|

|

- Jobless claims held at 248,000, with continuing claims rising to a three-year high, signaling a cooling labor market.1

- Inflation eased in May, keeping hopes alive for one or two Fed rate cuts later this year.

- Middle East tensions, sparked by Israeli and Iranian strikes, drove stocks lower and oil prices higher, as investors moved into safe-haven assets like gold and the U.S. dollar.

1. Jobless Claims Hold at Eight-Month High as Continuing Claims Rise

Initial jobless claims held steady at 248,000 last week, matching the highest level seen since October.1 While seasonal factors, like the end of the school year, may be to blame, economists are watching to see if this trend continues. The four-week average for initial claims also rose to 240,250, its highest level since August 2023.1 Meanwhile, continuing claims jumped to 1.95 million, the highest since late 2021, suggesting it’s taking longer for laid-off workers to find new jobs.1 Despite these signs of strain, experts are not yet concerned about a major downturn in the labor market. Still, the steady climb in claims could point to growing challenges for job seekers as demand for workers cools. If the trend persists into July, it may signal a more meaningful shift in labor market conditions.

2. Inflation Cools in May, Rate Cuts Still on the Table

Inflation came in softer than expected in May. Headline consumer prices rose just 0.1% for the month and 2.4% over the past year.2 Core inflation, which leaves out food and energy, also rose 0.1% for the month and 2.8% year-over-year.2 A key driver was the slowdown in core services, which rose 0.2% for the month and 3.6% year-over-year; the slowest pace since late 2021.2 Core goods prices were flat for the month and up just 0.3% from last year, showing little impact from tariffs so far.2 Some companies may be absorbing tariff costs, expecting those rates to fall over time. While inflation is trending lower, tariffs could still push prices up in the future. Even so, many believe the Federal Reserve is likely to cut rates once or twice later this year but will move slowly. However, this is contingent on economic conditions continuing to stabilize.

3. Markets Drop as Middle East Tensions Rise

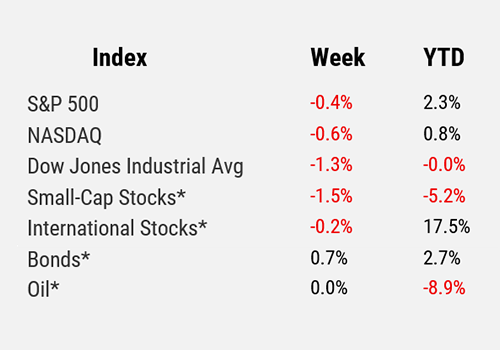

Tensions in the Middle East weighed on markets Friday. The S&P 500 finished the week down about 0.4% amid news that Israel struck Iran’s nuclear and military sites Thursday night.2 Iran responded with drone attacks. Oil prices surged 8% Friday morning on fears of supply disruptions.2 This led investors to seek safer assets like gold, which was up 1% at midday on Friday.2 Treasury yields remained steady, with the 10-year yield falling to 4.4% from 4.5% over the last five days.2 However, most major indices are still up for the year. While the situation is fluid, markets are closely watching for signs of further escalation. A prolonged conflict could push energy prices higher and impact global growth.

For the period ending 6/13/25.

* Small-cap stocks are represented by the Russell 2000® Index. International stocks are represented by the MSCI EAFE. Bonds are represented by the Bloomberg US Aggregate Bond Index. Oil is represented by WTI Oil (West Texas Intermediate Oil), a benchmark for light, sweet crude oil and a primary measure for pricing oil contracts and futures in the U.S.

Sources

1 MarketWatch

2 Factset

Disclosures

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

Additional Disclosures: International and Foreign Securities, Fixed Income Investments, the Consumer Price Index, the Producer Price Index.

Comparative Index Descriptions: The Standard & Poor’s (S&P) 500 Index, The Russell 2000® Index, The NASDAQ Composite Index, The MSCI EAFE Index, Dow Jones Industrial Average® (Dow Jones or DJIA), The Bloomberg Barclays US Aggregate Bond Index (US Agg Bond), The CBOE Volatility Index (VIX). CSP2025061_13