|

|

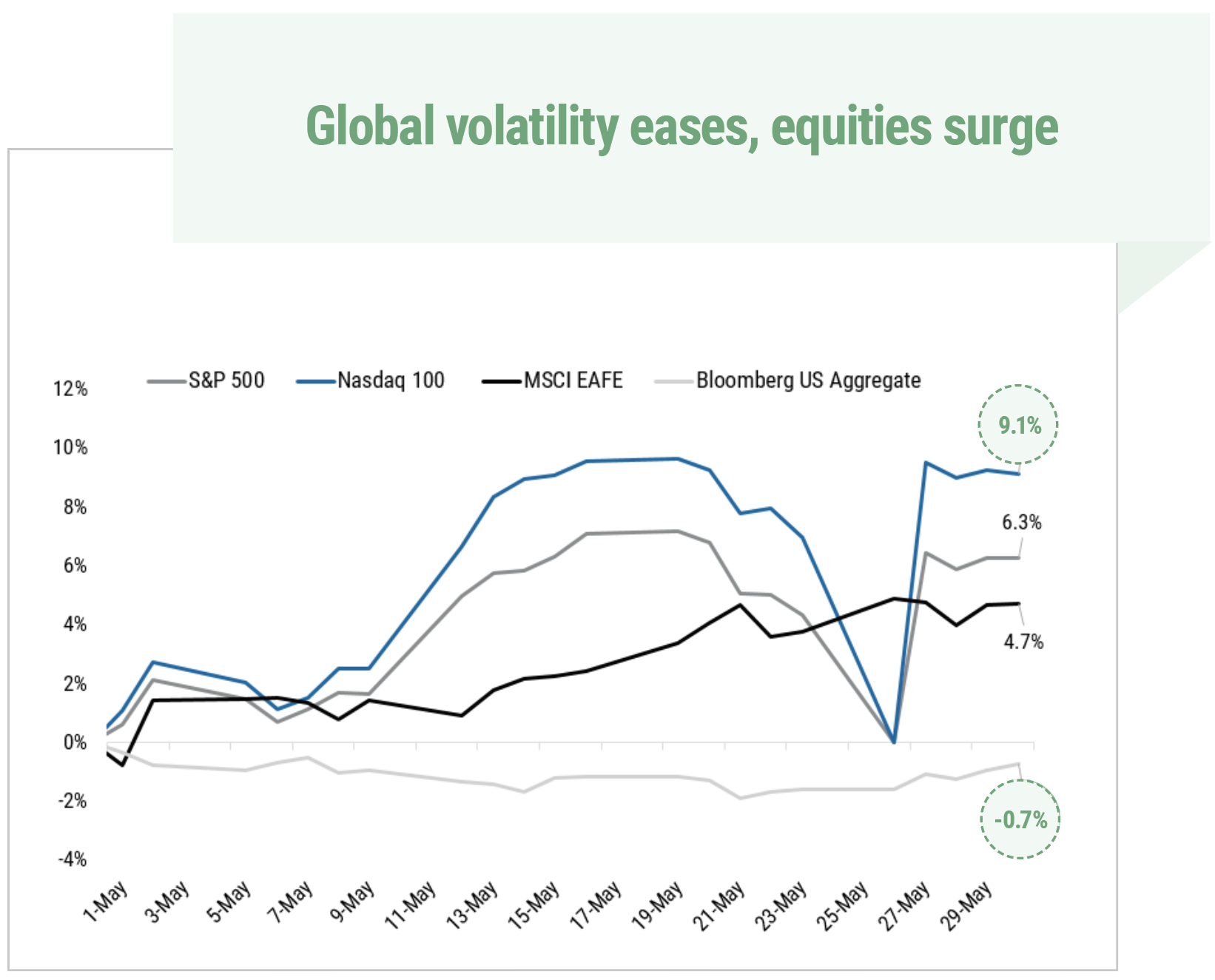

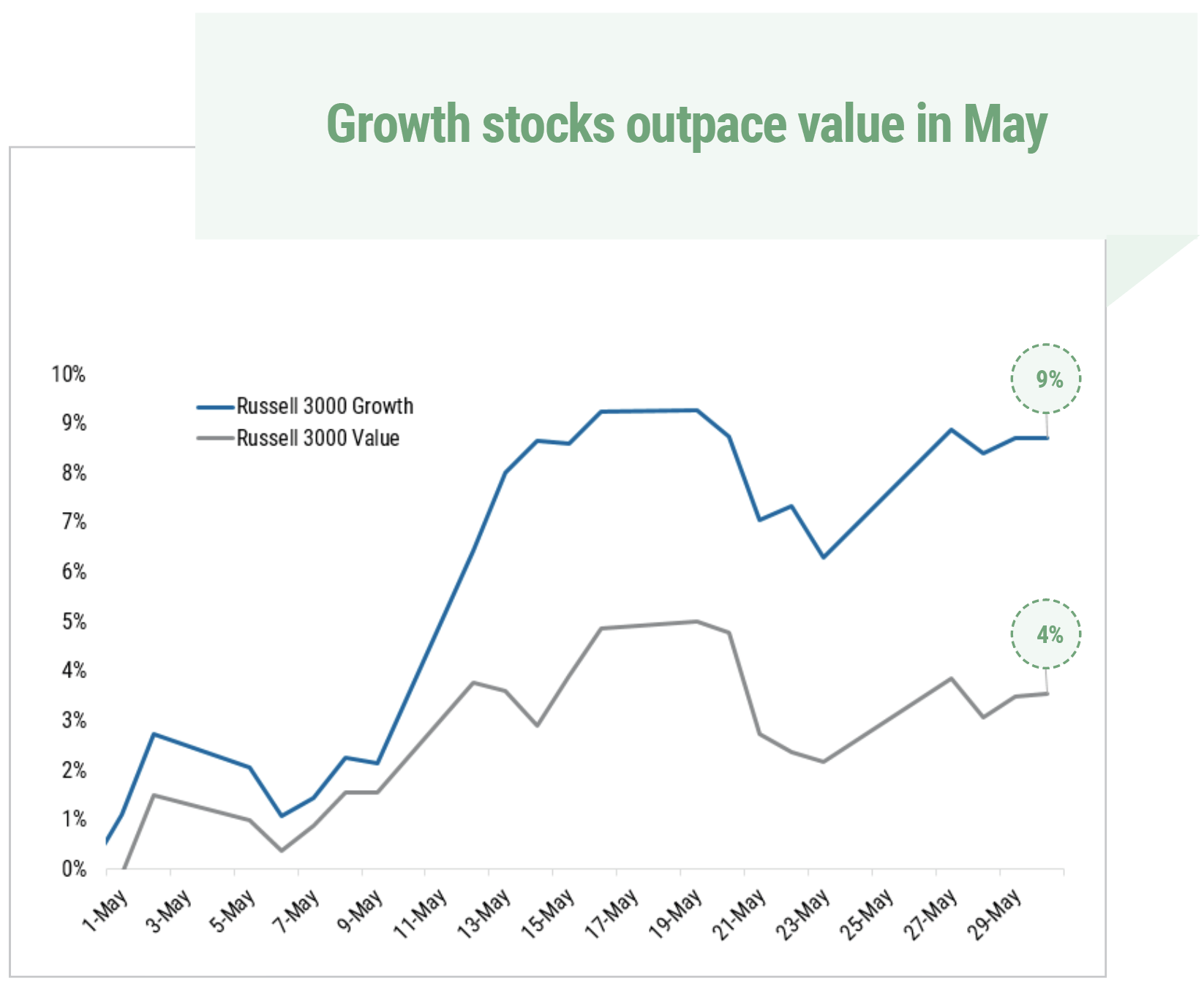

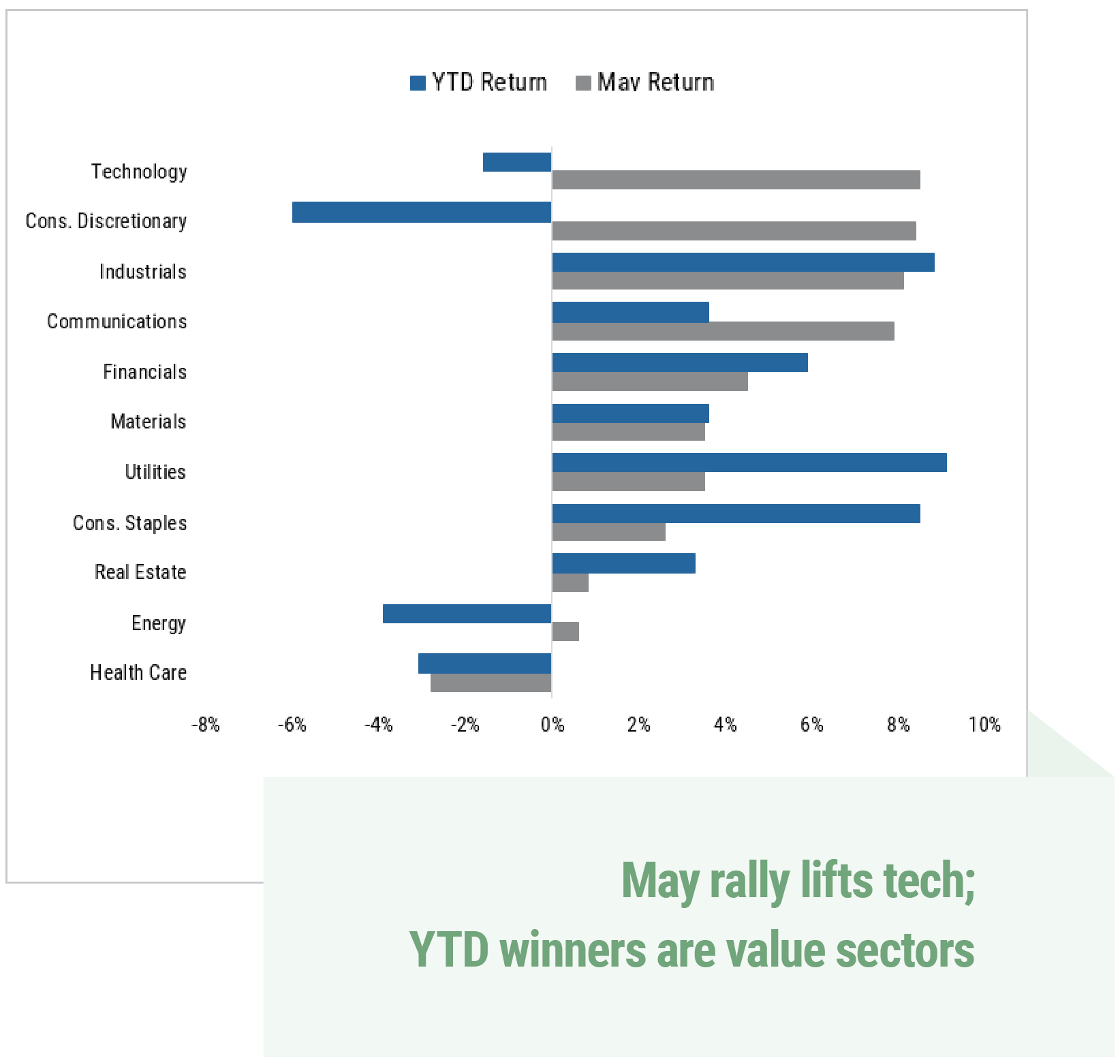

In May, equity markets put April’s rampant volatility in the rearview mirror and delivered strong returns. Led by growth stocks, the S&P 500 Index returned 6.3% and the Nasdaq 100 returned 9.1%. After experiencing a 20% drop between mid-February and early April, the S&P 500 ended the month just 4% off its record high. The Magnificent 7 tech stocks, which began May having significantly underperformed the market, were responsible for 62% of the S&P 500’s gains for the month.1 While more value-oriented sectors have performed well in 2025, the outsized influence of tech stocks continues.

Source: YCharts

Source: YCharts

Source: YCharts

International stocks are still well ahead of the U.S. for the year, with the MSCI EAFE gaining 16.9% through May, but trailed U.S. markets for the month at 4.6%. Meanwhile, the U.S. bond market saw its first monthly price decline for 2025, with the Bloomberg U.S. Aggregate Bond Index ending the month down 0.7%. U.S. Treasury yields were elevated during May due to fiscal concerns and a U.S. credit rating downgrade.

Calmer Markets and Solid Earnings Support Stocks

Several factors contributed to the U.S. equity rebound. First quarter earnings were better than expected, with 78% of S&P 500 companies reporting a positive earnings surprise, and index companies saw a blended year-over-year earnings-per-share growth rate of 13.3%.2 Additionally, inflation remains muted despite tariff concerns, with a lower-than-expected April Personal Consumption Expenditures Index increase of 2.1% from a year ago.

