|

|

- Business activity improved in May, but rising goods and services prices have renewed inflation concerns, despite a cooling labor market.

- Treasury yields continued to climb as strong economic data and fiscal concerns pushed rates higher, though investment-grade bonds remain up for the year.

- The House narrowly passed a sweeping GOP tax and spending bill, drawing mixed public reactions to tax relief, social program cuts and the bill’s projected deficit impact.

1. U.S. Business Activity Rises, Inflation Concerns Linger

U.S. business activity picked up in May, with the S&P Global Flash U.S. Composite PMI rising to 52.1 from 50.6 in April. A reading above 50 indicates economic expansion.1 This growth is attributed to a pause on certain tariffs, which boosted business confidence. Inflation concerns persist, however, as prices charged for goods and services rose at the fastest rate since August 2022.2 Economists note that a softening labor market may help offset these inflationary pressures by slowing wage growth, which could keep services inflation in check.

2. Bond Yields Continue to Climb

Bond yields moved higher on Wednesday, with the 10-year U.S. Treasury yield closing near 4.6% and the 30-year yield around 5.1%.3 In early April, the 10-year Treasury yield dropped to nearly 4% amid worries about a potential recession.3 Since then, easing trade tensions and resilient economic data have pushed yields higher. Moody’s recent downgrade of U.S. credit also reminded investors that the country’s debt path may not be sustainable, which also caused yields to increase.

Even with rising yields, U.S. investment-grade bond prices are higher year to date. The Bloomberg U.S. Aggregate Bond Index is up about 1.6% through Friday’s close. Because yields remain high relative to recent years, we suggest maintaining a neutral stance in U.S. investment-grade bonds.

3. House Passes GOP Tax and Spending Bill by One Vote

Congress narrowly passed President Trump’s “One Big Beautiful Bill,” with a 215–214 vote after an all-night session. The bill implements tax breaks for tips, overtime, and seniors, as well as raising the state and local tax (SALT) deduction cap to $40,000 vs. the original $10,000 for those earning under $500,000. To offset revenue losses, the bill seeks to impose stricter Medicaid and SNAP work requirements and reduce clean energy tax credits. It would also allocate $350 billion for defense and border security. The Congressional Budget Office estimates the bill could add $3.8 trillion to the deficit over a decade and result in 8.6 million people losing Medicaid coverage. The legislation now moves to the Senate, where further debate and amendments are expected.

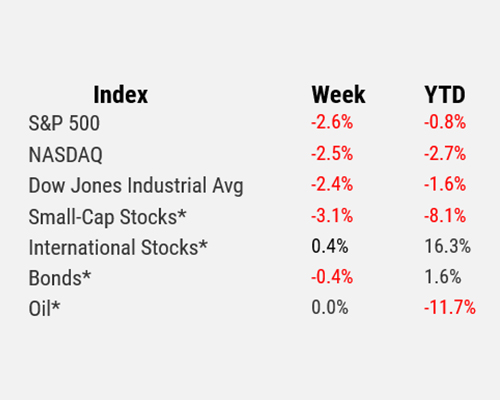

For the period ending 5/23/25.

* Small-cap stocks are represented by the Russell 2000® Index. International stocks are represented by the MSCI EAFE. Bonds are represented by the Bloomberg US Aggregate Bond Index. Oil is represented by WTI Oil (West Texas Intermediate Oil), a benchmark for light, sweet crude oil and a primary measure for pricing oil contracts and futures in the U.S.

Sources

1 The Wall Street Journal

2 S&P Global

3 FactSet

Disclosures

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein.

Cary Street Partners and its affiliates are broker-dealers and registered investment advisers and do not provide tax or legal advice; no one should act upon any tax or legal information contained herein without consulting a tax professional or an attorney.

We undertake no duty or obligation to publicly update or revise the information contained in these materials. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results.

Additional Disclosures: International and Foreign Securities, Fixed Income Investments, the Consumer Price Index, the Producer Price Index.

Comparative Index Descriptions: The Standard & Poor’s (S&P) 500 Index, The Russell 2000® Index, The NASDAQ Composite Index, The MSCI EAFE Index, Dow Jones Industrial Average® (Dow Jones or DJIA), The Bloomberg Barclays US Aggregate Bond Index (US Agg Bond), The CBOE Volatility Index (VIX). CSP2025061_10