index.

Comparative Index Descriptions: The Standard & Poor’s (S&P) 500 Index, The Russell 2000® Index, The NASDAQ Composite Index, The MSCI EAFE Index, Dow Jones Industrial Average® (Dow Jones or DJIA), The Bloomberg Barclays US Aggregate Bond Index (US Agg Bond), The CBOE Volatility Index (VIX). CSP2025061_8