Perhaps most important from a day-to-day volatility perspective, the market appears to have grown more comfortable riding out tariff uncertainty. While instability persists, market swings in response to the news cycle were less pronounced in May, and many believe bilateral agreements with U.S. trading partners are on the horizon, although the timing is uncertain.

Economic and Geopolitical Risks

Despite May’s relative calm, there are economic and geopolitical risks to consider. The U.S. fiscal situation has raised concerns about the sustainability of U.S. government borrowing. Tariff concerns remain, including a ruling about the legality of the current tariff policy, and significant tension in the U.S.-China trade talks could derail or significantly delay the creation of a lasting agreement. Additionally, although inflation has been benign, prices are likely to increase over time as the impacts of tariffs are absorbed into the system.

A question on many investors’ minds is the potential for rate cuts. The U.S. Federal Reserve has held interest rates steady in 2025. The Fed has signaled that any decision to cut rates is data-dependent and that it will continue to monitor the health of the economy, including inflation and unemployment numbers. At this point, the economy still appears relatively healthy: although GDP growth has slowed, a recession appears unlikely, and unemployment is steady.3 With tariffs projected to cause a short-term bump in inflation, the consensus view is that we will not see the first rate cut until later in the year, and that there will be fewer cuts in 2025 than previously anticipated.

The Value of Reframing Volatility

The market swings we experienced over the last couple of months serve as a reminder that volatility, while often uncomfortable, does not necessarily lead to lasting portfolio damage. Rather than reacting to short-term fluctuations, we view these periods as opportunities to thoughtfully rebalance and ensure alignment with clients’ long-term strategic goals. Maintaining diversification and a long-term perspective remains essential. While uncertainty will persist, we believe that staying invested and focused on the bigger picture offers the best path to capturing potential gains ahead.

1 Yahoo! Finance

2 FactSet

3 Charles Schwab

Cary Street Partners is the trade name used by Cary Street Partners LLC, Member FINRA/SIPC; Cary Street Partners Investment Advisory LLC and Cary Street Partners Asset Management LLC, registered investment advisers. Registration does not imply a certain level of skill or training.

Any opinions expressed here are those of the authors, and such statements or opinions do not necessarily represent the opinions of Cary Street Partners. These are statements of judgment as of a certain date and are subject to future change without notice. Future predictions are subject to certain risks and uncertainties, which could cause actual results to differ from those currently anticipated or projected.

These materials are furnished for informational and illustrative purposes only, to provide investors with an update on financial market conditions. The description of certain aspects of the market herein is a condensed summary only. Materials have been compiled from sources believed to be reliable; however, Cary Street Partners does not guarantee the accuracy or completeness of the information presented. Such information is not intended to be complete or to constitute all the information necessary to evaluate adequately the consequences of investing in any securities, financial instruments, or strategies described herein. Nothing contained herein should be considered a solicitation to purchase or sell any specific securities or investment-related services.

Cary Street Partners is a broker-dealer and registered investment adviser and does not provide tax or legal advice; no one should act upon any tax or legal information that may be contained herein without consulting a tax professional or an attorney.

Fixed income investments have several other asset-class specific risks. Inflation risk reduces the real value of such investments, as purchasing power declines on nominal dollars that are received as principal and interest. Interest rate risk comes from a rise in interest rates that causes a fixed income security to decline in price in order to make the market price-based yield competitive with the prevailing interest rate climate. Fixed income securities are also at risk of issuer default or the markets’ perception that default risk has increased. International and foreign securities are subject to additional risks such as currency fluctuations, political instability, differing financial standards, and the potential for illiquid markets.

Comparative Index Descriptions: Historical performance results for investment indices have been provided for general comparison purposes only and generally do not reflect the deduction of transaction or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings do or will correspond directly to any comparative indices. An investor cannot invest directly in the indices shown, and accurate mirroring of the indices is not possible.

The Standard & Poor’s (S&P) 500 Index is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists. The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market.

The MSCI EAFE Index is a stock market index that measures the performance of large- and mid-cap companies across 21 developed markets countries around the world. Canada and the USA are not included. EAFE is an acronym that stands for Europe, Australasia, and the Far East.

We undertake no duty or obligation to publicly update or revise the information contained in this letter. In addition, information related to past performance, while helpful as an evaluative tool, is not necessarily indicative of future results, the achievement of which cannot be assured. You should not view the past performance of securities, or information about the market, as indicative of future results. CSP2025138