|

|

- U.S. airstrikes on Iranian nuclear sites, over the weekend, sent oil prices higher.

- The Federal Reserve kept interest rates unchanged at its June meeting and maintained its forecast for two rate cuts this year amid updated inflation and growth expectations.2

- Jobless claims edged slightly lower last week, reflecting a still-strong but gradually cooling labor market. Wage growth continued to outpace inflation, supporting consumer spending.3

- Retail sales declined more than expected in May, driven by weaker spending on vehicles and building materials. Still, core retail categories and discretionary spending demonstrated strength, indicating steady household demand.

1. U.S. Airstrikes on Iran Rattle Markets, Oil Prices Surge

Stock futures fall after the U.S. launched airstrikes on Iranian nuclear sites, entering the war against Iran and raising fears of a wider Middle East turmoil. The conflict pushed oil prices up 3.8% to nearly $77 a barrel.1 Dow, S&P 500, and Nasdaq futures each dropped between 0.3% and 0.4%.1 The markets are now bracing for Iran’s response, which could include targeting U.S. forces or closing the Strait of Hormuz, a vital route for global oil. With the U.S. now fully involved, the baseline for oil is shifting higher.

2. Fed Held Rates Steady, Signals Slower Pace for Future Cuts

The Federal Open Market Committee (FOMC) wrapped up its June meeting last week by keeping the federal funds rate target unchanged at 4.25%–4.50% and continuing to forecast two rate cuts by year-end.2 The FOMC also lowered its outlook for real GDP growth while raising its estimates for inflation and unemployment. The Fed has been on hold this year, awaiting data on how tariffs might affect inflation, which is expected to rise in the short term, as consumers continue to absorb higher import costs. This could lead to temporary price increases without creating long-term inflation pressure. The strength of the labor market has provided the Fed with room to wait before easing. Meanwhile, bond markets priced in two rate cuts for this year and three more for next year.

3. Jobless Claims Ticked Lower as Labor Market Continued to Cool Gradually

Initial jobless claims fell to 245,000 last week, coming in below expectations of 250,000.4 Continuing claims, which track the number of people still receiving unemployment benefits, slipped to 1.94 million from 1.95 million the week before.4 While claims remained relatively low, they have increased gradually this year. This suggests the labor market stayed solid but continued to cool from a strong starting point. The unemployment rate held steady at 4.2%, and there were still 7.4 million job openings.4 Wage growth outpaced inflation, helping to support consumer spending and economic momentum.

4. Retail Sales Missed Expectations, but Discretionary Spending Remained Resilient

Consumer spending was in focus last Tuesday, June 17th, as May retail sales fell more than expected. Headline sales declined by 0.9% MoM, missing forecasts for a 0.7% drop.4 Weaker spending on building materials and motor vehicles drove the decline; auto sales likely pulled back after strong March figures, when buyers moved ahead of expected tariffs. April retail sales were also revised lower, showing a 0.1% decline instead of an expected 0.1% gain.4 Still, there was a silver lining: Control-group sales, which exclude volatile categories like gas, autos and building materials, rose 0.4% in May, matching expectations.4 Discretionary spending on items like furniture and clothing also increased, pointing to continued strength in household demand.

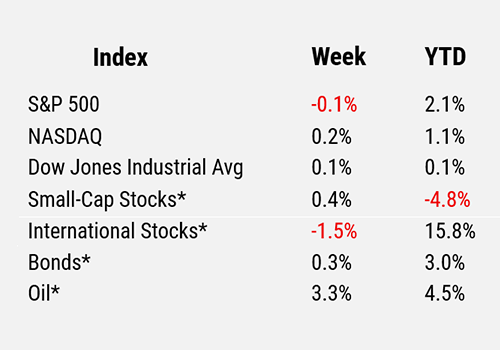

For the period ending 6/13/25.

* Small-cap stocks are represented by the Russell 2000® Index. International stocks are represented by the MSCI EAFE. Bonds are represented by the Bloomberg US Aggregate Bond Index. Oil is represented by WTI Oil (West Texas Intermediate Oil), a benchmark for light, sweet crude oil and a primary measure for pricing oil contracts and futures in the U.S.

Sources

1 CNBC

2 U.S. Federal Reserve

3 CME Fed Watch

4 FactSet

Disclosures

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

Additional Disclosures: International and Foreign Securities, Fixed Income Investments, the Consumer Price Index, the Producer Price Index.

Comparative Index Descriptions: The Standard & Poor’s (S&P) 500 Index, The Russell 2000® Index, The NASDAQ Composite Index, The MSCI EAFE Index, Dow Jones Industrial Average® (Dow Jones or DJIA), The Bloomberg Barclays US Aggregate Bond Index (US Agg Bond), The CBOE Volatility Index (VIX). CSP2025061_14