|

|

- Job growth slowed in May, with private payrolls missing expectations, but strong job openings suggest labor demand remains healthy.

- Growth stocks are outpacing value stocks in May amid strong performance in tech.3

- In a call, Trump and Xi discussed a potential restart in U.S.-China trade talks despite rising tensions.

1. Job Market Shows Signs of Slowing, But Remains Resilient

Employment data was in focus last week. The ADP employment report for May showed that the private sector added only 37,000 jobs, significantly lower than the expected 130,000 jobs and the weakest monthly gain since March 2023.1 Most of the new jobs came from the services sector, while goods-producing jobs fell by 2,000. May’s hiring slowdown suggests companies may be feeling more cautious about the outlook given economic and policy uncertainty. However, the JOLTS report released last week painted a more positive picture of job openings, which rose to 7.4 million in April, from 7.2 million in March.2 While the data is backward-looking, it suggests that labor demand remained strong in April. We expected that job market conditions would cool as growth slowed, but that any slowdown would likely be gradual and manageable. Given the overall strong employment picture to this point, the recent numbers are notable but not alarming.

2. Growth Stocks Start Off Strong in June

According to Russell Indices, growth stocks led the market last week, continuing a trend that has dominated much of the past decade. Value stocks briefly took the lead early in the year, particularly in January, thanks to strong gains in the financial and healthcare sectors. However, growth stocks have bounced back. The one month return through June 6th for the Russell 3000 Growth Index is 9.8% compared to the Russell 3000 Value index that was 4.3%.3 Over the past 10 years with the data ending June 6th, growth stocks returned 332.6%, compared with 125.2% for value.3 The recent resurgence reinforces investor confidence in growth’s long-term potential, even amid shifting economic backdrops.

3. Trump and Xi Reopen Dialogue as Trade Tensions Rise

Last Thursday, President Donald Trump and China’s President Xi Jinping spoke on the phone as trade tensions between the two countries grew. The call, which is their first during Trump’s second term, came after trade talks reached a standstill following a short tariff pause in May. The U.S. accused China of holding back exports of rare-earth minerals. China, in turn, criticized U.S. rules on AI chips and student visas. Still, both leaders showed an openness to resuming negotiations. The call took place during German Chancellor Friedrich Merz’s visit to Washington to discuss trade concerns. Additionally, meetings between Chinese and U.S. officials signaled ongoing efforts to navigate the complex bilateral trade relationship.

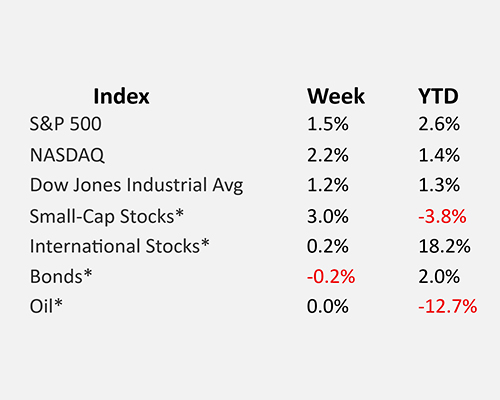

For the period ending 6/6/25.

* Small-cap stocks are represented by the Russell 2000® Index. International stocks are represented by the MSCI EAFE. Bonds are represented by the Bloomberg US Aggregate Bond Index. Oil is represented by WTI Oil (West Texas Intermediate Oil), a benchmark for light, sweet crude oil and a primary measure for pricing oil contracts and futures in the U.S.

Sources

1 ADP National Employment Report

2 U.S. Bureau of Labor Statistics

3 YCharts

Disclosures

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

Additional Disclosures: International and Foreign Securities, Fixed Income Investments, the Consumer Price Index, the Producer Price Index.

Comparative Index Descriptions: The Standard & Poor’s (S&P) 500 Index, The Russell 2000® Index, The NASDAQ Composite Index, The MSCI EAFE Index, Dow Jones Industrial Average® (Dow Jones or DJIA), The Bloomberg Barclays US Aggregate Bond Index (US Agg Bond), The CBOE Volatility Index (VIX). CSP2025061_12